Region:Middle East

Author(s):Geetanshi

Product Code:KRAA8046

Pages:87

Published On:September 2025

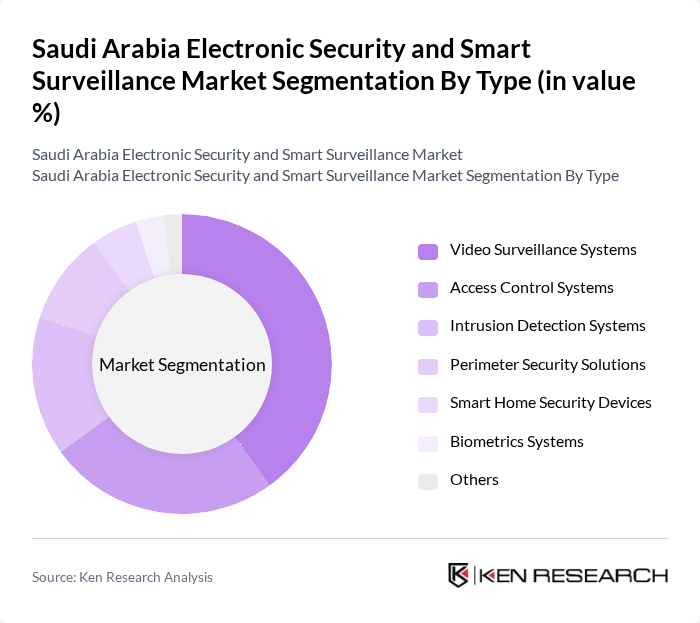

By Type:The market is segmented into various types of electronic security and smart surveillance solutions, including video surveillance systems, access control systems, intrusion detection systems, perimeter security solutions, smart home security devices, biometrics systems, and others. Among these, video surveillance systems are the most dominant due to their widespread adoption in both commercial and residential sectors, driven by the need for enhanced security and monitoring capabilities.

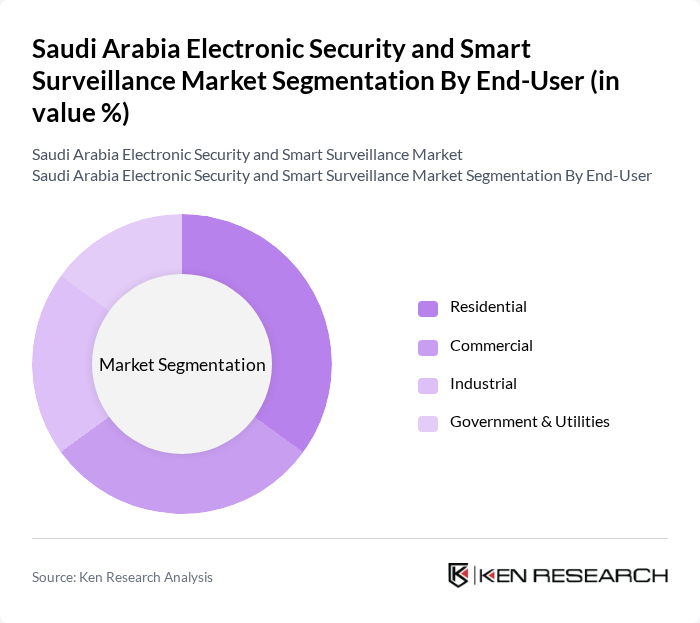

By End-User:The end-user segmentation includes residential, commercial, industrial, and government & utilities sectors. The residential segment is witnessing significant growth due to increasing consumer awareness regarding home security and the adoption of smart home technologies. Commercial establishments are also investing heavily in security solutions to protect assets and ensure safety, making them a key contributor to market growth.

The Saudi Arabia Electronic Security and Smart Surveillance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Axis Communications AB, Bosch Security Systems, Honeywell International Inc., Johnson Controls International plc, Tyco International plc, FLIR Systems, Inc., Genetec Inc., Avigilon Corporation, Panasonic Corporation, Samsung Techwin Co., Ltd., Milestone Systems A/S, SecureTech Solutions, ZKTeco Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electronic security and smart surveillance market in Saudi Arabia appears promising, driven by technological advancements and government support. As urbanization continues, the demand for integrated security solutions is expected to rise significantly. By future, the market is likely to see a shift towards cloud-based systems and IoT integration, enhancing real-time monitoring capabilities. Additionally, the focus on cybersecurity measures will become increasingly critical as more devices connect to the internet, ensuring data protection and system integrity.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Surveillance Systems Access Control Systems Intrusion Detection Systems Perimeter Security Solutions Smart Home Security Devices Biometrics Systems Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Retail Security Transportation Security Critical Infrastructure Protection Public Safety |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Outlets |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Grants for Technology Adoption |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Security Agencies | 100 | Security Directors, Policy Makers |

| Commercial Enterprises | 80 | Facility Managers, IT Security Officers |

| Residential Customers | 70 | Homeowners, Property Managers |

| Technology Integrators | 60 | System Engineers, Project Managers |

| Consultants in Security Technology | 50 | Industry Analysts, Security Consultants |

The Saudi Arabia Electronic Security and Smart Surveillance Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, government initiatives for smart city projects, and increasing public safety concerns.