Region:Europe

Author(s):Rebecca

Product Code:KRAB5900

Pages:94

Published On:October 2025

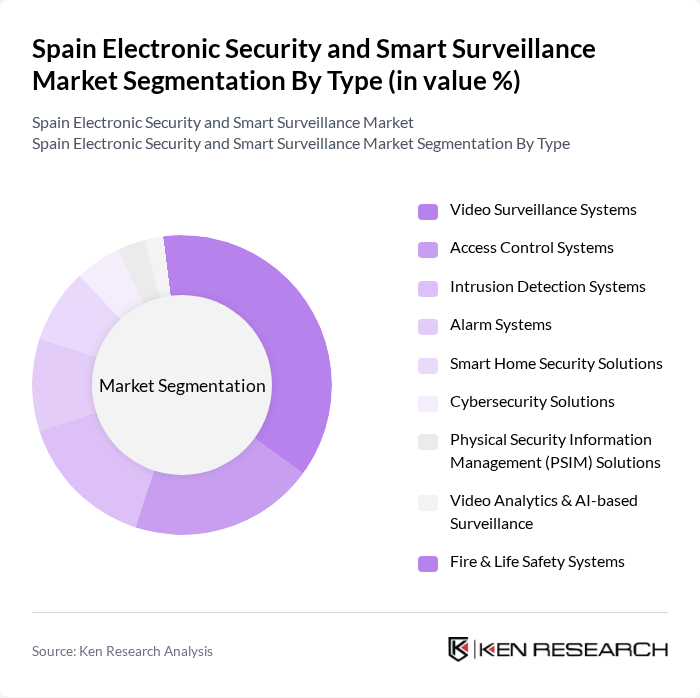

By Type:The market is segmented into various types of electronic security and smart surveillance solutions, including Video Surveillance Systems, Access Control Systems, Intrusion Detection Systems, Alarm Systems, Smart Home Security Solutions, Cybersecurity Solutions, Physical Security Information Management (PSIM) Solutions, Video Analytics & AI-based Surveillance, and Fire & Life Safety Systems. Among these, Video Surveillance Systems lead the market, driven by widespread adoption in residential, commercial, and public sectors, and the increasing need for real-time monitoring, crime prevention, and compliance with regulatory standards .

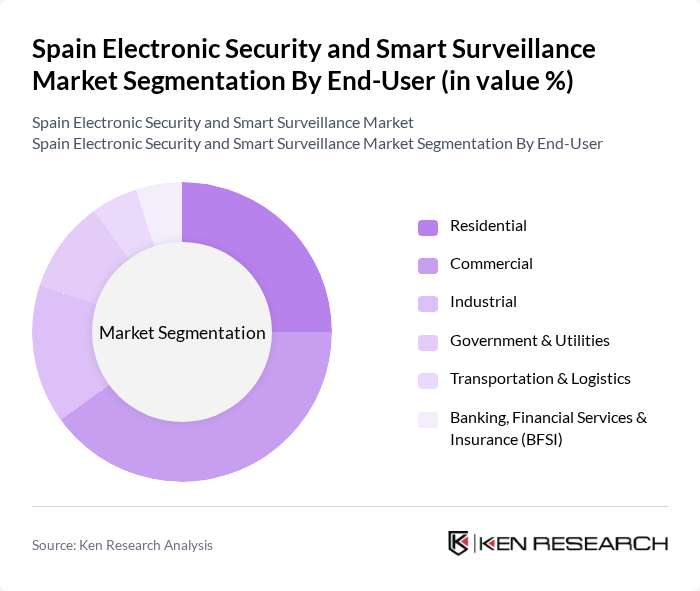

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, Transportation & Logistics, and Banking, Financial Services & Insurance (BFSI). The Commercial sector is the largest end-user, driven by the increasing need for security in retail spaces, offices, and public venues, as well as the growing adoption of integrated security and cybersecurity solutions to protect assets and personnel .

The Spain Electronic Security and Smart Surveillance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Securitas AB, Prosegur Compañía de Seguridad S.A., Grupo Eulen S.A., Axis Communications AB, Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Bosch Security Systems, Johnson Controls International plc, Tyco Integrated Security (Johnson Controls), Honeywell International Inc., FLIR Systems, Inc. (Teledyne FLIR), Avigilon Corporation (Motorola Solutions), Genetec Inc., Indra Sistemas S.A., Telefónica Tech contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electronic security and smart surveillance market in Spain appears promising, driven by technological advancements and increasing urbanization. As cities evolve into smart environments, the integration of IoT and AI technologies will enhance surveillance capabilities. Additionally, the focus on public safety will continue to spur investments in security infrastructure. However, addressing data privacy concerns and compliance with regulations will be crucial for market players to capitalize on emerging opportunities and maintain consumer trust.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Surveillance Systems Access Control Systems Intrusion Detection Systems Alarm Systems Smart Home Security Solutions Cybersecurity Solutions Physical Security Information Management (PSIM) Solutions Video Analytics & AI-based Surveillance Fire & Life Safety Systems |

| By End-User | Residential Commercial Industrial Government & Utilities Transportation & Logistics Banking, Financial Services & Insurance (BFSI) |

| By Application | Retail Security Transportation Security Banking and Financial Services Critical Infrastructure Protection Public Safety and Law Enforcement Healthcare Security Education Campus Security Others |

| By Component | Hardware (Cameras, Sensors, Control Panels, etc.) Software (VMS, Analytics, Access Control Software, etc.) Services (Installation, Maintenance, Managed Services) |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Retail Wholesale E-commerce |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Security Systems | 100 | Homeowners, Property Managers |

| Commercial Surveillance Solutions | 80 | Facility Managers, Security Directors |

| Governmental Security Initiatives | 60 | Public Safety Officials, Urban Planners |

| Smart City Surveillance Projects | 50 | City Officials, Technology Consultants |

| Integrated Security Systems | 70 | IT Managers, Security System Integrators |

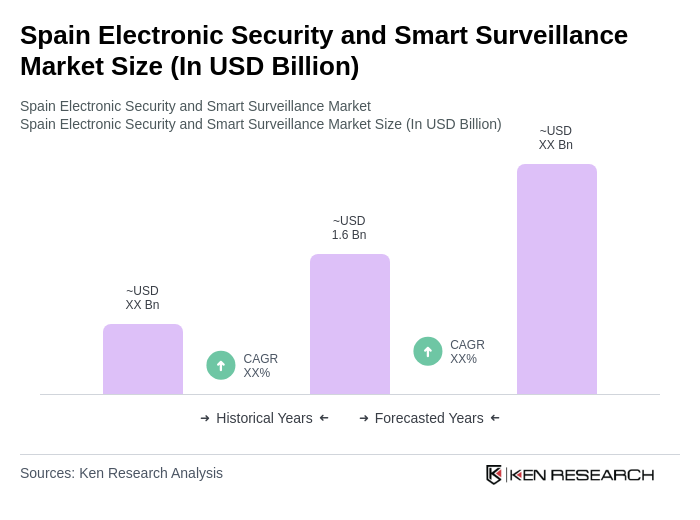

The Spain Electronic Security and Smart Surveillance Market is valued at approximately USD 1.6 billion, reflecting significant growth driven by urbanization, crime concerns, and the demand for advanced security solutions across various sectors.