Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1204

Pages:80

Published On:November 2025

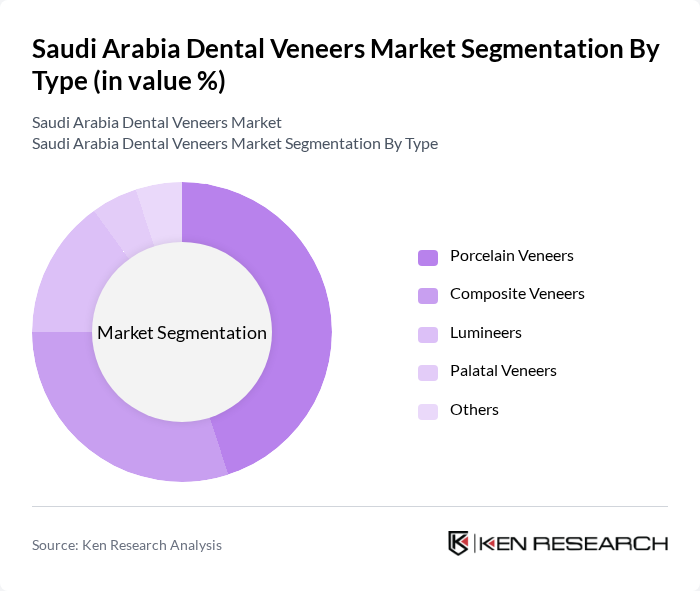

By Type:The market is segmented into various types of dental veneers, including Porcelain Veneers, Composite Veneers, Lumineers, Palatal Veneers, and Others. Among these, Porcelain Veneers are the most popular due to their durability and natural appearance, making them a preferred choice for cosmetic dental procedures. Composite Veneers are also gaining traction due to their cost-effectiveness and ease of application. The demand for Lumineers is increasing as they offer a less invasive option, while Palatal Veneers cater to specific dental needs. Recent trends show growing interest in minimally invasive techniques and digital smile design, which are shaping product preferences and clinical approaches .

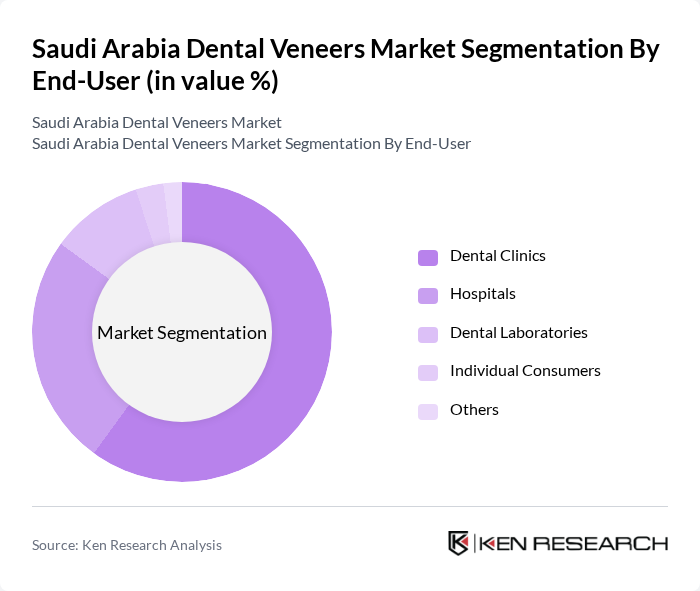

By End-User:The end-user segmentation includes Dental Clinics, Hospitals, Dental Laboratories, Individual Consumers, and Others. Dental Clinics dominate the market as they are the primary providers of veneer treatments, offering specialized services and personalized care. Hospitals also play a significant role, particularly for patients requiring comprehensive dental care. Dental Laboratories support the market by providing high-quality veneer products, while Individual Consumers are increasingly seeking cosmetic enhancements directly. The trend toward direct-to-consumer dental aesthetics is supported by rising disposable incomes and improved access to information .

The Saudi Arabia Dental Veneers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Harbi Dental Clinic, Dr. Sulaiman Al Habib Medical Group, Al-Faisal Dental Center, Saudi German Hospital, Al-Muhaidib Dental Clinics, Al-Dar Dental Clinic, Dr. Abdulaziz Al-Mansour Dental Clinic, Al-Mahd Dental Center, Al-Jazeera Dental Clinic, Al-Mansour Dental Clinic, Dr. Nasser Al-Shehri Dental Clinic, Al-Salam Dental Center, Al-Muhaidib Group, Dr. Khalid Al-Mansour Dental Clinic, Al-Farabi Dental Clinic, Dr. Abdulrahman Al Shammari Dental Center, Al Nahdi Dental Clinic, Dr. Bader Al-Omran Dental Center, Dr. Mazen Al-Johani Dental Clinic, Dr. Abdulaziz Al-Saleh Dental Center contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia dental veneers market is poised for significant growth, driven by increasing consumer awareness and advancements in dental technology. As the population becomes more health-conscious and aesthetic-driven, the demand for cosmetic dental solutions will likely rise. Additionally, the expansion of dental clinics and the integration of digital dentistry will enhance service delivery, making veneers more accessible. The market is expected to evolve with a focus on minimally invasive procedures and sustainable materials, aligning with global trends in healthcare and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Porcelain Veneers Composite Veneers Lumineers Palatal Veneers Others |

| By End-User | Dental Clinics Hospitals Dental Laboratories Individual Consumers Others |

| By Material | Ceramic Resin Composite Zirconia Others |

| By Distribution Channel | Direct Sales Online Sales Dental Supply Distributors Others |

| By Region | Riyadh Jeddah Dammam Eastern Region Western Region Northern and Central Region Southern Region Others |

| By Age Group | Adults Teenagers Seniors Others |

| By Treatment Type | Cosmetic Treatment Restorative Treatment Preventive Treatment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Clinics Offering Veneers | 100 | Dentists, Clinic Managers |

| Patients Who Have Received Veneers | 120 | Dental Patients, Cosmetic Dentistry Clients |

| Dental Supply Distributors | 60 | Sales Representatives, Product Managers |

| Dental Insurance Providers | 50 | Underwriters, Claims Adjusters |

| Dental Education Institutions | 40 | Faculty Members, Program Coordinators |

The Saudi Arabia Dental Veneers Market is valued at approximately USD 725 million, reflecting significant growth driven by increasing consumer awareness of dental aesthetics and advancements in dental technology and materials.