Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7257

Pages:89

Published On:December 2025

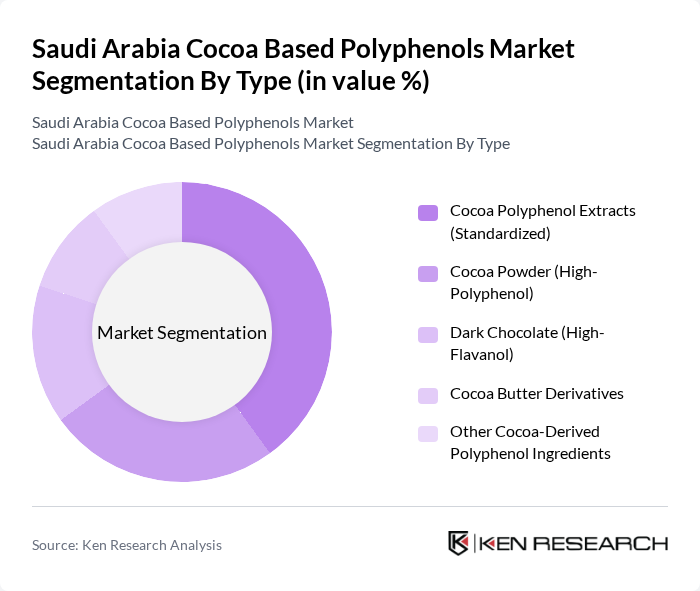

By Type:The market is segmented into various types of cocoa-based polyphenols, including Cocoa Polyphenol Extracts (Standardized), Cocoa Powder (High-Polyphenol), Dark Chocolate (High-Flavanol), Cocoa Butter Derivatives, and Other Cocoa-Derived Polyphenol Ingredients. Among these, Cocoa Polyphenol Extracts (Standardized) are leading the market due to their concentrated health benefits and versatility in various applications, including dietary supplements and functional foods. The increasing trend of health-conscious consumers is driving the demand for these extracts, as they are perceived to offer superior health benefits compared to other forms.

By End-User:The end-user segmentation includes Food and Beverage Manufacturers, Nutraceutical and Dietary Supplement Companies, Cosmetics and Personal Care Manufacturers, Pharmaceutical and OTC Product Manufacturers, and Research Institutions and Others. Food and Beverage Manufacturers dominate this segment, driven by the increasing incorporation of cocoa polyphenols in health-oriented products. The growing trend of functional foods and beverages, coupled with rising health awareness, has led to a significant increase in demand from this sector.

The Saudi Arabia Cocoa Based Polyphenols Market is characterized by a dynamic mix of regional and international players. Leading participants such as Barry Callebaut AG, Archer Daniels Midland Company (ADM), Cargill Incorporated, Olam International Limited, Mars Incorporated, Mondelez International Inc., Nestlé S.A., The Hershey Company, Ferrero International S.A., Puratos Group, Blommer Chocolate Company, Naturex S.A., Sabinsa Corporation, Kemin Industries Inc., Local and Regional Players (Saudi- and GCC-based Cocoa and Ingredient Processors) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cocoa-based polyphenols market in Saudi Arabia appears promising, driven by increasing health awareness and a growing preference for natural ingredients. As the functional food market expands, manufacturers are likely to innovate and introduce new products that cater to health-conscious consumers. Additionally, the government's support for health initiatives will further bolster market growth. With strategic marketing and educational campaigns, the industry can overcome current challenges and tap into the rising demand for health-oriented products.

| Segment | Sub-Segments |

|---|---|

| By Type | Cocoa Polyphenol Extracts (Standardized) Cocoa Powder (High-Polyphenol) Dark Chocolate (High-Flavanol) Cocoa Butter Derivatives Other Cocoa-Derived Polyphenol Ingredients |

| By End-User | Food and Beverage Manufacturers Nutraceutical and Dietary Supplement Companies Cosmetics and Personal Care Manufacturers Pharmaceutical and OTC Product Manufacturers Research Institutions and Others |

| By Distribution Channel | Business-to-Business (B2B) Ingredient Supply Pharmacies and Drugstores Supermarkets/Hypermarkets Online Retail and E-commerce Platforms Specialty Health and Organic Stores |

| By Formulation | Capsules and Tablets Powder and Granules Liquid and Ready-to-Drink Formulations Chocolate and Confectionery Formats |

| By Application | Functional Beverages Functional Foods and Bakery Products Dietary Supplements Cosmetics and Dermatology Products Cardiovascular and Metabolic Health Products |

| By Source | Conventional Cocoa Organic and Fair-Trade Cocoa By-Product and Upcycled Cocoa Streams |

| By Region | Central Region (Including Riyadh) Eastern Region (Including Dammam/Al Khobar) Western Region (Including Jeddah/Makkah/Medina) Southern Region Northern and Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cocoa Product Manufacturers | 100 | Production Managers, Quality Control Officers |

| Health and Wellness Brands | 80 | Product Development Managers, Marketing Directors |

| Retailers of Cocoa Products | 70 | Category Managers, Purchasing Agents |

| Consumers of Health Supplements | 120 | Health-Conscious Consumers, Fitness Enthusiasts |

| Food Scientists and Researchers | 60 | Research Scientists, Academic Professionals |

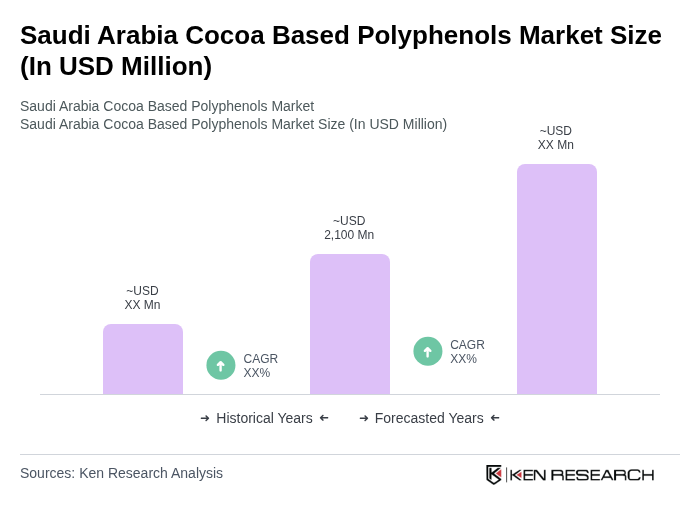

The Saudi Arabia Cocoa Based Polyphenols Market is valued at approximately USD 2,100 million, reflecting a significant growth trend driven by increasing consumer awareness of health benefits associated with cocoa polyphenols, such as antioxidant properties and cardiovascular health.