Region:Middle East

Author(s):Rebecca

Product Code:KRAD8201

Pages:96

Published On:December 2025

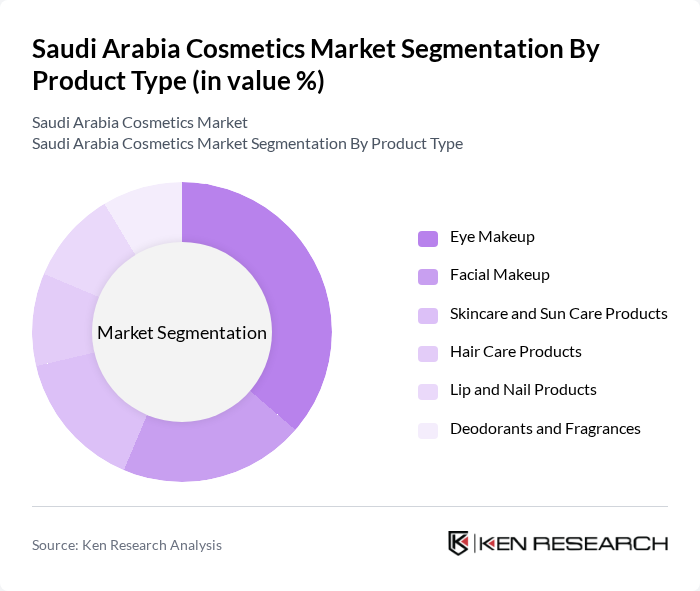

By Product Type:The product type segmentation includes various categories such as Eye Makeup, Facial Makeup, Skincare and Sun Care Products, Hair Care Products, Lip and Nail Products, and Deodorants and Fragrances. Among these, Eye Makeup is currently the leading sub-segment, driven by the increasing popularity of makeup tutorials on social media and the rising demand for eye cosmetics among younger consumers. The trend towards bold and expressive eye makeup has significantly influenced purchasing behavior, making it a focal point in the cosmetics market.

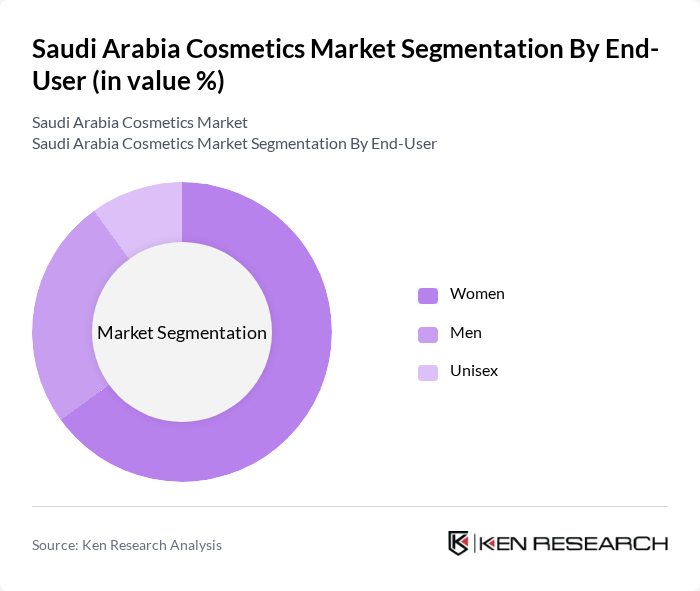

By End-User:The end-user segmentation includes Women, Men, and Unisex categories. Women represent the largest segment, driven by a strong cultural emphasis on beauty and personal grooming. The increasing availability of products tailored specifically for women, along with targeted marketing strategies, has solidified their dominance in the cosmetics market. Men’s grooming products are also gaining traction, reflecting a shift in societal norms and increasing acceptance of male cosmetics.

The Saudi Arabia Cosmetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Perfumes, Abdul Samad Al Qurashi, Al Nahdi Medical Company, Sephora Middle East, L'Oréal Middle East, Unilever Arabia, Procter & Gamble Arabia, Estée Lauder Companies, Beiersdorf AG, Coty Inc., Pantene (Procter & Gamble), Dove (Unilever), Nykaa (E-commerce Platform), Shiseido Company, Limited, Amway Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi cosmetics market appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability and eco-friendly products is expected to shape product development, with brands investing in green formulations. Additionally, the rise of personalized beauty solutions, facilitated by data analytics and AI, will cater to individual consumer needs, enhancing customer satisfaction. As the market continues to adapt, innovative marketing strategies and collaborations with local influencers will play a crucial role in brand visibility and consumer engagement.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Eye Makeup (36.34% market share) Facial Makeup Skincare and Sun Care Products Hair Care Products Lip and Nail Products Deodorants and Fragrances |

| By End-User | Women Men Unisex |

| By Distribution Channel | Specialty Stores (57.34% market share) Online Retail (8.25% CAGR growth) Supermarkets and Hypermarkets Pharmacies Others |

| By Price Range | Premium Mass Market (69.34% market share) Economy |

| By Ingredient Type | Conventional and Synthetic (72.46% market share) Natural and Organic (6.86% CAGR growth) Halal-Certified Products |

| By Packaging Type | Bottles Tubes Jars Others |

| By Brand Type | Local Brands International Brands Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Skincare Products | 120 | Female Consumers, Ages 18-45 |

| Makeup Product Preferences | 100 | Beauty Enthusiasts, Makeup Artists |

| Haircare Product Usage | 80 | Hair Salon Owners, Stylists |

| Fragrance Market Insights | 70 | Retail Managers, Brand Representatives |

| Online Shopping Behavior | 100 | Frequent Online Shoppers, E-commerce Users |

The Saudi Arabia cosmetics market is valued at approximately USD 4 billion, driven by increasing consumer awareness of personal grooming, the rise of e-commerce, and a growing preference for premium, organic, and halal products.