Region:Middle East

Author(s):Rebecca

Product Code:KRAB4749

Pages:94

Published On:October 2025

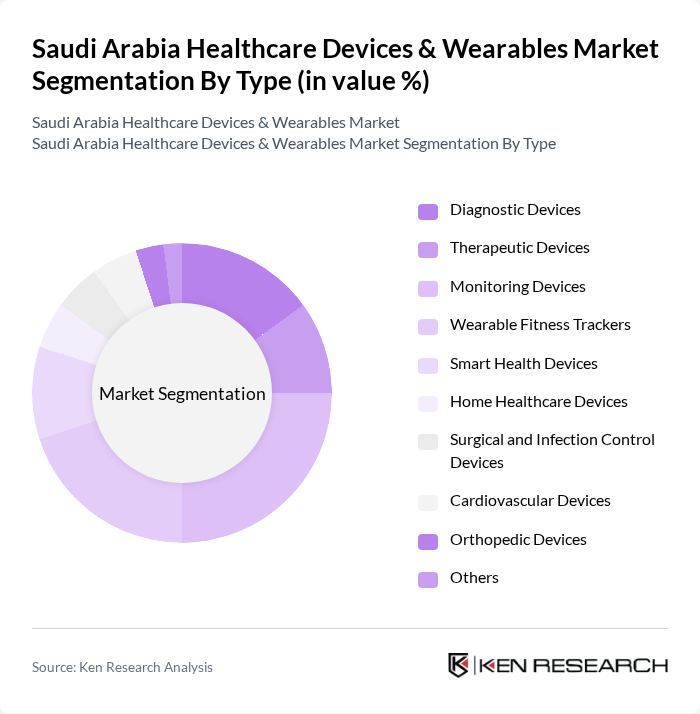

By Type:The market is segmented into various types of healthcare devices and wearables, including diagnostic devices, therapeutic devices, monitoring devices, wearable fitness trackers, smart health devices, home healthcare devices, surgical and infection control devices, cardiovascular devices, orthopedic devices, and others. Among these, diagnostic and monitoring devices are experiencing strong demand due to the need for early disease detection and continuous management of chronic conditions. Wearable fitness trackers and smart health devices are also gaining traction, reflecting a broader shift toward preventive healthcare and personal wellness, supported by the rapid growth of the digital health market, which was estimated at USD 2.5 billion in 2024.

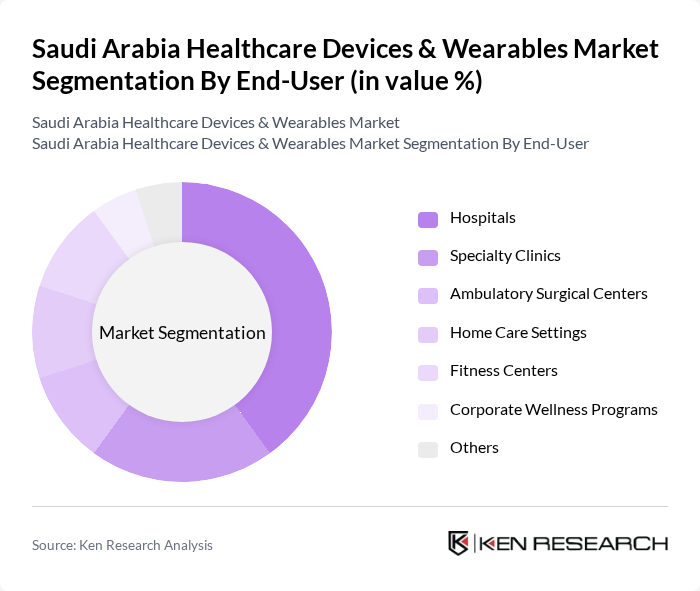

By End-User:The end-user segmentation includes hospitals, specialty clinics, ambulatory surgical centers, home care settings, fitness centers, corporate wellness programs, and others. Hospitals remain the leading end-users, driven by the need for advanced medical devices to support a growing patient population, particularly for chronic disease management and surgical procedures. The expansion of hospital infrastructure and increasing privatization under Vision 2030 further reinforce this segment’s dominance.

The Saudi Arabia Healthcare Devices & Wearables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Siemens Healthineers, GE Healthcare, Medtronic, Abbott Laboratories, Johnson & Johnson, Fitbit, Inc., Apple Inc., Samsung Electronics, Omron Healthcare, Boston Scientific, Stryker Corporation, B. Braun Melsungen AG, Canon Medical Systems, Honeywell Life Sciences, Bayer AG, Smith & Nephew plc, Baxter International Inc., Roche Diagnostics, Coloplast A/S, Hollister Incorporated, ConvaTec Group PLC, Cordis, Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO), Al Faisaliah Medical Systems, Al Amin Medical Instruments Company, Jamjoom Medical Industries contribute to innovation, geographic expansion, and service delivery in this space.

The future of the healthcare devices and wearables market in Saudi Arabia appears promising, driven by increasing investments in healthcare infrastructure and technology. The government’s Vision 2030 initiative aims to enhance healthcare services, which will likely lead to greater adoption of digital health solutions. Additionally, the integration of AI and telehealth services is expected to transform patient care, making healthcare more accessible and efficient, thus fostering a more dynamic market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Devices Therapeutic Devices Monitoring Devices Wearable Fitness Trackers Smart Health Devices Home Healthcare Devices Surgical and Infection Control Devices Cardiovascular Devices Orthopedic Devices Others |

| By End-User | Hospitals Specialty Clinics Ambulatory Surgical Centers Home Care Settings Fitness Centers Corporate Wellness Programs Others |

| By Application | Chronic Disease Management Fitness and Wellness Remote Patient Monitoring Emergency Care Rehabilitation General Surgery Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Premium Price Range |

| By Brand | Established Brands Emerging Brands Private Labels Others |

| By Technology | Bluetooth Technology Wi-Fi Technology NFC Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 80 | Doctors, Nurses, Hospital Administrators |

| Wearable Device Users | 70 | Patients, Fitness Enthusiasts, Tech-savvy Individuals |

| Healthcare Device Manufacturers | 40 | Product Managers, R&D Heads, Marketing Directors |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers, Health Regulators |

| Technology Developers | 50 | Software Engineers, Product Developers, UX Designers |

The Saudi Arabia Healthcare Devices & Wearables Market is valued at approximately USD 6.3 billion, driven by increasing healthcare expenditure, a rise in chronic diseases, and a demand for advanced medical technologies, including mobile platforms and artificial intelligence.