Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8157

Pages:96

Published On:November 2025

By Type:The market is segmented into various types of copper wire, including Bare Copper Wire, Tinned Copper Wire, Enamelled Copper Wire, Copper Clad Aluminum Wire, High Voltage Copper Wire, Low Voltage Copper Wire, and Others. Each type serves different applications and industries, catering to specific consumer needs .

The Bare Copper Wire segment leads the market due to its widespread use in electrical applications, particularly in power transmission and distribution. Its excellent conductivity and reliability make it the preferred choice for electrical utilities and construction projects. The growing demand for renewable energy systems also boosts the need for Bare Copper Wire, as it is essential for efficient energy transfer in solar and wind energy applications .

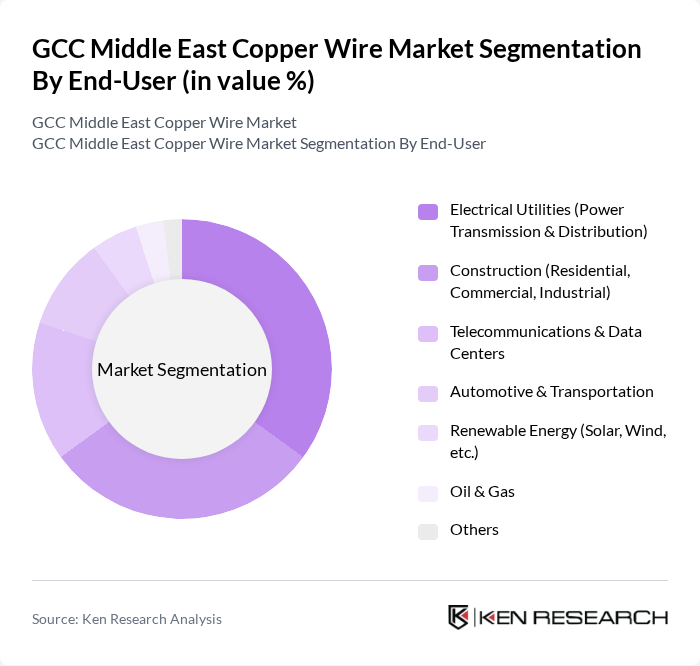

By End-User:The market is segmented by end-user industries, including Electrical Utilities (Power Transmission & Distribution), Construction (Residential, Commercial, Industrial), Telecommunications & Data Centers, Automotive & Transportation, Renewable Energy (Solar, Wind, etc.), Oil & Gas, and Others. Each segment reflects the diverse applications of copper wire across various sectors .

The Electrical Utilities segment dominates the market, driven by the ongoing expansion of power infrastructure and the need for reliable energy distribution. The increasing investments in renewable energy projects further enhance the demand for copper wire in this sector, as it is crucial for efficient energy transmission. Additionally, the Construction sector is also a significant contributor, as urbanization and infrastructure development continue to rise across the GCC region .

The GCC Middle East Copper Wire Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Cable and Electrical Industries Company K.S.C.P., Saudi Cable Company, Oman Cables Industry S.A.O.G., Ducab (Dubai Cable Company), Emirates Cables (Emirates Electrical Engineering LLC), Alfanar, Riyadh Cables Group Company, Elsewedy Electric, Prysmian Group, Nexans, Leoni AG, Sumitomo Electric Industries, Ltd., Furukawa Electric Co., Ltd., LS Cable & System Ltd., Southwire Company, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC copper wire market appears promising, driven by ongoing investments in infrastructure and renewable energy. As urbanization continues, the demand for high-quality copper wire will likely increase, particularly in smart grid and electric vehicle charging infrastructure. Additionally, advancements in manufacturing technologies will enhance production efficiency, allowing companies to meet the growing demand while adhering to environmental regulations. The market is poised for innovation, with a focus on sustainability and efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Bare Copper Wire Tinned Copper Wire Enamelled Copper Wire Copper Clad Aluminum Wire High Voltage Copper Wire Low Voltage Copper Wire Others |

| By End-User | Electrical Utilities (Power Transmission & Distribution) Construction (Residential, Commercial, Industrial) Telecommunications & Data Centers Automotive & Transportation Renewable Energy (Solar, Wind, etc.) Oil & Gas Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Application | Power Generation Power Transmission Power Distribution Renewable Energy Systems Building Wiring Industrial Automation Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Research and Development Grants Others |

| By Technology | Conventional Wire Manufacturing Advanced Wire Drawing Techniques Automated Production Systems Smart Wire Technologies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Copper Wire Usage | 100 | Project Managers, Electrical Engineers |

| Electrical Equipment Manufacturers | 60 | Product Development Managers, Procurement Specialists |

| Wholesale Distributors of Copper Products | 50 | Sales Managers, Inventory Analysts |

| Telecommunications Infrastructure Providers | 40 | Network Engineers, Operations Managers |

| Recycling and Scrap Dealers | 40 | Business Owners, Operations Supervisors |

The GCC Middle East Copper Wire Market is valued at approximately USD 2.2 billion, reflecting significant growth driven by increasing demand in construction, automotive, and renewable energy sectors across the region.