Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7978

Pages:84

Published On:December 2025

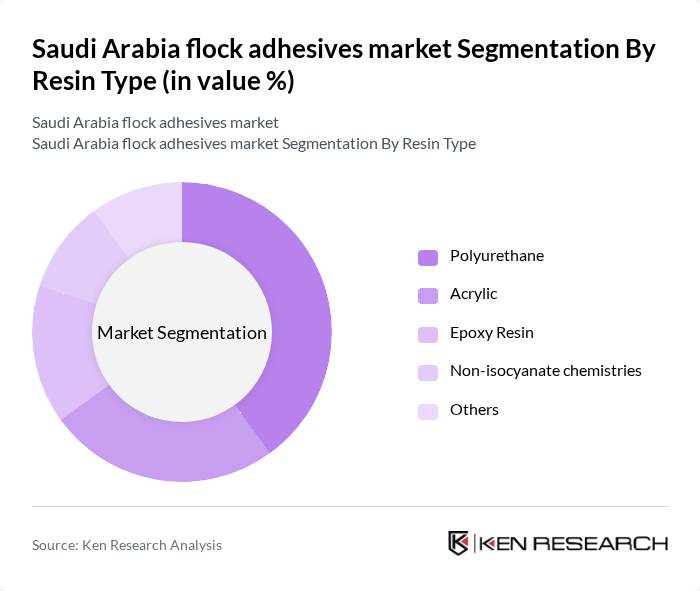

By Resin Type:The flock adhesives market is segmented by resin type into several categories, including Polyurethane, Acrylic, Epoxy Resin, Non-isocyanate chemistries, and Others. Polyurethane is currently the leading sub-segment due to its superior bonding properties and versatility in various applications. Acrylic adhesives are also gaining traction due to their quick curing times and environmental benefits. The demand for eco-friendly formulations is driving innovation in non-isocyanate chemistries, which are becoming increasingly popular among manufacturers.

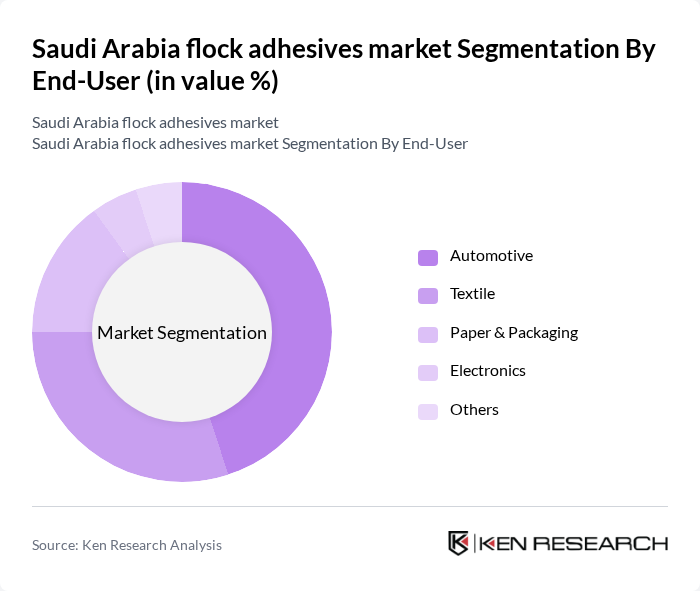

By End-User:The market is also segmented by end-user, which includes Automotive, Textile, Paper & Packaging, Electronics, and Others. The automotive sector is the dominant end-user, driven by the increasing production of vehicles and the need for high-performance adhesives in interior components. The textile industry follows closely, as flock adhesives are essential for creating textured surfaces in apparel and home furnishings. The growing demand for sustainable packaging solutions is also boosting the paper and packaging segment.

The Saudi Arabia flock adhesives market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, Sika AG, H.B. Fuller Company, The Dow Chemical Company, Kiwo Inc., International Coatings Company, Inc., Parker Hannifin Corporation, Stahl Holdings B.V., Argent International, Inc., Kissel + Wolf GmbH, BASF SE, Arkema S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia flock adhesives market is poised for significant growth, driven by increasing demand across various sectors, including automotive, textiles, and construction. As sustainability becomes a priority, manufacturers are likely to invest in eco-friendly adhesive formulations, aligning with global trends. Additionally, advancements in technology will enhance product performance, catering to the growing preference for high-performance adhesives. Strategic partnerships and collaborations will further bolster market expansion, ensuring a competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Resin Type | Polyurethane Acrylic Epoxy Resin Non-isocyanate chemistries Others |

| By End-User | Automotive Textile Paper & Packaging Electronics Others |

| By Application | Interior automotive components (dashboards, door panels, upholstery) Flocked textiles and apparel Product labeling and packaging Battery-thermal management Others |

| By Distribution Channel | Direct sales Distributors Online retail Specialty stores Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Product Formulation | Standard formulations Low-VOC formulations Eco-friendly formulations High-performance formulations Others |

| By Packaging Type | Bulk packaging Retail packaging Industrial packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Adhesives | 120 | Project Managers, Procurement Officers |

| Automotive Adhesives | 100 | Manufacturing Engineers, Quality Control Managers |

| Packaging Adhesives | 110 | Production Supervisors, Supply Chain Managers |

| Specialty Adhesives | 90 | R&D Managers, Product Development Specialists |

| Consumer Adhesives | 80 | Retail Managers, Marketing Executives |

The Saudi Arabia flock adhesives market is valued at approximately USD 40 million, reflecting a five-year historical analysis. This growth is primarily driven by demand from the automotive and textile industries, which utilize flock adhesives for enhanced aesthetics and functionality.