Region:Africa

Author(s):Rebecca

Product Code:KRAB2994

Pages:98

Published On:October 2025

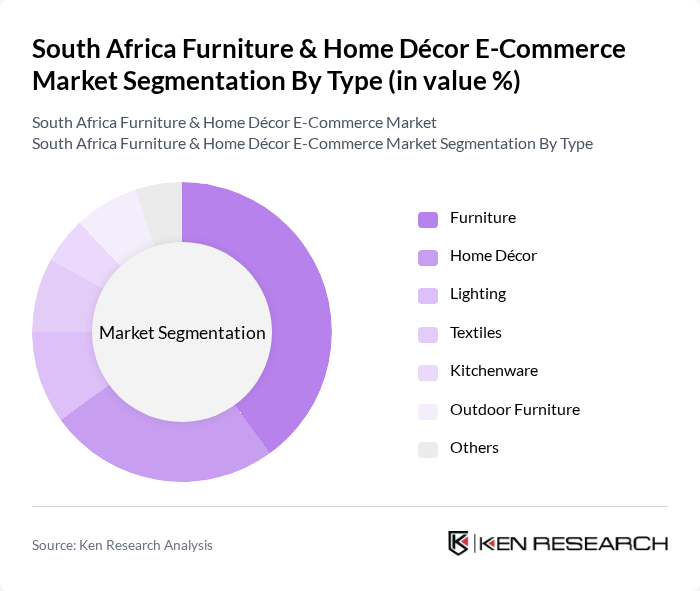

By Type:The market is segmented into various types, including Furniture, Home Décor, Lighting, Textiles, Kitchenware, Outdoor Furniture, and Others. Among these, Furniture is the leading sub-segment, driven by the increasing demand for stylish and functional pieces that cater to modern living spaces. Consumers are increasingly investing in quality furniture that enhances their home aesthetics and provides comfort.

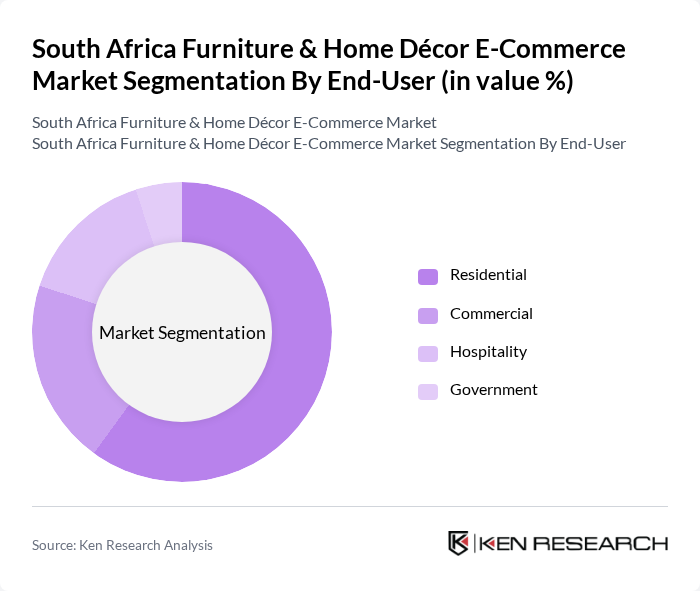

By End-User:The market is segmented by end-user into Residential, Commercial, Hospitality, and Government. The Residential segment dominates the market, as consumers increasingly seek to personalize their living spaces with unique furniture and décor items. The trend of home renovation and improvement has led to a significant rise in demand from residential customers, who prioritize comfort and style in their homes.

The South Africa Furniture & Home Décor E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Takealot, Makro, Mr Price Home, Coricraft, Weylandts, Homewood, @Home, Furniture City, The Bed Shop, Leroy Merlin, IKEA South Africa, H&M Home, Urban Lounge, The Living Room, The Furniture Warehouse contribute to innovation, geographic expansion, and service delivery in this space.

The South African furniture and home décor e-commerce market is poised for significant growth, driven by technological advancements and evolving consumer preferences. The integration of augmented reality tools will enhance the online shopping experience, allowing customers to visualize products in their homes. Additionally, the increasing focus on sustainability will lead to a rise in demand for eco-friendly products. As these trends continue to shape the market, businesses that adapt to consumer needs will likely thrive in this dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Furniture Home Décor Lighting Textiles Kitchenware Outdoor Furniture Others |

| By End-User | Residential Commercial Hospitality Government |

| By Sales Channel | Direct-to-Consumer Online Marketplaces Retail Partnerships Social Media Platforms |

| By Price Range | Budget Mid-Range Premium |

| By Material | Wood Metal Plastic Fabric |

| By Design Style | Modern Traditional Rustic Contemporary |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Driven Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Furniture Retailers | 100 | Business Owners, E-commerce Managers |

| Home Décor E-commerce Platforms | 80 | Marketing Directors, Product Managers |

| Consumer Insights on Home Décor Purchases | 150 | Online Shoppers, Interior Design Enthusiasts |

| Logistics and Supply Chain in E-commerce | 70 | Logistics Managers, Supply Chain Analysts |

| Market Trends and Consumer Behavior | 90 | Market Researchers, Industry Analysts |

The South Africa Furniture & Home Décor E-Commerce Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased internet penetration, rising disposable incomes, and a shift in consumer preferences towards online shopping for home furnishings and décor.