Region:Middle East

Author(s):Dev

Product Code:KRAD1685

Pages:83

Published On:November 2025

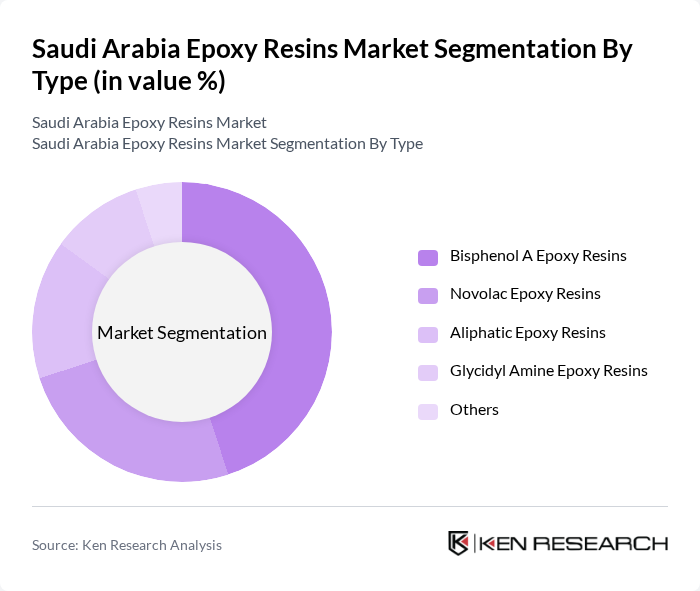

By Type:The epoxy resins market can be segmented into Bisphenol A Epoxy Resins, Novolac Epoxy Resins, Aliphatic Epoxy Resins, Glycidyl Amine Epoxy Resins, and Others. Among these, Bisphenol A Epoxy Resins are the most widely used due to their excellent mechanical properties, chemical resistance, and versatility in coatings, adhesives, and composites. Novolac Epoxy Resins are increasingly adopted in high-performance applications such as automotive, aerospace, and electronics, where superior thermal and chemical stability is required .

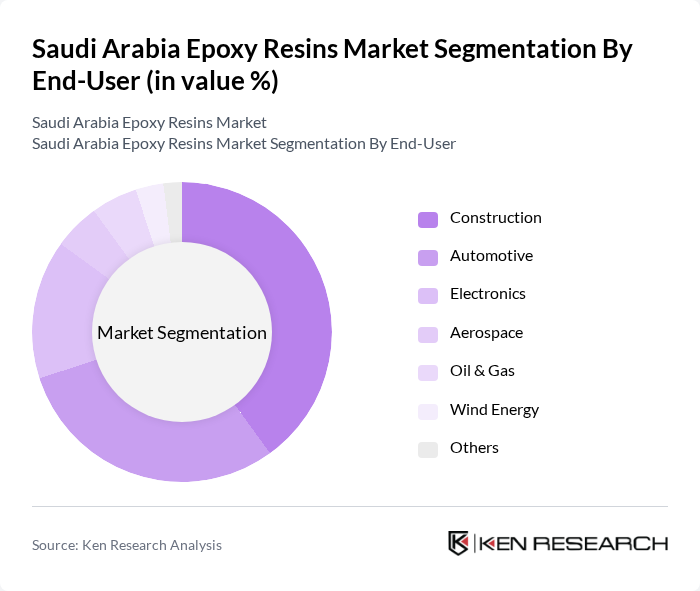

By End-User:The epoxy resins market is segmented by end-user industries, including Construction, Automotive, Electronics, Aerospace, Oil & Gas, Wind Energy, and Others. The construction sector remains the largest consumer of epoxy resins, driven by the need for durable, high-performance materials in flooring, adhesives, and protective coatings. The automotive industry is a significant contributor, as manufacturers focus on lightweight, strong materials to enhance vehicle efficiency and safety. Electronics and wind energy sectors are also experiencing increased adoption due to the demand for advanced composites and high-performance insulation materials .

The Saudi Arabia Epoxy Resins Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Epoxy Resins Company, BASF SE, Huntsman Corporation, Dow Chemical Company, Momentive Performance Materials Inc., KUKDO Chemical Co., Ltd., Aditya Birla Chemicals, Olin Corporation, Hexion Inc., Mitsubishi Chemical Corporation, Nan Ya Plastics Corporation, EPOXY Technology, Inc., Reichhold LLC, AOC Resins, Jotun A/S, SABIC (Saudi Basic Industries Corporation), AkzoNobel N.V., PPG Industries, Inc., Solvay S.A., Kansai Paint Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia epoxy resins market appears promising, driven by ongoing industrial diversification and technological advancements. As the construction and automotive sectors continue to expand, the demand for high-performance epoxy resins is expected to rise. Additionally, the shift towards sustainable materials and eco-friendly products will likely create new opportunities for manufacturers. Companies that invest in innovative formulations and comply with environmental regulations will be well-positioned to capitalize on these trends, ensuring long-term growth in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Bisphenol A Epoxy Resins Novolac Epoxy Resins Aliphatic Epoxy Resins Glycidyl Amine Epoxy Resins Others |

| By End-User | Construction Automotive Electronics Aerospace Oil & Gas Wind Energy Others |

| By Application | Coatings Adhesives Composites Electrical Insulation Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Product Form | Liquid Epoxy Resins Solid Epoxy Resins Waterborne Epoxy Resins Others |

| By End-Use Industry | Marine Wind Energy Oil & Gas Infrastructure Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Applications | 100 | Project Managers, Procurement Officers |

| Automotive Sector Usage | 60 | Product Development Engineers, Quality Assurance Managers |

| Electronics Manufacturing | 50 | Manufacturing Engineers, Supply Chain Managers |

| Adhesives and Sealants Market | 40 | R&D Managers, Technical Sales Representatives |

| Coatings and Finishes Segment | 70 | Marketing Managers, Application Engineers |

The Saudi Arabia Epoxy Resins Market is valued at approximately USD 1.0 billion, driven by increasing demand from sectors such as construction, automotive, and electronics, along with advancements in resin technologies and infrastructure spending.