Region:Global

Author(s):Rebecca

Product Code:KRAC9663

Pages:83

Published On:November 2025

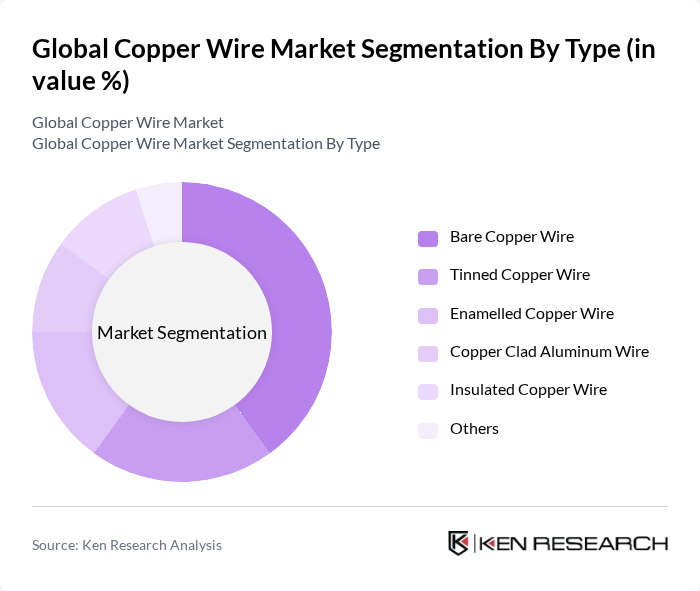

By Type:The market is segmented into Bare Copper Wire, Tinned Copper Wire, Enamelled Copper Wire, Copper Clad Aluminum Wire, Insulated Copper Wire, and Others. Bare Copper Wire is the most dominant segment due to its extensive use in electrical applications, where high conductivity is essential. Demand for Insulated Copper Wire is rising, driven by stringent safety regulations, the need for efficient energy transmission, and the growth of smart grid and renewable energy projects .

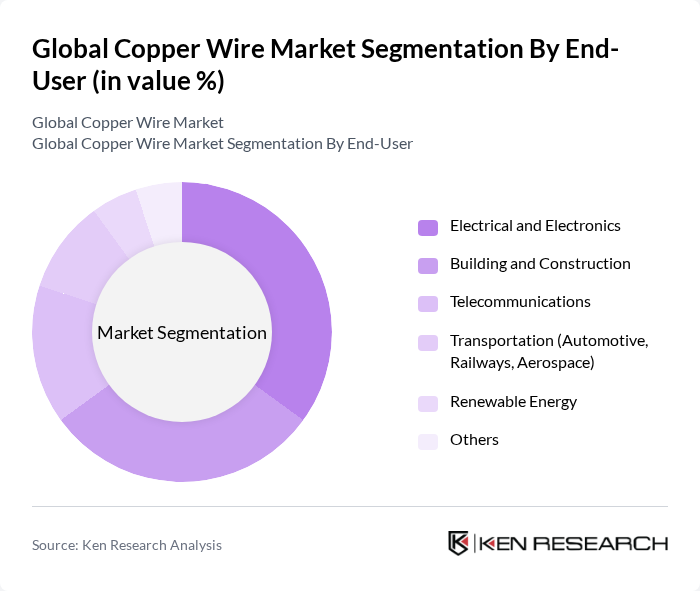

By End-User:The end-user segments include Electrical and Electronics, Building and Construction, Telecommunications, Transportation (Automotive, Railways, Aerospace), Renewable Energy, and Others. The Electrical and Electronics segment holds the largest share, driven by the increasing demand for consumer electronics, electrical appliances, and digital infrastructure. The Building and Construction sector is also significant, as copper wire is essential for electrical installations in residential, commercial, and industrial buildings. Telecommunications and renewable energy are rapidly growing segments due to the expansion of fiber networks and solar/wind installations .

The Global Copper Wire Market is characterized by a dynamic mix of regional and international players. Leading participants such as Southwire Company, LLC, Nexans S.A., General Cable Technologies Corporation, Prysmian Group, Amphenol Corporation, Leoni AG, Encore Wire Corporation, Sumitomo Electric Industries, Ltd., Furukawa Electric Co., Ltd., KME Group S.p.A., Alan Wire Co., American Wire Group, Aviva Metals Inc., Elcowire Group AB, Finolex Cables Ltd., Hindalco Industries Limited, Fujikura Ltd., Belden Inc., LS Cable & System Ltd., KEI Industries Ltd., Cords Cable Industries Ltd., Metalurgica Gerdau S.A., TPC Wire & Cable Corp., The Okonite Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the copper wire market appears promising, driven by the ongoing transition towards renewable energy and the expansion of electrical infrastructure. As global economies recover and invest in sustainable technologies, the demand for copper wire is expected to rise. Additionally, the integration of smart technologies in electrical systems will further enhance the need for high-quality copper wire, positioning the industry for substantial growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Bare Copper Wire Tinned Copper Wire Enamelled Copper Wire Copper Clad Aluminum Wire Insulated Copper Wire Others |

| By End-User | Electrical and Electronics Building and Construction Telecommunications Transportation (Automotive, Railways, Aerospace) Renewable Energy Others |

| By Region | Asia-Pacific North America Europe Latin America Middle East and Africa Others |

| By Application | Power Generation Power Transmission Power Distribution Electronics & Consumer Devices Renewable Energy Systems Others |

| By Investment Source | Private Investments Public Funding Foreign Direct Investment (FDI) Joint Ventures Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Regulatory Support Others |

| By Technology | Conventional Manufacturing Advanced Manufacturing Techniques Automation in Production Smart Manufacturing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Copper Wire Usage | 100 | Project Managers, Electrical Engineers |

| Automotive Wiring Applications | 60 | Manufacturing Engineers, Procurement Managers |

| Consumer Electronics Sector | 50 | Product Development Managers, Supply Chain Analysts |

| Telecommunications Infrastructure | 40 | Network Engineers, Operations Managers |

| Electrical Distribution Networks | 45 | Utility Managers, Electrical Contractors |

The Global Copper Wire Market is valued at approximately USD 149 billion, driven by increasing demand in sectors such as construction, automotive, and renewable energy. This valuation is based on a five-year historical analysis of market trends and growth factors.