Region:Middle East

Author(s):Dev

Product Code:KRAD5239

Pages:87

Published On:December 2025

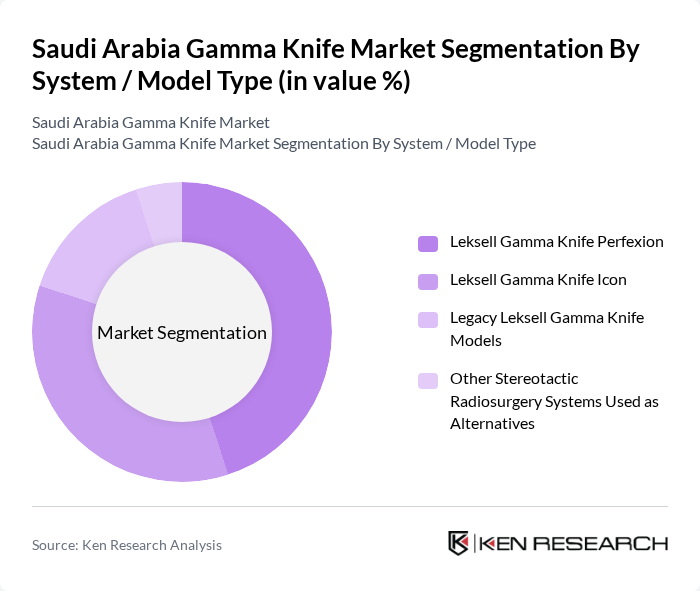

By System / Model Type:The market is segmented into various system types, including advanced models and legacy systems. The Leksell Gamma Knife Perfexion and Icon are leading the installed base and new placements, supported by their high precision, frameless and frame-based treatment options, integrated imaging, and workflow-optimizing software, which are increasingly preferred in comprehensive cancer and neuroscience centers. Legacy Leksell Gamma Knife models still hold a significant share where earlier-generation units remain in operation within major public hospitals. Other stereotactic radiosurgery systems, such as linear accelerator (LINAC)–based radiosurgery and robotic radiosurgery platforms, are also gaining traction as complementary or alternative options, particularly in institutions looking to use multifunctional radiotherapy equipment for both body and brain indications.

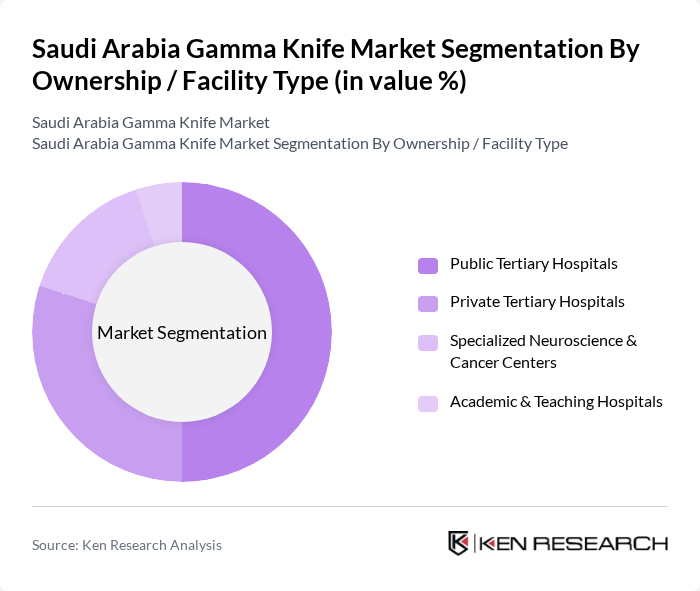

By Ownership / Facility Type:The market is categorized based on ownership and facility types, including public and private hospitals, specialized centers, and academic institutions. Public tertiary hospitals dominate the market due to extensive government funding, priority access to high?cost capital equipment, and their role as national referral centers for complex neurosurgical and oncology cases. Private tertiary hospitals are increasingly adopting advanced radiosurgery technologies to differentiate their oncology and neuroscience services, attract medical tourism, and participate in government-backed PPP models. Specialized neuroscience and cancer centers, many of which are embedded within large academic and teaching hospitals, are also significant players, providing multidisciplinary, protocol-driven care and participating in clinical research related to stereotactic radiosurgery outcomes.

The Saudi Arabia Gamma Knife Market is characterized by a dynamic mix of regional and international players. Leading participants such as Elekta AB, King Faisal Specialist Hospital & Research Centre (Riyadh), King Fahad Medical City (Riyadh), King Abdulaziz University Hospital (Jeddah), King Khalid University Hospital / King Saud University Medical City (Riyadh), King Fahd Specialist Hospital (Dammam), Ministry of Health, Kingdom of Saudi Arabia, Dr. Sulaiman Al Habib Medical Group, Saudi German Hospital Group, National Guard Health Affairs (including King Abdulaziz Medical City), King Faisal Specialist Hospital & Research Centre (Jeddah), International Medical Center (Jeddah), SEHA / Health Holding Company (regional clusters), Almana Group of Hospitals, Al-Mouwasat Medical Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Gamma Knife market in Saudi Arabia appears promising, driven by ongoing advancements in medical technology and increasing healthcare investments. As the government continues to prioritize healthcare infrastructure, the integration of innovative treatment options will likely expand. Furthermore, the growing trend towards personalized medicine and the incorporation of artificial intelligence in treatment planning are expected to enhance patient outcomes. These developments will create a conducive environment for the Gamma Knife market to thrive in future.

| Segment | Sub-Segments |

|---|---|

| By System / Model Type | Leksell Gamma Knife Perfexion Leksell Gamma Knife Icon Legacy Leksell Gamma Knife Models Other Stereotactic Radiosurgery Systems Used as Alternatives |

| By Ownership / Facility Type | Public Tertiary Hospitals Private Tertiary Hospitals Specialized Neuroscience & Cancer Centers Academic & Teaching Hospitals |

| By Clinical Indication | Brain Metastases Primary Brain Tumors (Benign & Malignant) Arteriovenous Malformations (AVMs) Functional Disorders (e.g., Trigeminal Neuralgia, Movement Disorders) Other Neurosurgical & Radiosurgical Indications |

| By Region | Central Region (including Riyadh) Western Region (including Jeddah, Makkah, Madinah) Eastern Region (including Dammam, Khobar) Southern & Northern Regions |

| By Treatment Modality | Single-Fraction Stereotactic Radiosurgery (SRS) Hypofractionated / Multi-Session Stereotactic Radiotherapy (SRT) Boost / Re-treatment Procedures |

| By Patient Demographics | Adult Patients Pediatric & Adolescent Patients Elderly Patients (65+ Years) |

| By Service Delivery Type | Inpatient-Based Gamma Knife Procedures Outpatient / Day-Care Gamma Knife Procedures Cross-Referral & Medical Tourism Cases |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Gamma Knife Usage | 100 | Neurosurgeons, Radiation Oncologists |

| Private Clinic Treatment Protocols | 75 | Medical Directors, Treatment Coordinators |

| Medical Device Procurement Insights | 50 | Procurement Managers, Hospital Administrators |

| Patient Experience and Outcomes | 60 | Patients, Caregivers, Support Groups |

| Market Trends and Innovations | 40 | Medical Device Manufacturers, Industry Analysts |

The Saudi Arabia Gamma Knife Market is valued at approximately USD 5 million, driven by the increasing prevalence of brain tumors and advancements in stereotactic radiosurgery technology, along with the demand for non-invasive treatment options.