Region:Middle East

Author(s):Rebecca

Product Code:KRAD2931

Pages:88

Published On:November 2025

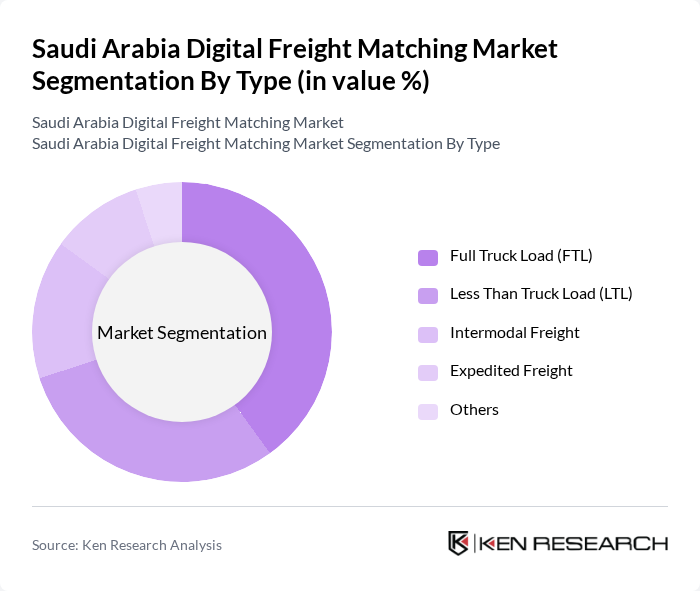

By Type:The market is segmented into various types, including Full Truck Load (FTL), Less Than Truck Load (LTL), Intermodal Freight, Expedited Freight, and Others. Each of these segments caters to different logistics needs, with FTL and LTL being the most prominent due to their widespread application in freight transportation. Intermodal freight is gaining traction as companies seek multimodal solutions for efficiency and cost savings, while expedited freight addresses urgent delivery requirements for time-sensitive shipments .

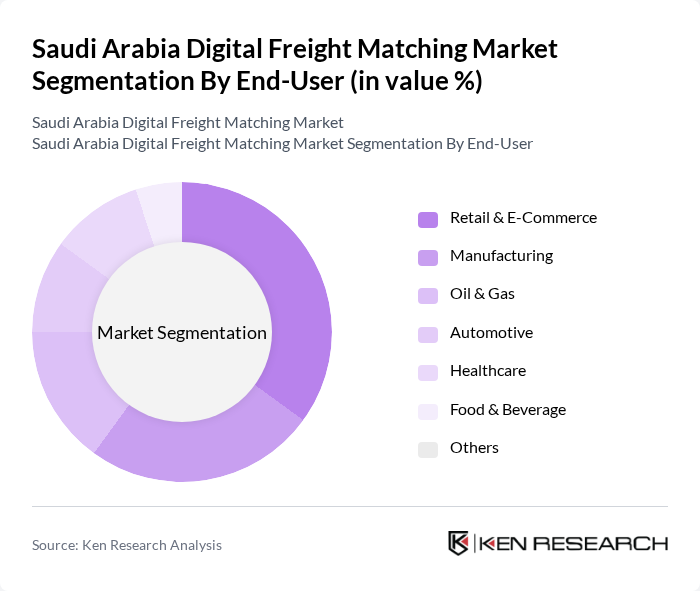

By End-User:The end-user segmentation includes Retail & E-Commerce, Manufacturing, Oil & Gas, Automotive, Healthcare, Food & Beverage, and Others. Retail & E-Commerce is the leading segment, driven by the surge in online shopping and the demand for efficient delivery services. Manufacturing and Oil & Gas sectors leverage digital freight matching platforms for improved supply chain visibility and cost optimization, while automotive and healthcare segments utilize these platforms for timely and secure transportation of goods .

The Saudi Arabia Digital Freight Matching Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trukkin, Fetchr, Saloodo! (DHL Group), Qabala, Transportify, Zajil Express, Naqel Express, Aramex, DHL Supply Chain, Agility Logistics, Al-Futtaim Logistics, Al-Muhaidib Group, Al-Jazira Transport, Al-Hokair Group, Al-Mansour Group, Freight Tiger, C.H. Robinson Worldwide Inc., Convoy, XPO Logistics, Uber Freight contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital freight matching market in Saudi Arabia appears promising, driven by technological advancements and increasing demand for efficient logistics solutions. As the government continues to invest in digital infrastructure, companies are likely to adopt innovative technologies such as AI and machine learning. Additionally, the growing e-commerce sector will further propel the need for real-time tracking and automated logistics processes, enhancing overall service delivery and customer satisfaction in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Intermodal Freight Expedited Freight Others |

| By End-User | Retail & E-Commerce Manufacturing Oil & Gas Automotive Healthcare Food & Beverage Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Cloud-based Solutions Mobile Applications AI and Machine Learning Blockchain Technology Others |

| By Application | Freight Brokerage Fleet Management Route Optimization Load Matching Value-Added Services Others |

| By Investment Source | Private Investments Government Funding Venture Capital Public-Private Partnerships Others |

| By Policy Support | Subsidies for Digital Solutions Tax Incentives for Startups Grants for Technology Development Regulatory Support for Innovation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Freight Platforms | 50 | Product Managers, Business Development Executives |

| Logistics Service Providers | 60 | Operations Managers, Fleet Coordinators |

| Shippers and Freight Forwarders | 70 | Supply Chain Managers, Logistics Directors |

| Technology Providers | 40 | CTOs, Software Development Leads |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Saudi Arabia Digital Freight Matching Market is valued at approximately USD 930 million, reflecting significant growth driven by the adoption of digital technologies in logistics, the rise of e-commerce, and the need for efficient supply chain management.