Japan Aromatherapy Market Overview

- The Japan Aromatherapy Market is valued at USD 270 million, based on a five-year historical analysis of country-level industry data. This growth is primarily driven by increasing consumer awareness of wellness and holistic health, alongside a rising demand for natural and organic products, particularly among aging and urban populations seeking stress relief and non-pharmaceutical options. The market has seen a significant uptick in the popularity of essential oils and related products as consumers seek alternatives to synthetic fragrances and conventional drugs, with aromatherapy increasingly integrated into beauty, personal care, spa, and home-use applications.

- Tokyo, Osaka, and Yokohama are the dominant cities in the Japan Aromatherapy Market, primarily due to their large urban populations and a growing trend towards wellness and self-care. These cities fall within major economic regions such as the Kanto and Kansai/Kinki areas, which collectively host a high concentration of wellness centers, spas, department stores, specialty retailers, and lifestyle chains that sell essential oils, diffusers, and related aromatherapy products, making them key demand hubs in the market.

- In 2023, the Japanese government implemented regulations to ensure the quality and safety of essential oils and aromatherapy products. This includes mandatory labeling requirements and safety assessments for products sold in the market, aimed at protecting consumers and promoting the use of high-quality, safe products. The core framework is provided by the Act on Securing Quality, Efficacy and Safety of Products Including Pharmaceuticals and Medical Devices (Pharmaceuticals and Medical Devices Act, PMD Act) issued by the Ministry of Health, Labour and Welfare, under which essential oil–based products making medical or quasi-drug claims must comply with standards for ingredient quality, safety testing, labeling, and manufacturing control.

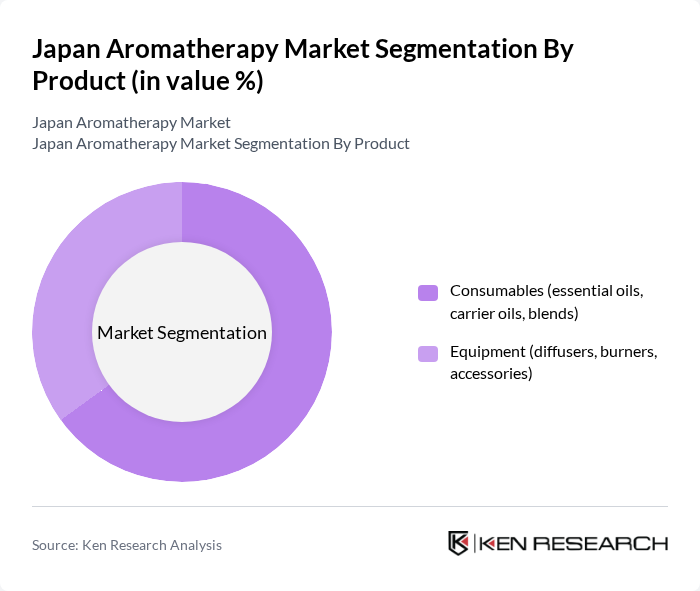

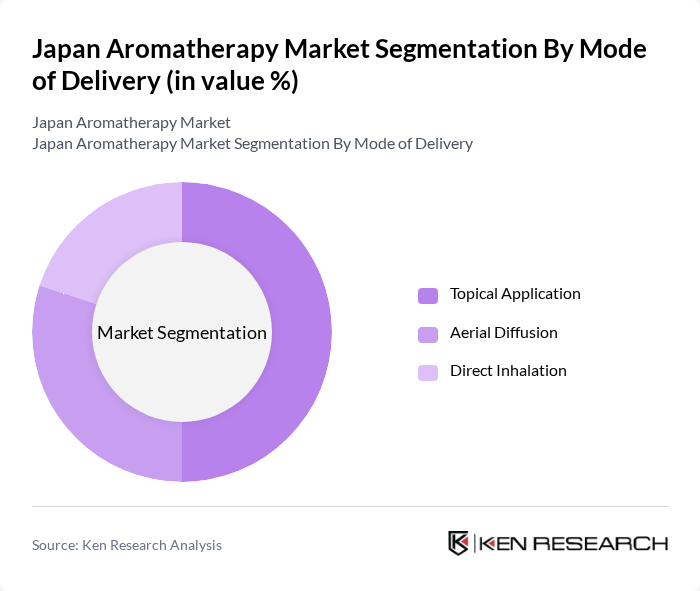

Japan Aromatherapy Market Segmentation

By Product:The product segmentation includes consumables and equipment. Consumables consist of essential oils, carrier oils, and blends, while equipment includes diffusers, burners, and accessories. The consumables segment is currently dominating the market due to the increasing popularity of essential oils for personal use and therapeutic applications, supported by rising awareness of their benefits for relaxation, sleep support, and mood management. Consumers are increasingly purchasing essential oils for home use through retail and direct-to-consumer channels, which has led to a surge in demand for high-quality, organic, and sustainably sourced options.

By Mode of Delivery:The mode of delivery segmentation includes topical application, aerial diffusion, and direct inhalation. Topical application is the leading method, as consumers prefer applying essential oils directly to the skin, often diluted, for localized therapeutic benefits such as muscle relaxation, skincare, and tension relief. Aerial diffusion is also popular, particularly in wellness centers, spas, hospitality facilities, and households, where creating a calming or refreshing atmosphere is essential and supports ongoing demand for diffusers and room fragrances. Direct inhalation is gaining traction among consumers seeking immediate support for stress, fatigue, and mood enhancement, including use through personal inhalers and on-the-go roll-ons.

Japan Aromatherapy Market Competitive Landscape

The Japan Aromatherapy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ryohin Keikaku Co., Ltd. (MUJI), Flavor Life Co., Ltd., HONO KA, ARTQ ORGANICS, Ecology Shimanto, Shiono Koryo Kaisha, Ltd., Yuica (Takasho Co., Ltd.), Young Living Essential Oils, doTERRA International, Saje Natural Wellness, Tisserand Aromatherapy, Neal’s Yard Remedies, L’OCCITANE en Provence, The Body Shop, and other emerging Japan-based brands contribute to innovation, geographic expansion, and service delivery in this space.

Japan Aromatherapy Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness of Health Benefits:The Japanese population is increasingly aware of the health benefits associated with aromatherapy, with over 60% of consumers recognizing its potential to alleviate stress and improve mental well-being. According to a recent survey by the Japan Health Promotion Foundation, 46 million people in Japan regularly use essential oils for relaxation and therapeutic purposes. This growing awareness is driving demand for aromatherapy products, contributing to a projected increase in market engagement.

- Rising Demand for Natural and Organic Products:The shift towards natural and organic products is evident in Japan, where the organic market reached ¥1.3 trillion, reflecting a 9% increase from the previous year. Consumers are increasingly seeking products free from synthetic chemicals, with 72% of respondents in a recent study indicating a preference for organic essential oils. This trend is propelling the growth of the aromatherapy market, as brands adapt to meet consumer expectations for purity and sustainability.

- Growth in Wellness Tourism:Japan's wellness tourism sector is thriving, with an estimated 21 million wellness tourists visiting, contributing ¥1.6 trillion to the economy. This influx is fostering a greater interest in holistic health practices, including aromatherapy. Many wellness centers and spas are incorporating aromatherapy into their services, enhancing the overall experience for tourists. This trend is expected to further stimulate demand for aromatherapy products and services in the future.

Market Challenges

- Regulatory Hurdles in Product Approvals:The Japanese aromatherapy market faces significant regulatory challenges, particularly regarding the approval of essential oils and related products. The Ministry of Health, Labour and Welfare has stringent guidelines that can delay product launches by up to 16 months. This regulatory environment can hinder innovation and limit the availability of new products, impacting market growth and competitiveness.

- High Competition from Synthetic Alternatives:The presence of synthetic alternatives poses a substantial challenge to the aromatherapy market in Japan. With synthetic fragrances accounting for approximately 38% of the fragrance market, many consumers opt for these cheaper options. This competition can undermine the perceived value of natural aromatherapy products, making it difficult for brands to differentiate themselves and maintain market share in a price-sensitive environment.

Japan Aromatherapy Market Future Outlook

The future of the Japan aromatherapy market appears promising, driven by increasing consumer interest in holistic health and wellness practices. As more individuals prioritize mental well-being, the demand for aromatherapy products is expected to rise. Additionally, the integration of technology, such as smart diffusers and mobile applications, will likely enhance user experience and engagement. Brands that focus on sustainable practices and innovative product offerings will be well-positioned to capture market share in this evolving landscape.

Market Opportunities

- Expansion into E-commerce Platforms:The shift towards online shopping presents a significant opportunity for aromatherapy brands. E-commerce sales in Japan reached ¥22 trillion, with a growing segment dedicated to health and wellness products. By leveraging online platforms, brands can reach a broader audience, enhance customer engagement, and increase sales, particularly among younger consumers who prefer digital shopping experiences.

- Development of Innovative Product Formulations:There is a growing opportunity for brands to create innovative product formulations that cater to specific consumer needs. For instance, products targeting sleep improvement or stress relief are gaining traction. The market for sleep aids in Japan was valued at ¥320 billion, indicating a strong demand for solutions that integrate aromatherapy with other wellness practices, thus enhancing market potential.