Region:Middle East

Author(s):Shubham

Product Code:KRAD0779

Pages:82

Published On:August 2025

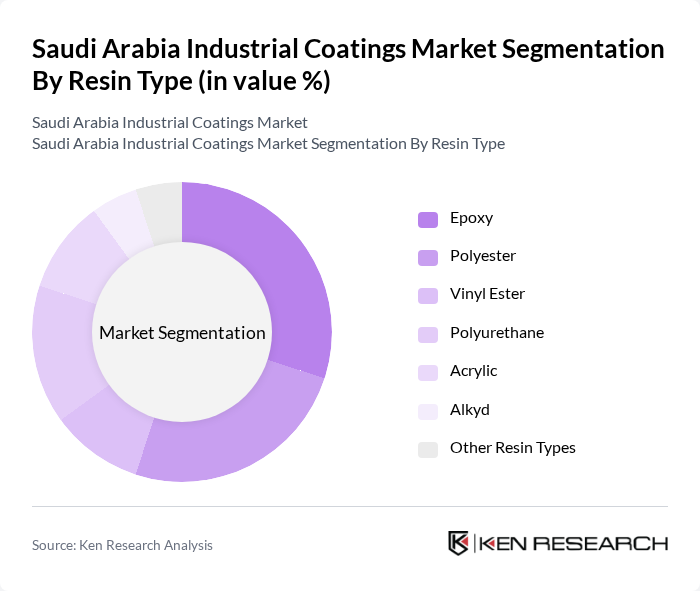

By Resin Type:The resin type segmentation includes various materials that are essential for the formulation of industrial coatings. The primary subsegments are Epoxy, Polyester, Vinyl Ester, Polyurethane, Acrylic, Alkyd, and Other Resin Types. Each of these resins offers unique properties that cater to different industrial applications, influencing their market demand. Epoxy resins are favored for their excellent adhesion, chemical resistance, and durability, making them ideal for protective coatings in automotive, construction, and oil & gas sectors. Polyester and polyurethane resins are valued for their flexibility and weather resistance, while acrylic and alkyd resins are commonly used in decorative and maintenance coatings.

The epoxy resin segment is currently dominating the market due to its excellent adhesion, chemical resistance, and durability, making it ideal for protective coatings in various industries, including automotive, construction, and oil & gas. The increasing demand for high-performance coatings that can withstand harsh environmental conditions has further propelled the growth of this segment. Additionally, the versatility of epoxy resins in formulating different types of coatings enhances their appeal among manufacturers.

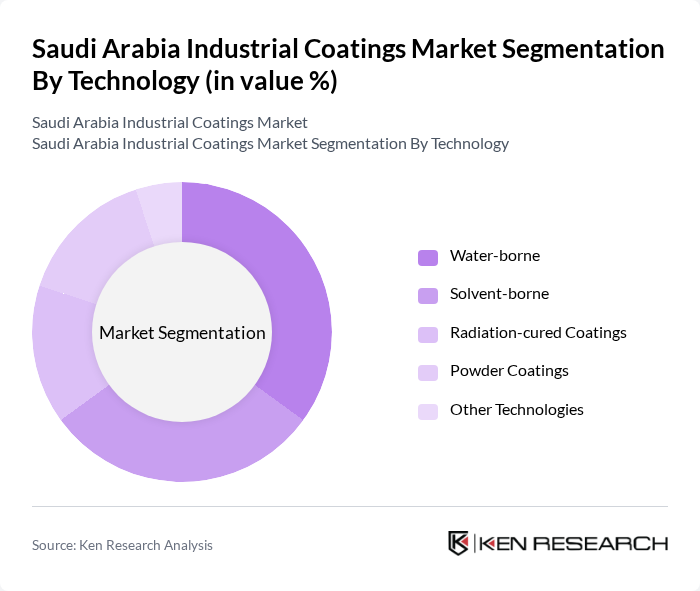

By Technology:The technology segmentation encompasses various application methods used in the industrial coatings market. The primary subsegments include Water-borne, Solvent-borne, Radiation-cured Coatings, Powder Coatings, and Other Technologies. Each technology offers distinct advantages, influencing their adoption across different industries. Water-borne coatings are preferred for their lower environmental impact and compliance with VOC regulations, while solvent-borne coatings remain popular for specific industrial applications requiring rapid curing and strong adhesion. Powder coatings are gaining traction due to their durability and eco-friendly profile, and radiation-cured coatings are used in specialized manufacturing processes.

The water-borne technology segment is leading the market due to its lower environmental impact and compliance with stringent regulations regarding VOC emissions. This technology is increasingly favored in various applications, including automotive, industrial maintenance, and infrastructure, as it offers ease of application and quick drying times. The shift towards sustainable practices and regulatory compliance in the coatings industry further supports the growth of water-borne coatings.

The Saudi Arabia Industrial Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Paints and Chemical Industries, Jotun Saudi Arabia, National Paints Factories Co. Ltd, Al-Jazeera Paints Company, BASF Saudi Arabia, PPG Industries, Inc., AkzoNobel N.V., Sherwin-Williams Saudi Arabia, RPM International Inc., Hempel A/S, Tikkurila, Sika Saudi Arabia, Henkel AG & Co. KGaA, Dow Chemical Saudi Arabia, 3M Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia industrial coatings market is poised for significant transformation, driven by technological advancements and a shift towards sustainability. As the government emphasizes green initiatives, manufacturers are likely to invest in eco-friendly coating solutions, aligning with global trends. Additionally, the rise of smart coatings, which offer enhanced functionality, is expected to gain traction. The market will also see increased digitalization, with e-commerce platforms facilitating easier access to coatings, thereby expanding customer reach and enhancing sales channels.

| Segment | Sub-Segments |

|---|---|

| By Resin Type | Epoxy Polyester Vinyl Ester Polyurethane Acrylic Alkyd Other Resin Types |

| By Technology | Water-borne Solvent-borne Radiation-cured Coatings Powder Coatings Other Technologies |

| By Product Type | General Industrial Protective Oil and Gas Mining Power Infrastructure Others |

| By End-User | Construction Automotive Aerospace Marine Oil & Gas Manufacturing Others |

| By Application | Protective Coatings Decorative Coatings Industrial Maintenance Automotive Finishes Marine Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Retail Stores Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Coatings | 100 | Project Managers, Procurement Officers |

| Automotive Coatings | 80 | Manufacturing Engineers, Quality Control Managers |

| Protective Coatings for Industrial Applications | 70 | Facility Managers, Safety Officers |

| Marine Coatings | 60 | Marine Engineers, Operations Managers |

| Specialty Coatings for Electronics | 40 | Product Development Managers, R&D Specialists |

The Saudi Arabia Industrial Coatings Market is valued at approximately USD 1.1 billion, driven by growth in sectors such as construction, oil & gas, and automotive, alongside significant infrastructure investments under the Vision 2030 initiative.