Region:Middle East

Author(s):Dev

Product Code:KRAB3116

Pages:98

Published On:October 2025

By Type:The market is segmented into various types, including Furniture, Home Décor Items, Lighting Solutions, Textiles and Fabrics, Kitchenware, Outdoor Furniture, and Others. Among these, Furniture is the leading sub-segment, driven by the growing trend of home renovations and the increasing demand for customized solutions. Consumers are increasingly investing in quality furniture that reflects their personal style and enhances their living spaces.

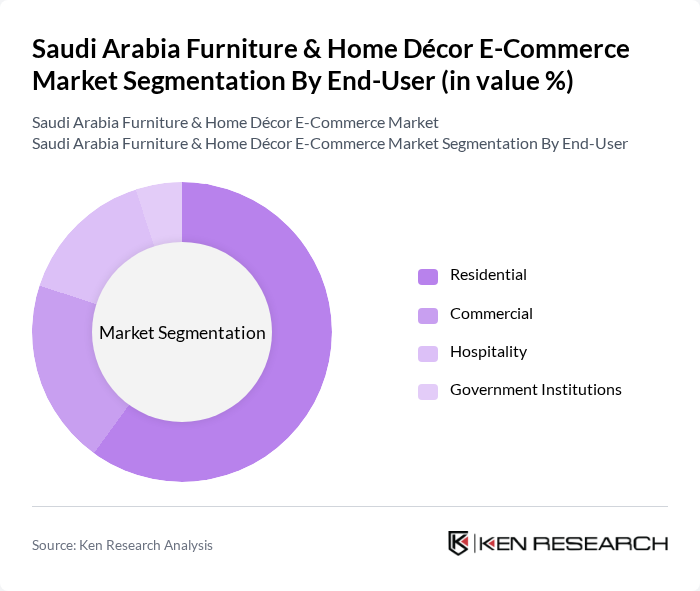

By End-User:The market is segmented by end-user into Residential, Commercial, Hospitality, and Government Institutions. The Residential segment is the largest, as more consumers are investing in home improvement and décor. The trend of remote work has also led to increased spending on home office furniture, further boosting this segment's growth.

The Saudi Arabia Furniture & Home Décor E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Home Centre, Pan Emirates, Al-Futtaim ACE, The One, Jollychic, Souq.com, Ounass, Noon.com, Danube Home, Home Box, Muji, West Elm, Crate and Barrel, Pottery Barn contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia furniture and home décor e-commerce market appears promising, driven by technological advancements and evolving consumer preferences. As more consumers embrace digital shopping, companies are likely to invest in enhancing user experiences through personalized services and innovative technologies. Additionally, the integration of sustainable practices in product offerings will resonate with environmentally conscious consumers, further shaping market dynamics and encouraging growth in this sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Furniture Home Décor Items Lighting Solutions Textiles and Fabrics Kitchenware Outdoor Furniture Others |

| By End-User | Residential Commercial Hospitality Government Institutions |

| By Sales Channel | Direct-to-Consumer Online Marketplaces Social Media Platforms B2B Sales |

| By Price Range | Budget Mid-Range Premium |

| By Material | Wood Metal Plastic Fabric |

| By Design Style | Modern Traditional Minimalist Rustic |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Driven Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Furniture Retailers | 100 | E-commerce Managers, Marketing Directors |

| Home Décor Product Manufacturers | 80 | Product Development Managers, Sales Executives |

| Consumer Insights on E-commerce | 150 | Online Shoppers, Interior Design Enthusiasts |

| Logistics Providers for E-commerce | 70 | Operations Managers, Supply Chain Analysts |

| Market Trends and Forecasts | 60 | Industry Analysts, Economic Researchers |

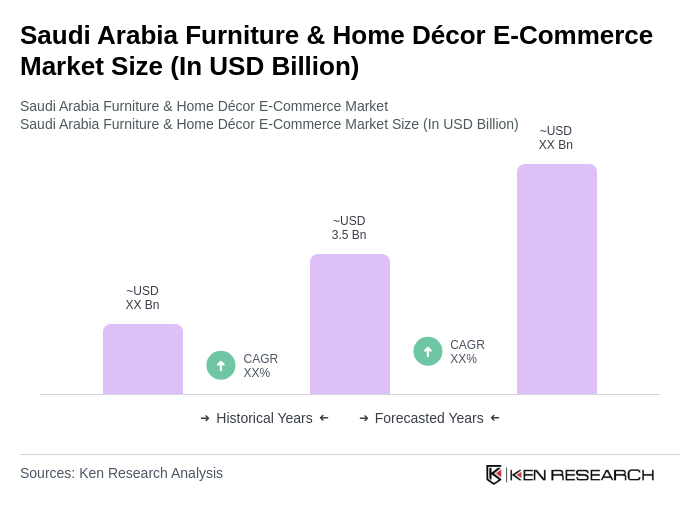

The Saudi Arabia Furniture & Home Décor E-Commerce Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by urbanization, a rising middle class, and increased online shopping accessibility across the country.