Region:Middle East

Author(s):Shubham

Product Code:KRAA8896

Pages:87

Published On:November 2025

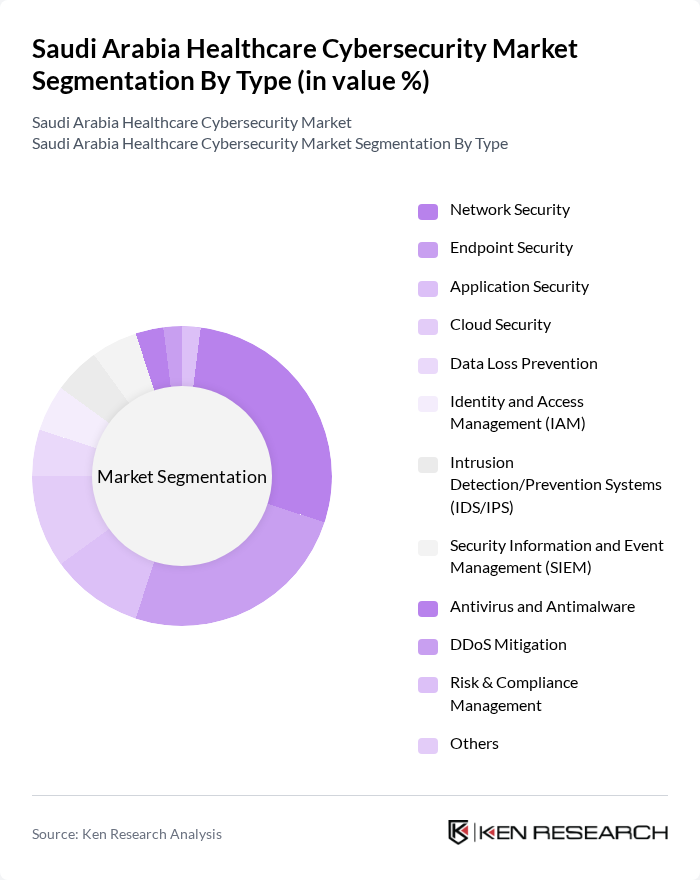

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Endpoint Security, Application Security, Cloud Security, Data Loss Prevention, Identity and Access Management (IAM), Intrusion Detection/Prevention Systems (IDS/IPS), Security Information and Event Management (SIEM), Antivirus and Antimalware, DDoS Mitigation, Risk & Compliance Management, and Others. Among these,Network SecurityandEndpoint Securityare the most prominent segments, driven by the increasing need to protect sensitive healthcare data and devices from cyber threats. Rapid growth is also observed in IAM and SIEM solutions, reflecting the sector’s growing focus on secure access management and centralized threat monitoring .

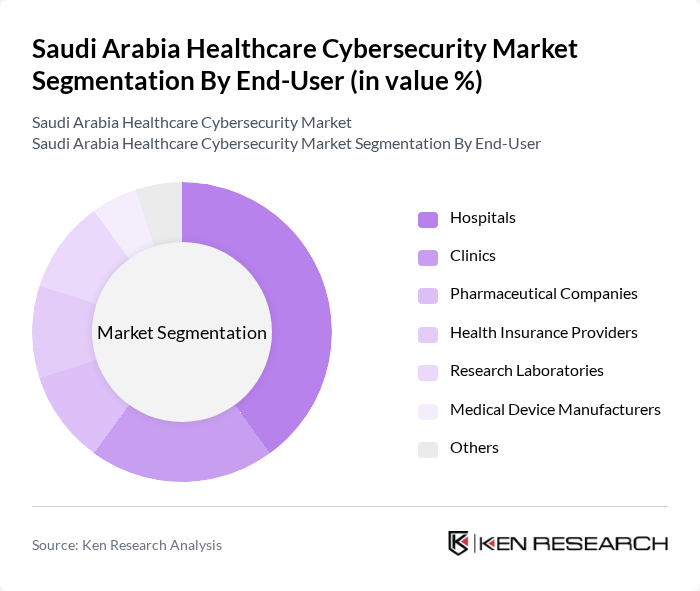

By End-User:The end-user segmentation includes Hospitals, Clinics, Pharmaceutical Companies, Health Insurance Providers, Research Laboratories, Medical Device Manufacturers, and Others.Hospitalsare the leading segment, driven by the increasing adoption of electronic health records, high patient volumes, and the need for secure patient data management. Medical device cybersecurity and research laboratories are also emerging as significant sub-segments, reflecting the rise of IoT-connected devices and the need to protect proprietary research data .

The Saudi Arabia Healthcare Cybersecurity Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Solutions, CyberX, DarkMatter, IBM Security, Cisco Systems, Fortinet, Palo Alto Networks, Check Point Software Technologies, McAfee, Trend Micro, RSA Security, FireEye (now Trellix), Kaspersky Lab, Symantec (now part of Broadcom), CrowdStrike, Spire Solutions, SAMA Cybersecurity, Help AG, Malomatia, Trend Micro Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the healthcare cybersecurity market in Saudi Arabia appears promising, driven by increasing investments in technology and a heightened focus on data protection. As telehealth services expand, the demand for secure digital platforms will grow, necessitating advanced cybersecurity solutions. Additionally, the integration of artificial intelligence in cybersecurity practices is expected to enhance threat detection and response capabilities, positioning healthcare organizations to better safeguard sensitive patient information against evolving cyber threats.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Cloud Security Data Loss Prevention Identity and Access Management (IAM) Intrusion Detection/Prevention Systems (IDS/IPS) Security Information and Event Management (SIEM) Antivirus and Antimalware DDoS Mitigation Risk & Compliance Management Others |

| By End-User | Hospitals Clinics Pharmaceutical Companies Health Insurance Providers Research Laboratories Medical Device Manufacturers Others |

| By Region | Riyadh (Central Region) Eastern Region Western Region (including Makkah) Southern Region |

| By Technology | Artificial Intelligence Blockchain Machine Learning Big Data Analytics IoT Security Others |

| By Application | Patient Data Security Medical Device Security Health Information Exchange Security Telemedicine Security E-Pharmacy Security Others |

| By Deployment Mode | On-Premise Cloud-Based Hybrid |

| By Investment Source | Government Funding Private Investments Public-Private Partnerships International Aid |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Cybersecurity Strategies | 100 | IT Security Managers, Chief Information Officers |

| Healthcare IT Infrastructure | 60 | Network Administrators, Systems Analysts |

| Telehealth Security Measures | 50 | Telehealth Program Directors, Compliance Officers |

| Cybersecurity Training Programs | 40 | HR Managers, Training Coordinators |

| Regulatory Compliance in Healthcare | 70 | Regulatory Affairs Specialists, Legal Advisors |

The Saudi Arabia Healthcare Cybersecurity Market is valued at approximately USD 540 million, reflecting significant growth driven by digitalization, increased cyber threats, and compliance with data protection regulations.