Region:Middle East

Author(s):Dev

Product Code:KRAD3420

Pages:87

Published On:November 2025

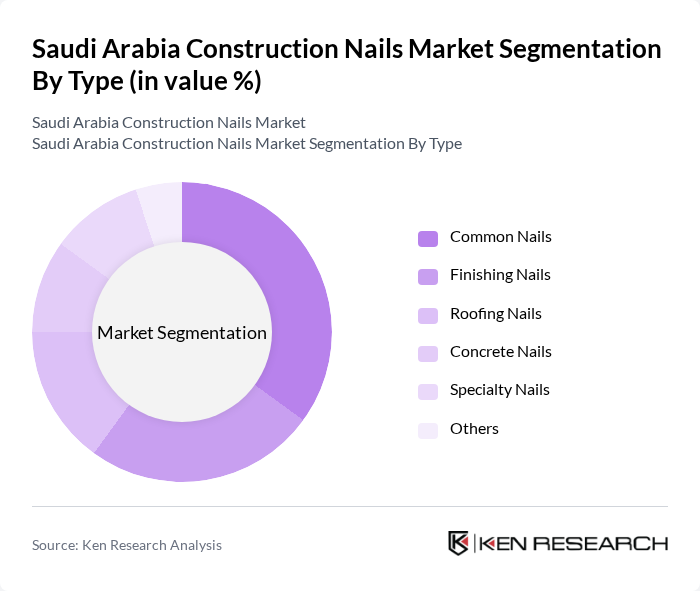

By Type:The market is segmented into various types of nails, including Common Nails, Finishing Nails, Roofing Nails, Concrete Nails, Specialty Nails, and Others. Each type serves specific applications and is preferred based on the requirements of different construction projects.

The Common Nails segment dominates the market due to their versatility and widespread use in various construction applications. They are essential for framing, roofing, and general construction tasks, making them a staple in the industry. The demand for Common Nails is driven by the ongoing construction boom in Saudi Arabia, where builders prefer cost-effective and reliable fastening solutions. Finishing Nails follow closely, as they are favored for aesthetic applications in carpentry and furniture making. The growing adoption of prefabricated and modular construction methods is also increasing the demand for specialized nail types, including coil and collated nails, which are compatible with pneumatic tools .

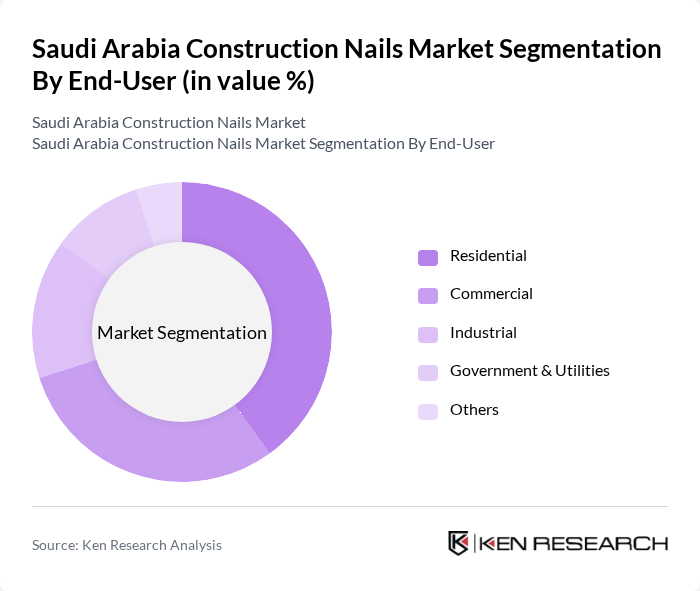

By End-User:The market is segmented based on end-users, including Residential, Commercial, Industrial, Government & Utilities, and Others. Each segment reflects the diverse applications of construction nails across different sectors.

The Residential segment leads the market, driven by the increasing demand for housing and urban development projects. The growth in population and the government's focus on affordable housing initiatives have significantly boosted the need for construction nails in residential buildings. The Commercial segment also shows strong demand due to ongoing commercial projects, including offices and retail spaces, which require reliable fastening solutions. Government and utility projects, including infrastructure and public buildings, are also contributing to the demand for high-quality nails, especially in light of stricter building codes and safety standards ; .

The Saudi Arabia Construction Nails Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Fozan Group, Al-Jazira Factory for Steel Products, Al-Muhaidib Group, Saudi Steel Pipe Company, Al-Babtain Group, Al-Khodari & Sons, Al-Rajhi Construction, Al-Omran Group, Al-Mansour Group, Al-Suwaidi Industrial Services, Al-Hokair Group, Al-Faisaliah Group, Al-Saeed Group, Al-Muhaidib Steel, Al-Bilad Concrete contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia construction nails market appears promising, driven by ongoing government initiatives and a focus on sustainable construction practices. As the Kingdom invests heavily in infrastructure and housing projects, the demand for high-quality construction nails is expected to rise. Additionally, the integration of advanced manufacturing technologies will enhance production efficiency, allowing manufacturers to meet the evolving needs of the construction industry while maintaining compliance with regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Common Nails Finishing Nails Roofing Nails Concrete Nails Specialty Nails Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Application | Construction Renovation DIY Projects Others |

| By Material | Steel Stainless Steel Aluminum Others |

| By Distribution Channel | Direct Sales Retail Stores Online Sales Distributors Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 45 | Project Managers, Site Supervisors |

| Commercial Building Contractors | 38 | Construction Managers, Procurement Officers |

| Manufacturers of Construction Materials | 28 | Production Managers, Quality Control Officers |

| Distributors of Construction Materials | 32 | Sales Managers, Logistics Coordinators |

| Government Infrastructure Projects | 22 | Project Coordinators, Infrastructure Specialists |

The Saudi Arabia Construction Nails Market is valued at approximately USD 1.1 billion, driven by the booming construction sector and government investments in infrastructure projects. This growth reflects the increasing demand for construction nails in various applications across the country.