Region:Middle East

Author(s):Geetanshi

Product Code:KRAD6040

Pages:94

Published On:December 2025

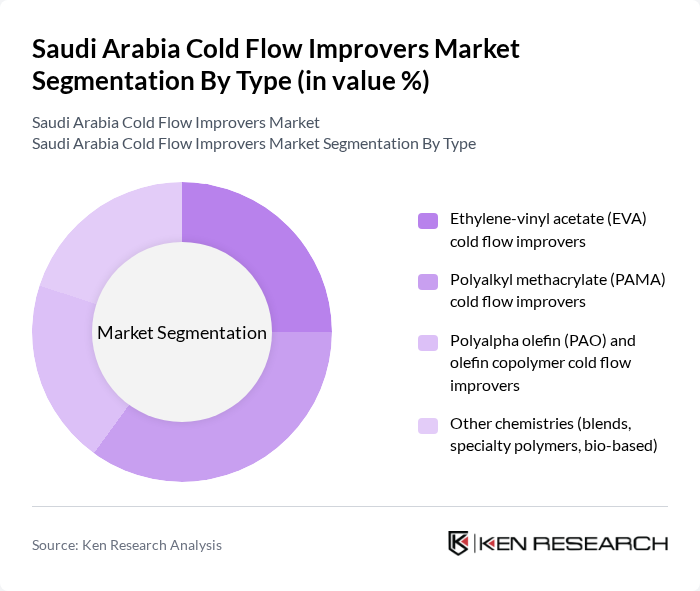

By Type:The market is segmented into various types of cold flow improvers, including Ethylene-vinyl acetate (EVA), Polyalkyl methacrylate (PAMA), Polyalpha olefin (PAO) and olefin copolymer, and other chemistries such as blends and bio-based products. Among these, Polyalkyl methacrylate (PAMA) cold flow improvers are gaining traction due to their superior performance in low-temperature conditions, making them a preferred choice for many refiners and fuel blenders.

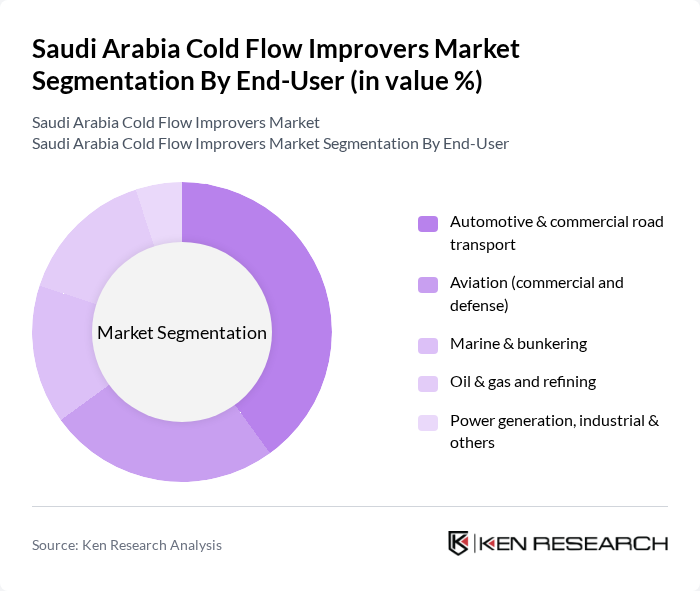

By End-User:The end-user segmentation includes Automotive & commercial road transport, Aviation (commercial and defense), Marine & bunkering, Oil & gas and refining, and Power generation, industrial & others. The automotive sector is the leading end-user, driven by the increasing demand for efficient fuel solutions and stringent emission regulations, which necessitate the use of advanced cold flow improvers.

The Saudi Arabia Cold Flow Improvers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Clariant AG, Afton Chemical Corporation, Innospec Inc., Evonik Industries AG, Chevron Oronite Company LLC, The Lubrizol Corporation, TotalEnergies SE, Baker Hughes Company, Huntsman Corporation, Croda International Plc, Infineum International Limited, Eastman Chemical Company, Dorf Ketal Chemicals, and Saudi Aramco (Saudi Arabian Oil Company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold flow improvers market in Saudi Arabia appears promising, driven by increasing investments in infrastructure and a strong push towards sustainability. As the government continues to implement regulations that favor eco-friendly products, manufacturers are likely to innovate and adapt their offerings. Additionally, the integration of digital technologies in production processes will enhance efficiency and product quality, positioning the market for significant growth in the coming years, particularly as global demand for refined products rises.

| Segment | Sub-Segments |

|---|---|

| By Type | Ethylene-vinyl acetate (EVA) cold flow improvers Polyalkyl methacrylate (PAMA) cold flow improvers Polyalpha olefin (PAO) and olefin copolymer cold flow improvers Other chemistries (blends, specialty polymers, bio-based) |

| By End-User | Automotive & commercial road transport Aviation (commercial and defense) Marine & bunkering Oil & gas and refining Power generation, industrial & others |

| By Application | Diesel and gasoil (including biodiesel blends) Fuel oil and heating oil Jet fuel and aviation turbine fuel Lubricating oil and specialty fuels |

| By Distribution Channel | Direct sales to refiners and NOCs Sales via regional distributors and trading houses OEM and service company channels Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Product Formulation | Liquid concentrates Solid and powder formulations Pour-in packages and customized blends |

| By Regulatory Compliance | Products compliant with SASO, GSO, and international fuel standards Non-compliant and off-spec products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Refinery Operations | 100 | Operations Managers, Process Engineers |

| Petrochemical Product Development | 80 | R&D Managers, Product Development Engineers |

| Logistics and Transportation | 70 | Logistics Coordinators, Supply Chain Analysts |

| Environmental Compliance | 60 | Compliance Officers, Environmental Managers |

| Market Research and Analysis | 90 | Market Analysts, Business Development Managers |

The Saudi Arabia Cold Flow Improvers Market is valued at approximately USD 10 million, driven by the increasing demand for high-performance fuels in the automotive and aviation sectors, as well as the expansion of the oil and gas industry.