Region:Middle East

Author(s):Dev

Product Code:KRAD5225

Pages:81

Published On:December 2025

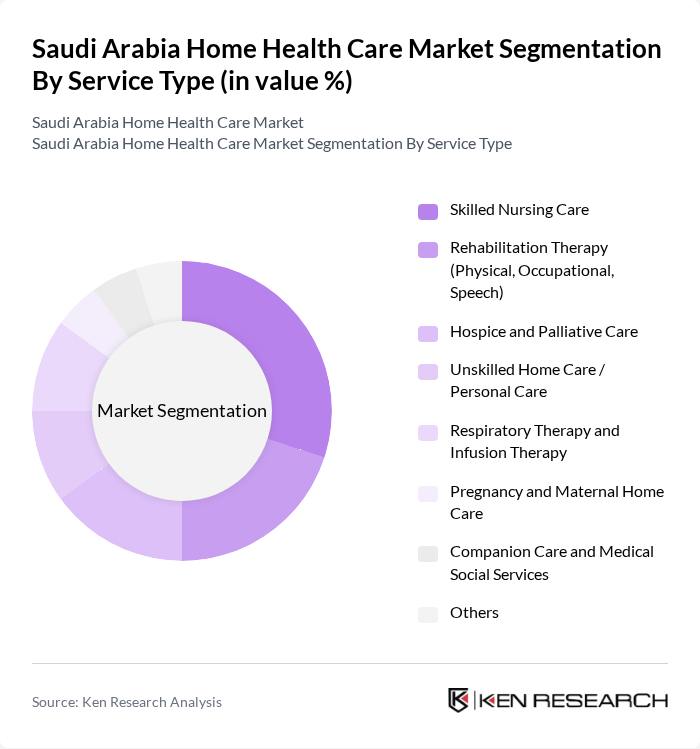

By Service Type:The service type segmentation includes various categories that cater to different healthcare needs. Skilled nursing care is a significant segment, providing professional medical services at home. Rehabilitation therapy, including physical, occupational, and speech therapy, is also crucial for patients recovering from surgeries or injuries. Hospice and palliative care focus on providing comfort to terminally ill patients, while unskilled home care offers personal assistance. Other services include respiratory therapy, maternal care, and companion care, which are increasingly in demand due to the growing elderly population.

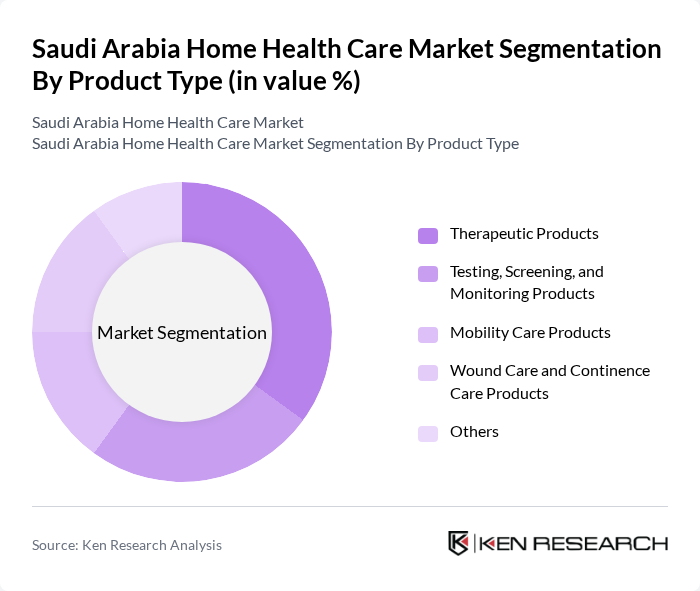

By Product Type:The product type segmentation encompasses various medical and therapeutic products used in home health care. Therapeutic products, including medications and medical devices, are essential for managing chronic conditions. Testing, screening, and monitoring products are vital for tracking patient health remotely. Mobility care products assist patients with mobility issues, while wound care and continence care products are crucial for patients recovering from surgeries or managing chronic wounds. The demand for these products is driven by the increasing need for at-home medical care and monitoring.

The Saudi Arabia Home Health Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Home Healthcare Company, Home Health Care Company (Riyadh Care Group), Dr. Sulaiman Al Habib Medical Group – Home Care Services, Saudi German Health – Home Care Services, King Faisal Specialist Hospital & Research Centre – Home Health Care Program, King Abdulaziz Medical City (National Guard Health Affairs) – Home Care Services, Ministry of Health Home Care Program, King Fahad Medical City – Home Health Care Services, Fakeeh Care Group – Home Care Services, Aster DM Healthcare – Aster Home Care (Saudi Arabia), Al Nahdi Medical Company – Home Health Support Services, Bupa Arabia – Home Healthcare and Chronic Care Management Programs, Tamer Group – Home Medical Equipment and Home Care Support, Philips Healthcare Saudi Arabia – Home Healthcare Devices and Remote Monitoring Solutions, ResMed Saudi Arabia – Home Respiratory and Sleep Therapy Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the home health care market in Saudi Arabia appears promising, driven by demographic shifts and technological advancements. As the population ages and chronic diseases become more prevalent, the demand for home-based care solutions will likely increase. Additionally, the government's commitment to enhancing healthcare infrastructure and promoting telehealth services will further support market growth. Stakeholders must focus on addressing challenges such as workforce shortages and awareness to fully capitalize on these emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Skilled Nursing Care Rehabilitation Therapy (Physical, Occupational, Speech) Hospice and Palliative Care Unskilled Home Care / Personal Care Respiratory Therapy and Infusion Therapy Pregnancy and Maternal Home Care Companion Care and Medical Social Services Others |

| By Product Type | Therapeutic Products Testing, Screening, and Monitoring Products Mobility Care Products Wound Care and Continence Care Products Others |

| By Indication | Cardiovascular Diseases and Hypertension Diabetes and Metabolic Disorders Respiratory Diseases (COPD, Asthma, Others) Cancer and Post-Chemotherapy Care Movement Disorders and Neurological Conditions Wound Care and Post-Surgical Recovery Pregnancy and Neonatal Care Others |

| By Phase of Service | Primary Home Care Services Post-Acute and Post-Discharge Care Long-Term Chronic Care and Maintenance Urgent and Short-Term Episodic Care Others |

| By Payment & Payer Type | Out-of-Pocket Payments Private Health Insurance Government and Public Payers Corporate and Employer-Sponsored Programs Others |

| By Technology Utilization | Remote Patient Monitoring Systems Telehealth and Virtual Care Platforms Mobile Health (mHealth) Applications Home Healthcare Software and Clinical Management Systems Others |

| By Geographic Region | Northern and Central Region (including Riyadh) Western Region (including Makkah and Madinah) Eastern Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Health Care Service Users | 120 | Patients, Family Caregivers |

| Healthcare Professionals in Home Care | 100 | Nurses, Physical Therapists |

| Insurance Providers | 60 | Claims Managers, Policy Analysts |

| Regulatory Bodies | 40 | Health Policy Makers, Compliance Officers |

| Home Health Care Equipment Suppliers | 70 | Sales Managers, Product Specialists |

The Saudi Arabia Home Health Care Market is valued at approximately USD 1.6 billion, driven by an aging population, increasing chronic diseases, and a shift towards home-based care solutions. This market is expected to grow further due to advancements in medical technology.