Region:Middle East

Author(s):Rebecca

Product Code:KRAD6161

Pages:99

Published On:December 2025

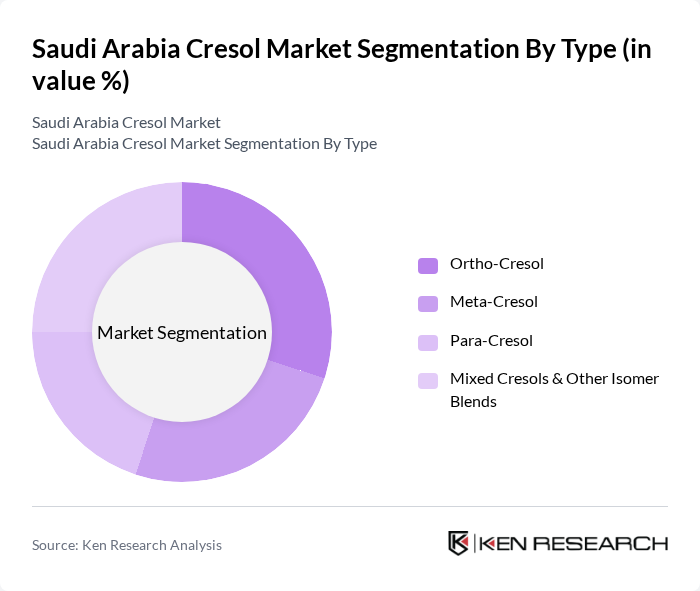

By Type:The cresol market can be segmented into four main types: Ortho-Cresol, Meta-Cresol, Para-Cresol, and Mixed Cresols & Other Isomer Blends. Each type serves distinct applications across various industries—para-cresol and meta-cresol are widely used as intermediates in fragrances, vitamin E, antioxidants, and agrochemicals, while ortho-cresol and mixed isomer blends are important for resins, disinfectants, and specialty intermediates—thereby influencing their market dynamics and consumer preferences.

The Ortho-Cresol segment is currently leading the market due to its extensive use in the production of antioxidants and disinfectants, which are in high demand in the healthcare and agricultural sectors, consistent with the broader cresols market where cresols are important intermediates for disinfectants, resins, and antioxidant additives. The increasing focus on health and hygiene, especially after recent global public health crises, has driven the consumption of Ortho-Cresol in disinfectant formulations and hygiene-related products. Additionally, its application in the synthesis of various chemical intermediates used in specialty resins, coatings, and industrial additives further solidifies its market leadership within the Saudi specialty chemicals value chain.

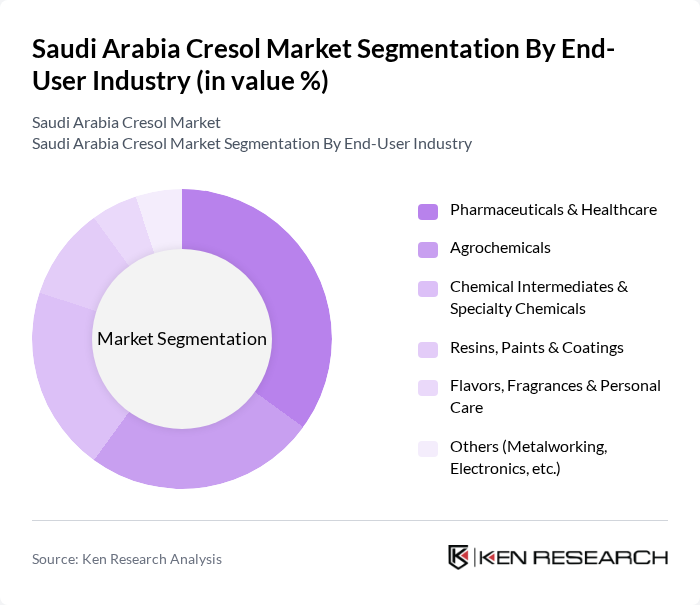

By End-User Industry:The cresol market is segmented based on end-user industries, including Pharmaceuticals & Healthcare, Agrochemicals, Chemical Intermediates & Specialty Chemicals, Resins, Paints & Coatings, Flavors, Fragrances & Personal Care, and Others (Metalworking, Electronics, etc.). Each industry has unique requirements and applications for cresols: pharmaceutical and healthcare uses center on antiseptics, preservatives, and intermediates for active ingredients; agrochemicals use cresols as intermediates in herbicides and pesticides; specialty chemicals and resins rely on cresols for high-performance resins, plasticizers, and antioxidants; and the flavors and fragrances segment uses para-cresol derivatives in aroma chemicals.

The Pharmaceuticals & Healthcare sector is the dominant end-user industry for cresols, accounting for a significant portion of the market, in line with global patterns where medical, pharmaceutical, and disinfectant applications form a major demand base for cresol derivatives and intermediates. This is attributed to the increasing demand for pharmaceutical products, antiseptics, and disinfectants, particularly amid heightened health awareness and ongoing investments in healthcare infrastructure in Saudi Arabia. The agrochemical industry also plays a crucial role, driven by the need for effective pesticides and herbicides in support of domestic food security and agricultural productivity, further supporting the growth of cresol consumption in these sectors as cresols are key intermediates in several crop protection molecules.

The Saudi Arabia Cresol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Saudi Kayan Petrochemical Company, Saudi Chevron Phillips Company, Petro Rabigh (Rabigh Refining and Petrochemical Company), Sadara Chemical Company, Saudi Aramco (Chemicals & Downstream), Tasnee (National Industrialization Company), Advanced Petrochemical Company, National Petrochemical Company (NATPET), Al-Jubail Petrochemical Company (KEMYA), Sahara International Petrochemical Company (Sipchem), Riyadh Chemical Industries Company (RCIC), Arabian Chemical Terminals Co. Ltd., Gulf Stabilizers Industries (GSI), Saudi Industrial Investment Group (SIIG) contribute to innovation, geographic expansion, and service delivery in this space, leveraging Saudi Arabia’s large petrochemical base and expanding specialty chemicals and derivatives capabilities.

The Saudi Arabia cresol market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. In future, the adoption of green chemistry principles is expected to reshape production processes, enhancing efficiency and reducing environmental impact. Additionally, the focus on product innovation will likely lead to the development of new applications for cresol, particularly in high-demand sectors such as automotive and electronics, fostering a more resilient market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Ortho-Cresol Meta-Cresol Para-Cresol Mixed Cresols & Other Isomer Blends |

| By End-User Industry | Pharmaceuticals & Healthcare Agrochemicals Chemical Intermediates & Specialty Chemicals Resins, Paints & Coatings Flavors, Fragrances & Personal Care Others (Metalworking, Electronics, etc.) |

| By Application | Chemical Intermediates (Antioxidants, Plasticizers, etc.) Resins & Laminates Disinfectants & Preservatives Solvents Others |

| By Distribution Channel | Direct Sales to End Users Industrial Distributors & Traders International Importers/Off-takers Others |

| By Region (Within Saudi Arabia) | Eastern Province (Jubail, Dammam, Ras Al-Khair) Central Region (Riyadh & Surrounding Areas) Western Region (Jeddah, Yanbu, Makkah & Madinah) Southern & Northern Regions |

| By Product Form | Liquid Cresols Solid/Flake Cresols Others |

| By Regulatory & Quality Compliance | Products Compliant with SASO / SFDA / GSO Standards ISO-Certified Production (ISO 9001 / ISO 14001 / ISO 45001) Reach/Globally Compliant Imported Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cresol Production Insights | 120 | Production Managers, Chemical Engineers |

| Pharmaceutical Applications of Cresol | 100 | R&D Managers, Quality Assurance Officers |

| Agrochemical Sector Usage | 90 | Product Development Managers, Regulatory Affairs Specialists |

| Cresol Market Trends | 110 | Market Analysts, Business Development Executives |

| Environmental Impact Assessments | 80 | Sustainability Managers, Compliance Officers |

The Saudi Arabia Cresol Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for cresols in pharmaceuticals, agrochemicals, and specialty chemicals.