Region:Asia

Author(s):Dev

Product Code:KRAB6526

Pages:89

Published On:October 2025

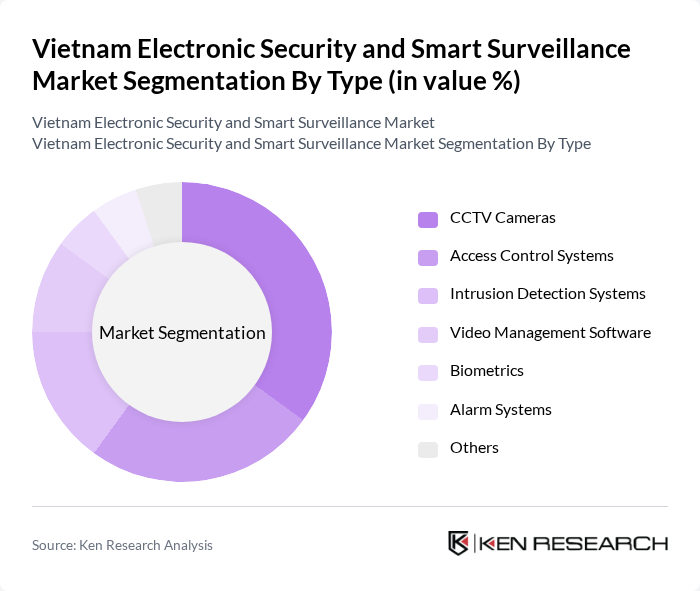

By Type:The market is segmented into various types of electronic security and smart surveillance solutions, including CCTV Cameras, Access Control Systems, Intrusion Detection Systems, Video Management Software, Biometrics, Alarm Systems, and Others. Each of these segments plays a crucial role in enhancing security measures across different sectors.

The CCTV Cameras segment is currently dominating the market due to their widespread adoption in both residential and commercial sectors. The increasing need for real-time monitoring and the affordability of advanced camera technologies have made CCTV systems a preferred choice for many users. Additionally, the integration of smart features such as motion detection and remote access has further enhanced their appeal. As urban areas continue to expand, the demand for CCTV solutions is expected to remain strong, making it the leading subsegment in the electronic security market.

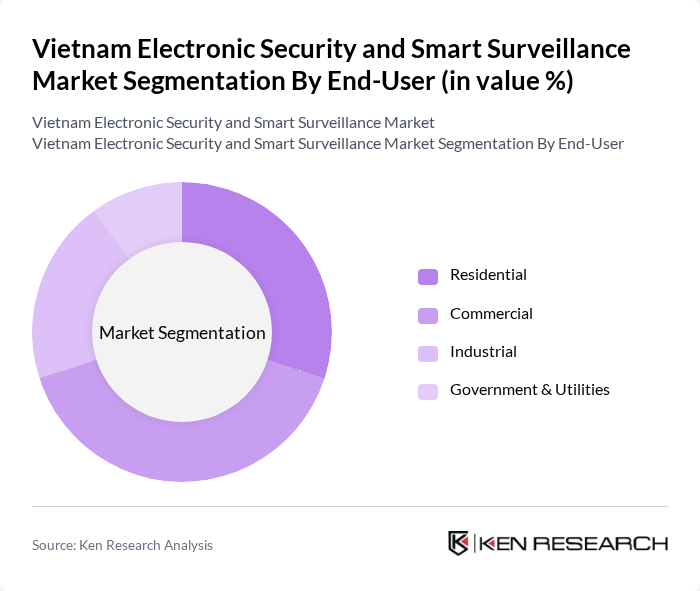

By End-User:The market is segmented by end-user into Residential, Commercial, Industrial, and Government & Utilities. Each segment has unique security needs and requirements, influencing the adoption of electronic security solutions.

The Commercial segment is leading the market due to the increasing need for security in businesses and retail environments. With rising concerns over theft and vandalism, companies are investing heavily in electronic security systems to protect their assets and ensure the safety of their employees and customers. The growth of e-commerce and the expansion of retail spaces have further fueled the demand for advanced surveillance and access control solutions in this segment.

The Vietnam Electronic Security and Smart Surveillance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Axis Communications AB, Bosch Security Systems, Hanwha Techwin Co., Ltd., FLIR Systems, Inc., Honeywell International Inc., Tyco International plc, Panasonic Corporation, Johnson Controls International plc, ZKTeco Co., Ltd., Avigilon Corporation, Genetec Inc., Milestone Systems A/S, SecureTech Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam electronic security and smart surveillance market is poised for significant growth, driven by urbanization, public safety concerns, and government initiatives. As cities evolve into smart urban centers, the integration of advanced technologies will become essential. The increasing adoption of cloud-based solutions and AI-driven analytics will enhance surveillance capabilities, while regulatory frameworks will evolve to address data privacy. Overall, the market is expected to adapt to emerging trends, fostering innovation and investment in security technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | CCTV Cameras Access Control Systems Intrusion Detection Systems Video Management Software Biometrics Alarm Systems Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Public Safety Traffic Monitoring Retail Security Home Security Corporate Security Others |

| By Distribution Channel | Direct Sales Online Retail Distributors System Integrators |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Others |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Analog Systems IP-Based Systems Wireless Systems Hybrid Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Security Systems | 150 | Facility Managers, Security Directors |

| Residential Surveillance Solutions | 100 | Homeowners, Property Managers |

| Government Surveillance Initiatives | 80 | Public Safety Officials, Urban Planners |

| Smart City Surveillance Projects | 70 | City Officials, Technology Integrators |

| Retail Security Systems | 90 | Loss Prevention Managers, Store Owners |

The Vietnam Electronic Security and Smart Surveillance Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, rising crime rates, and increased public safety measures.