Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0049

Pages:85

Published On:August 2025

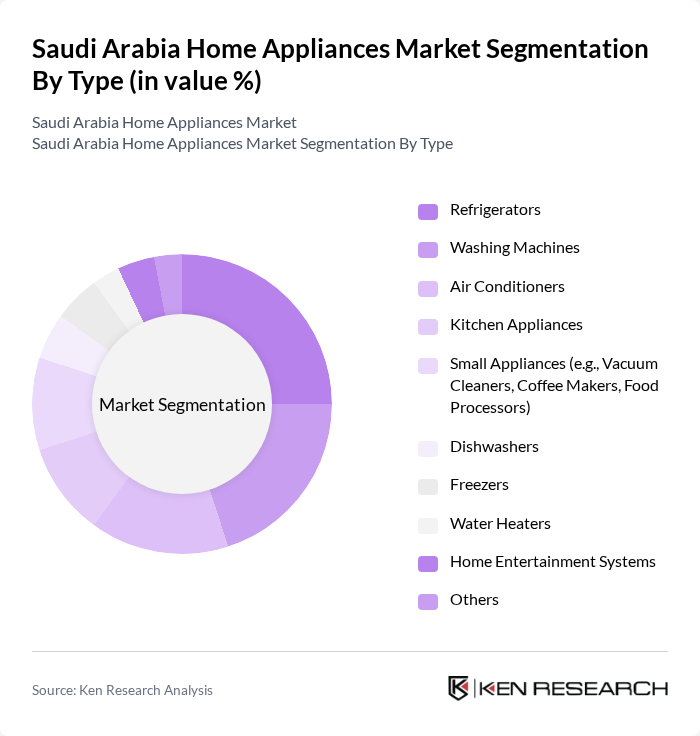

By Type:The market is segmented into various types of home appliances, including refrigerators, washing machines, air conditioners, kitchen appliances, small appliances (such as vacuum cleaners, coffee makers, and food processors), dishwashers, freezers, water heaters, home entertainment systems, and others. Each of these segments addresses specific consumer needs, with demand patterns influenced by lifestyle changes, technological advancements, and the growing adoption of smart and energy-efficient products .

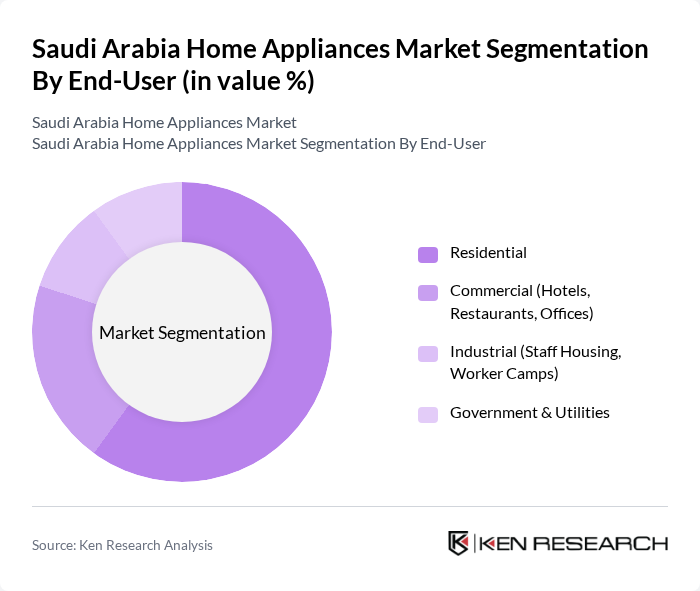

By End-User:The home appliances market is segmented by end-user into residential, commercial (including hotels, restaurants, and offices), industrial (such as staff housing and worker camps), and government & utilities. Each segment has distinct requirements and purchasing behaviors, shaped by economic conditions, urbanization, and the adoption of advanced technologies .

The Saudi Arabia Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., LG Electronics Inc., Whirlpool Corporation, Panasonic Holdings Corporation, Haier Group Corporation, Electrolux AB, Bosch Home Appliances (BSH Hausgeräte GmbH), Midea Group Co., Ltd., Sharp Corporation, Arçelik A.?., Gree Electric Appliances Inc., TCL Technology Group Corporation, Hisense Group, Beko (subsidiary of Arçelik A.?.), Smeg S.p.A., Zamil Air Conditioners, Alessa Industries Co., National Refrigerators & Air Conditioners Co. (National), Philips Domestic Appliances, and Gorenje Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia home appliances market is poised for significant growth, driven by urbanization, rising disposable incomes, and technological advancements. As consumers increasingly seek energy-efficient and smart appliances, manufacturers will need to innovate continuously. The government's focus on sustainability and energy efficiency will further shape market dynamics. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice and driving sales in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators Washing Machines Air Conditioners Kitchen Appliances Small Appliances (e.g., Vacuum Cleaners, Coffee Makers, Food Processors) Dishwashers Freezers Water Heaters Home Entertainment Systems Others |

| By End-User | Residential Commercial (Hotels, Restaurants, Offices) Industrial (Staff Housing, Worker Camps) Government & Utilities |

| By Sales Channel | Supermarkets & Hypermarkets Specialty Stores E-commerce Platforms Direct Sales Distributors |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Local Brands (e.g., Zamil, Alessa, National) International Brands (e.g., Samsung, LG, Whirlpool, Bosch, Panasonic, Haier, Electrolux, Midea, Hisense, Gree, Beko, Sharp, Arçelik, Smeg, TCL) Private Labels |

| By Functionality | Smart Appliances Traditional Appliances |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Purchases | 120 | Homeowners, Renters, Young Professionals |

| Kitchen Appliances Market | 90 | Chefs, Home Cooks, Kitchen Designers |

| Energy-Efficient Appliances | 60 | Environmentally Conscious Consumers, Energy Auditors |

| Smart Home Devices | 50 | Tech Enthusiasts, Early Adopters, Home Automation Specialists |

| After-Sales Service Satisfaction | 70 | Recent Buyers, Customer Service Representatives |

The Saudi Arabia Home Appliances Market is valued at approximately USD 6.8 billion, driven by factors such as rising disposable incomes, urbanization, and a growing preference for energy-efficient and smart appliances among consumers.