Region:Middle East

Author(s):Shubham

Product Code:KRAB0744

Pages:87

Published On:August 2025

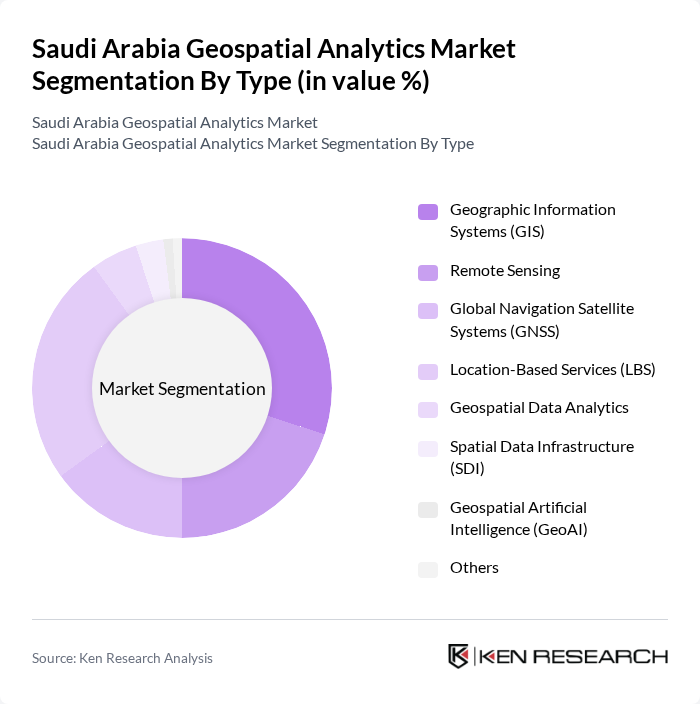

By Type:The market is segmented into Geographic Information Systems (GIS), Remote Sensing, Global Navigation Satellite Systems (GNSS), Location-Based Services (LBS), Geospatial Data Analytics, Spatial Data Infrastructure (SDI), Geospatial Artificial Intelligence (GeoAI), and Others. Each of these subsegments plays a crucial role in the overall market dynamics. GIS and LBS are particularly dominant, driven by their applications in urban planning, logistics, and real-time service delivery. Remote sensing and GNSS are also significant, supporting infrastructure monitoring, environmental management, and navigation solutions .

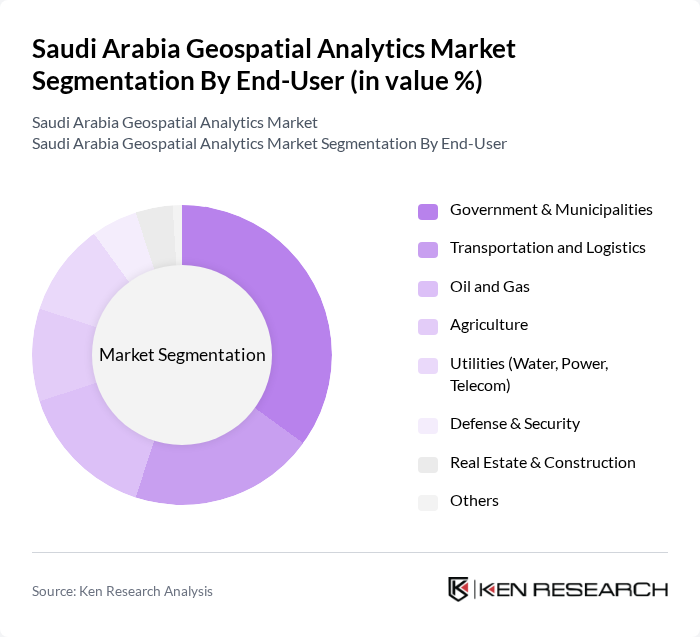

By End-User:The end-user segmentation includes Government & Municipalities, Transportation and Logistics, Oil and Gas, Agriculture, Utilities (Water, Power, Telecom), Defense & Security, Real Estate & Construction, and Others. Government and municipalities are the leading end-users, leveraging geospatial analytics for urban planning, resource management, and infrastructure development. The transportation and logistics sector is rapidly expanding its use of geospatial analytics for fleet management, route optimization, and smart mobility. Oil and gas, utilities, and defense sectors also represent substantial demand due to the need for asset tracking, environmental monitoring, and security operations .

The Saudi Arabia Geospatial Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Esri Saudi Arabia, Hexagon AB, Trimble Inc., Autodesk Inc., Bentley Systems, HERE Technologies, Bayanat, Maxar Technologies, Airbus Intelligence, GISTEC, Khatib & Alami, Fugro, Alat, Space Imaging Middle East, CARTO, and BAE Systems Applied Intelligence contribute to innovation, geographic expansion, and service delivery in this space.

The future of the geospatial analytics market in Saudi Arabia appears promising, driven by technological advancements and increasing integration of AI. As urbanization accelerates, the demand for smart city solutions will rise, necessitating innovative geospatial applications. Furthermore, the collaboration between public and private sectors is expected to enhance data sharing and resource allocation, fostering a more robust ecosystem. This collaborative approach will likely lead to the development of more sophisticated analytics tools, positioning Saudi Arabia as a leader in the geospatial analytics domain.

| Segment | Sub-Segments |

|---|---|

| By Type | Geographic Information Systems (GIS) Remote Sensing Global Navigation Satellite Systems (GNSS) Location-Based Services (LBS) Geospatial Data Analytics Spatial Data Infrastructure (SDI) Geospatial Artificial Intelligence (GeoAI) Others |

| By End-User | Government & Municipalities Transportation and Logistics Oil and Gas Agriculture Utilities (Water, Power, Telecom) Defense & Security Real Estate & Construction Others |

| By Application | Urban Planning & Smart Cities Disaster Management & Emergency Response Environmental Monitoring Infrastructure Development Asset Management Natural Resource Exploration Fleet & Supply Chain Management Others |

| By Component | Software Hardware Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Online Distribution Offline Distribution |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research and Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Planning and Development | 60 | City Planners, Urban Development Officials |

| Oil and Gas Sector Applications | 50 | Geologists, Operations Managers |

| Agricultural Technology Integration | 40 | Agronomists, Farm Managers |

| Environmental Monitoring Projects | 45 | Environmental Scientists, Policy Makers |

| Smart City Initiatives | 55 | IT Managers, Smart City Project Leads |

The Saudi Arabia Geospatial Analytics Market is valued at approximately USD 1.4 billion, driven by the increasing demand for location-based services and advancements in satellite and remote sensing technology.