Region:Middle East

Author(s):Rebecca

Product Code:KRAC2495

Pages:96

Published On:October 2025

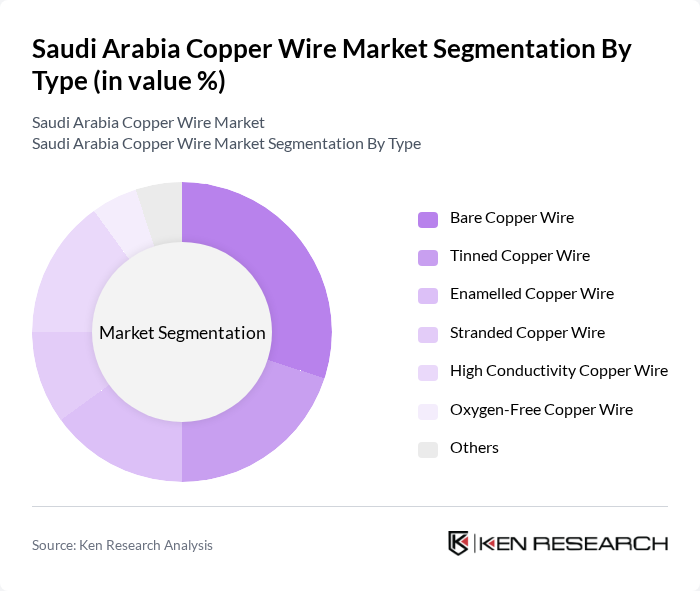

By Type:The market is segmented into various types of copper wire, including Bare Copper Wire, Tinned Copper Wire, Enamelled Copper Wire, Stranded Copper Wire, High Conductivity Copper Wire, Oxygen-Free Copper Wire, and Others. Each type serves different applications and industries, with specific characteristics that cater to varying consumer needs.

The Bare Copper Wire segment leads the market due to its widespread use in electrical wiring applications, particularly in residential and commercial buildings. Its excellent conductivity and affordability make it a preferred choice among consumers. Tinned Copper Wire follows closely, favored for its corrosion resistance, making it suitable for outdoor and marine applications. The demand for Enamelled Copper Wire is also rising, especially in electronics manufacturing, where insulation properties are crucial.

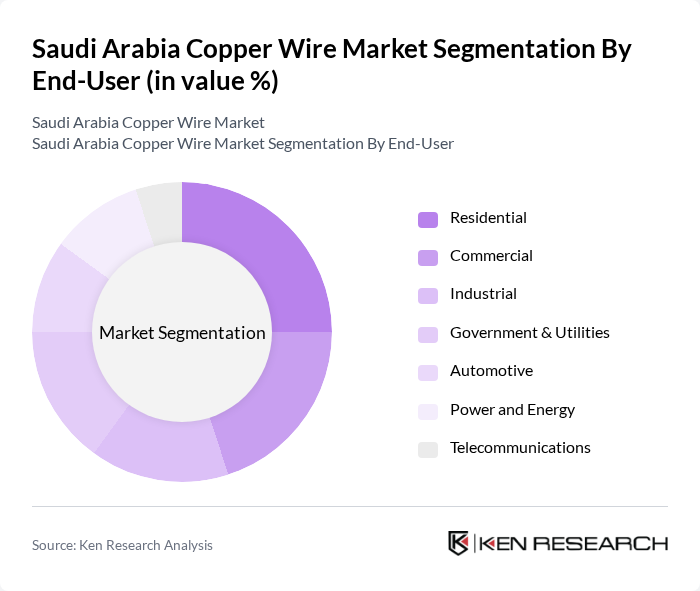

By End-User:The market is segmented by end-users, including Residential, Commercial, Industrial, Government & Utilities, Automotive, Power and Energy, and Telecommunications. Each end-user category has distinct requirements and applications for copper wire, influencing market dynamics.

The Residential segment is the largest end-user, driven by the growing construction of new homes and renovations of existing properties. The Commercial sector also shows significant demand due to the expansion of office buildings and retail spaces. Industrial applications are increasing as manufacturing and production facilities require reliable electrical systems. The Government & Utilities sector is crucial for infrastructure projects, while the Automotive and Telecommunications sectors are emerging as important contributors to market growth.

The Saudi Arabia Copper Wire Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Cable Company, Riyadh Cables Group Company, Alfanar Company, Ducab, Bahra Electric, Al-Jazira Cables, Gulf Cable and Electrical Industries Company, National Cables Industry, Al-Babtain Power & Telecommunication Co., Al-Suwaidi Industrial Services, Al-Rajhi Holding Group, Al-Muhaidib Group, Al-Falak Electronic Equipment & Supplies, Saudi Electricity Company, Al-Khodari & Sons contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia copper wire market is expected to experience robust growth driven by increasing investments in construction and renewable energy projects. As the government continues to prioritize infrastructure development, the demand for copper wire will remain strong. Additionally, technological advancements in wire production and a shift towards eco-friendly manufacturing practices will further enhance market dynamics. Companies that adapt to these trends and invest in sustainable practices will likely gain a competitive edge in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Bare Copper Wire Tinned Copper Wire Enamelled Copper Wire Stranded Copper Wire High Conductivity Copper Wire Oxygen-Free Copper Wire Others |

| By End-User | Residential Commercial Industrial Government & Utilities Automotive Power and Energy Telecommunications |

| By Application | Electrical Wiring Power Transmission Lines Electronics Manufacturing Electric Vehicles Industrial Machinery Telecommunications |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Price Range | Economy Mid-Range Premium |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Electrical Installations | 60 | Electrical Contractors, Home Builders |

| Commercial Construction Projects | 50 | Project Managers, Procurement Officers |

| Industrial Manufacturing Facilities | 45 | Facility Managers, Operations Directors |

| Government Infrastructure Projects | 40 | Public Works Officials, Policy Makers |

| Renewable Energy Installations | 45 | Energy Project Developers, Sustainability Managers |

The Saudi Arabia Copper Wire Market is valued at approximately USD 2.2 billion, driven by increasing demand in sectors such as construction, automotive, and telecommunications, alongside the growth of renewable energy projects.