Region:Middle East

Author(s):Dev

Product Code:KRAC4836

Pages:96

Published On:October 2025

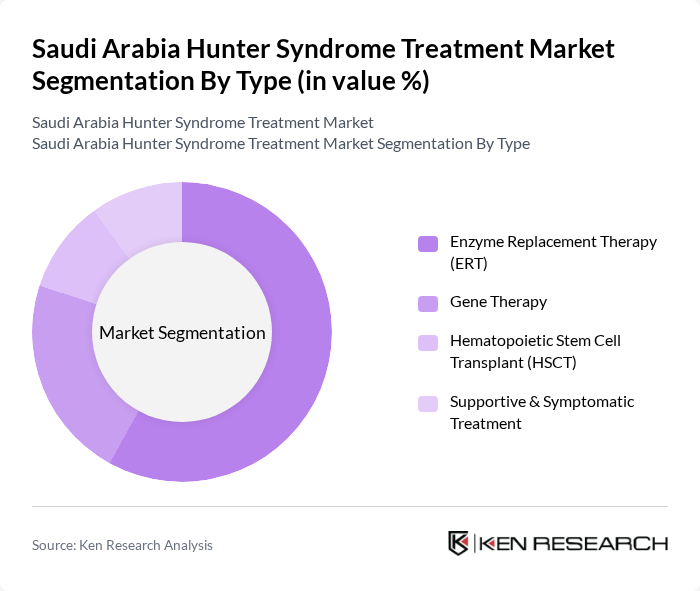

By Type:The market is segmented into various treatment types, including Enzyme Replacement Therapy (ERT), Gene Therapy, Hematopoietic Stem Cell Transplant (HSCT), and Supportive & Symptomatic Treatment. Among these,Enzyme Replacement Therapy (ERT)is the most widely adopted due to its established efficacy and safety profile. ERT directly addresses the enzyme deficiency characteristic of Hunter Syndrome, leading to improved patient outcomes and symptom management. The increasing availability of ERT options, ongoing clinical studies, and favorable reimbursement policies further bolster its dominance in the market.

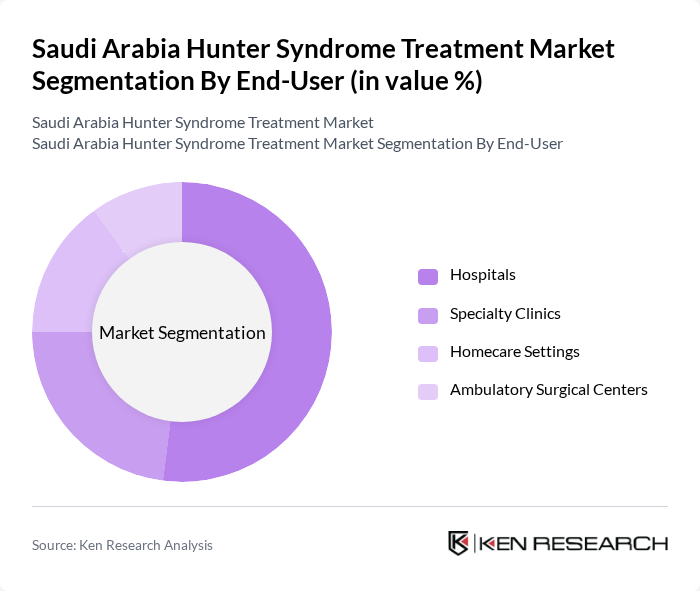

By End-User:The treatment market is categorized by end-users, including Hospitals, Specialty Clinics, Homecare Settings, and Ambulatory Surgical Centers.Hospitalsare the leading end-user segment, primarily due to their comprehensive facilities and access to specialized medical professionals. Hospitals provide a wide range of treatment options and have the necessary infrastructure to manage complex cases of Hunter Syndrome. The trend towards outpatient care is also driving growth in Specialty Clinics and Homecare Settings, as patients seek more personalized and convenient treatment options.

The Saudi Arabia Hunter Syndrome Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Takeda Pharmaceutical Company Limited, Sanofi Genzyme, BioMarin Pharmaceutical Inc., GC Pharma (Green Cross Corporation), Ultragenyx Pharmaceutical Inc., Orchard Therapeutics, Denali Therapeutics Inc., Regenxbio Inc., Amicus Therapeutics, Alexion Pharmaceuticals (AstraZeneca Rare Disease), Sobi (Swedish Orphan Biovitrum AB), Pfizer Inc., F. Hoffmann-La Roche Ltd, Johnson & Johnson Services, Inc., Novartis AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Hunter Syndrome treatment market in Saudi Arabia appears promising, driven by ongoing advancements in gene therapy and increased government funding for rare disease research. As healthcare infrastructure expands, more patients will gain access to innovative treatments. Additionally, the growing trend towards personalized medicine is expected to enhance treatment efficacy, leading to improved patient outcomes. Collaborative efforts between local and international pharmaceutical companies will likely accelerate the development of new therapies, further shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Enzyme Replacement Therapy (ERT) Gene Therapy Hematopoietic Stem Cell Transplant (HSCT) Supportive & Symptomatic Treatment (e.g., pain management, respiratory support) |

| By End-User | Hospitals Specialty Clinics Homecare Settings Ambulatory Surgical Centers |

| By Distribution Channel | Direct Sales Hospital Pharmacies Retail Pharmacies Online Platforms |

| By Patient Demographics | Pediatric Patients (Infants to Adolescents) Adult Patients (Young Adult to Senior) |

| By Treatment Duration | Short-term Treatment Long-term Treatment |

| By Geographic Region | Central Region Eastern Region Western Region Northern Region Southern Region |

| By Pricing Tier | Premium Mid-range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 100 | Pediatricians, Geneticists, Rare Disease Specialists |

| Pharmaceutical Distributors | 75 | Distribution Managers, Sales Representatives |

| Patient Advocacy Groups | 50 | Advocacy Leaders, Patient Support Coordinators |

| Health Insurance Companies | 60 | Policy Analysts, Claims Managers |

| Research Institutions | 40 | Clinical Researchers, Epidemiologists |

The Saudi Arabia Hunter Syndrome Treatment Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This valuation is influenced by increasing awareness of rare diseases and advancements in treatment options, particularly enzyme replacement therapy (ERT).