Region:Middle East

Author(s):Rebecca

Product Code:KRAC8543

Pages:89

Published On:November 2025

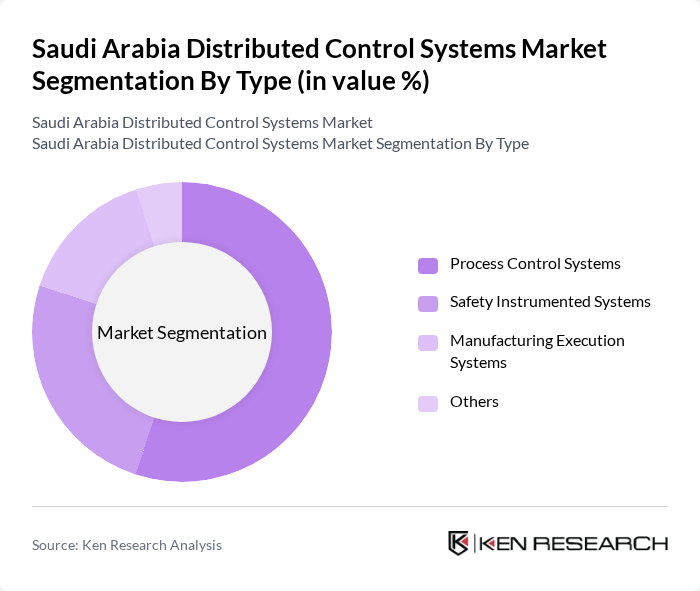

By Type:The market is segmented into Process Control Systems, Safety Instrumented Systems, Manufacturing Execution Systems, and Others. Among these, Process Control Systems are the most dominant, reflecting their critical role in managing and automating industrial processes, especially in oil and gas. The increasing complexity of operations, integration of digital technologies, and the need for real-time monitoring and control have led to higher adoption of these systems. Safety Instrumented Systems are also vital, particularly in industries where safety and regulatory compliance are paramount, but their deployment volume remains lower than Process Control Systems .

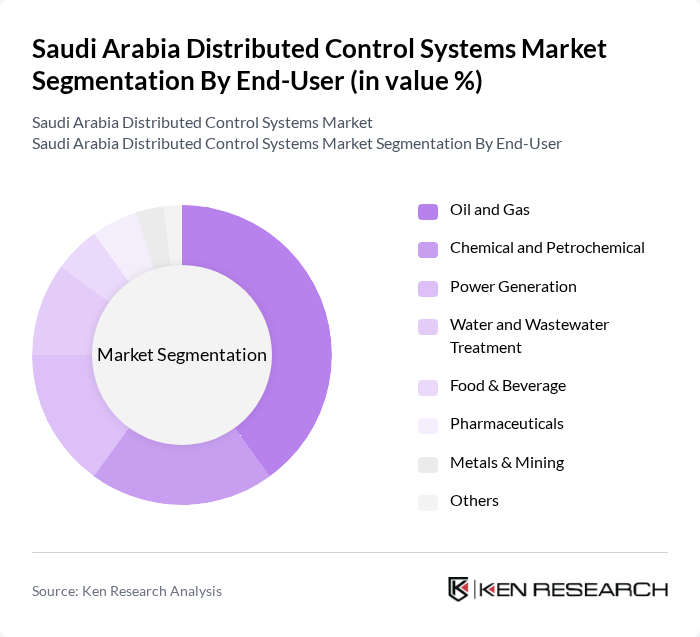

By End-User:The end-user segmentation includes Oil and Gas, Chemical and Petrochemical, Power Generation, Water and Wastewater Treatment, Food & Beverage, Pharmaceuticals, Metals & Mining, and Others. Oil and Gas remains the leading end-user, driven by the need for enhanced operational efficiency, digitalization, and safety in exploration and production. Chemical and Petrochemical industries follow, requiring precise control over complex processes. The increasing focus on sustainability, digital transformation, and regulatory compliance in these sectors further propels the demand for distributed control systems .

The Saudi Arabia Distributed Control Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Honeywell International Inc., ABB Ltd., Schneider Electric SE, Yokogawa Electric Corporation, Emerson Electric Co., Rockwell Automation, Inc., Mitsubishi Electric Corporation, General Electric Company, KROHNE Group, Endress+Hauser AG, National Instruments Corporation, Azbil Corporation, Schneider Electric Saudi Arabia, Yokogawa Saudi Arabia Ltd., Advanced Electronics Company (AEC), Saudi Controls Ltd., Alfanar Company, Nesma & Partners Contracting Co. Ltd., and Petro Rabigh contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia Distributed Control Systems market appears promising, driven by ongoing technological advancements and government support. As industries increasingly adopt automation and smart technologies, the demand for DCS is expected to rise significantly. Furthermore, the integration of IoT and AI into industrial processes will enhance operational efficiency and data analytics capabilities, positioning DCS as a critical component in the digital transformation of various sectors, particularly energy and manufacturing.

| Segment | Sub-Segments |

|---|---|

| By Type | Process Control Systems Safety Instrumented Systems Manufacturing Execution Systems Others |

| By End-User | Oil and Gas Chemical and Petrochemical Power Generation Water and Wastewater Treatment Food & Beverage Pharmaceuticals Metals & Mining Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Distributed Control Systems (DCS) Supervisory Control and Data Acquisition (SCADA) Programmable Logic Controllers (PLC) Industrial Internet of Things (IIoT) Others |

| By Application | Process Automation Batch Control Continuous Control Asset Management Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector DCS Implementation | 100 | Operations Managers, Automation Engineers |

| Petrochemical Industry Automation | 80 | Process Control Specialists, Project Managers |

| Water Treatment Facilities | 50 | Facility Managers, Environmental Engineers |

| Manufacturing Sector DCS Usage | 90 | Production Supervisors, IT Managers |

| Energy Sector Control Systems | 60 | Energy Analysts, System Integration Specialists |

The Saudi Arabia Distributed Control Systems Market is valued at approximately USD 255 million, reflecting the country's significant share in the Middle East market, primarily driven by the demand for automation in key industries like oil and gas.