Region:North America

Author(s):Geetanshi

Product Code:KRAA1252

Pages:84

Published On:August 2025

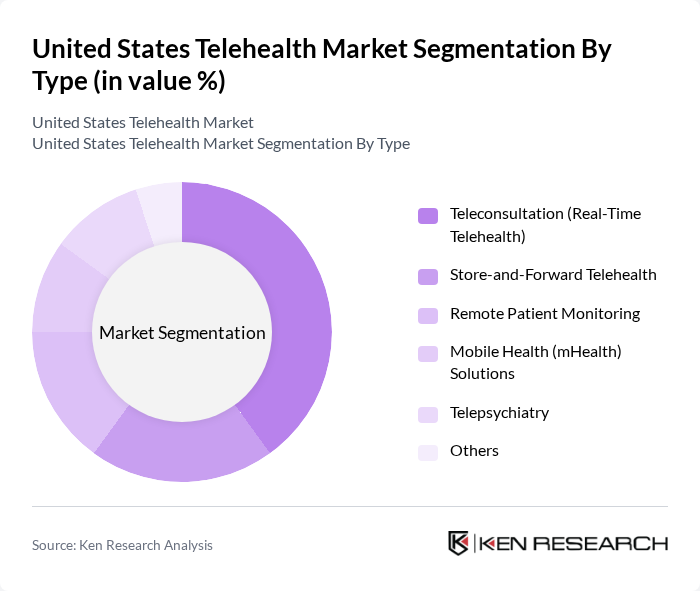

By Type:The telehealth market can be segmented into various types, including Teleconsultation (Real-Time Telehealth), Store-and-Forward Telehealth, Remote Patient Monitoring, Mobile Health (mHealth) Solutions, Telepsychiatry, and Others. Among these, Teleconsultation has emerged as the leading sub-segment due to its ability to provide immediate access to healthcare professionals, especially during the pandemic. Patients prefer real-time consultations for urgent medical needs, which has driven its popularity and market share. Remote patient monitoring and telepsychiatry are also experiencing rapid growth, supported by advances in wearable medical devices and increased demand for behavioral health services.

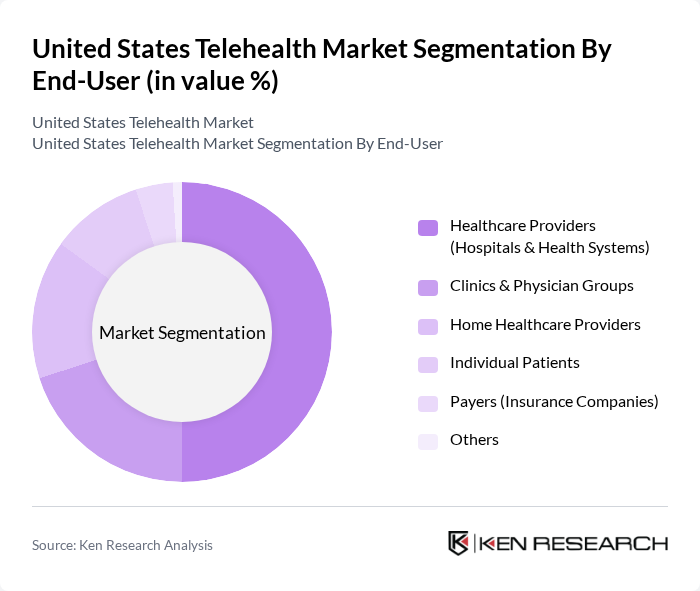

By End-User:The end-user segmentation includes Healthcare Providers (Hospitals & Health Systems), Clinics & Physician Groups, Home Healthcare Providers, Individual Patients, Payers (Insurance Companies), and Others. Healthcare Providers dominate this segment as they increasingly adopt telehealth solutions to enhance patient care and streamline operations. The shift towards value-based care and the need for efficient patient management have made telehealth an essential tool for healthcare providers. Clinics and physician groups are also rapidly integrating telehealth to expand their reach, while home healthcare providers leverage remote monitoring for chronic disease management.

The United States Telehealth Market is characterized by a dynamic mix of regional and international players. Leading participants such as Teladoc Health, Inc., Amwell (American Well Corporation), MDLIVE, Inc., Doxy.me, Doctor On Demand, Inc., HealthTap, Inc., PlushCare, Inc., Zocdoc, Inc., eVisit, Inc., SimplePractice, LLC, Luma Health, Inc., Talkspace, Inc., BetterHelp (a subsidiary of Teladoc Health), MyTelemedicine, Inc., Medici Technologies, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the telehealth market in the United States appears promising, driven by technological advancements and evolving patient expectations. As healthcare providers increasingly adopt telehealth solutions, the integration of artificial intelligence and machine learning is expected to enhance service delivery and patient outcomes. Furthermore, the ongoing expansion of telehealth coverage by insurance providers will likely facilitate broader access to these services, particularly in underserved areas. This evolving landscape presents significant opportunities for innovation and growth within the telehealth sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Teleconsultation (Real-Time Telehealth) Store-and-Forward Telehealth Remote Patient Monitoring Mobile Health (mHealth) Solutions Telepsychiatry Others |

| By End-User | Healthcare Providers (Hospitals & Health Systems) Clinics & Physician Groups Home Healthcare Providers Individual Patients Payers (Insurance Companies) Others |

| By Application | Chronic Disease Management Mental Health Services (Telepsychiatry) Preventive Healthcare & Wellness Post-Acute & Follow-Up Care Urgent Care & Emergency Telehealth Others |

| By Distribution Channel | Direct Sales (Enterprise/B2B) Online Platforms (B2C) Partnerships with Healthcare Providers Pharmacy/Retail Clinics Others |

| By Service Model | B2B Telehealth Services B2C Telehealth Services C2C Telehealth Services Hybrid Models Others |

| By Technology | Video Conferencing Platforms Mobile Health Applications Cloud-Based Solutions Remote Monitoring Devices & Wearables Artificial Intelligence & Analytics Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Bundled Services Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Primary Care Telehealth Services | 100 | Family Physicians, General Practitioners |

| Specialist Telehealth Consultations | 80 | Cardiologists, Psychiatrists, Dermatologists |

| Remote Patient Monitoring Solutions | 60 | Nurse Practitioners, Home Health Aides |

| Teletherapy Services | 50 | Licensed Therapists, Clinical Psychologists |

| Telehealth Technology Providers | 40 | Product Managers, Technology Developers |

The United States Telehealth Market is valued at approximately USD 60 billion, reflecting significant growth driven by the adoption of digital health technologies, the prevalence of chronic diseases, and the demand for convenient healthcare solutions, especially accelerated by the COVID-19 pandemic.