Region:Asia

Author(s):Rebecca

Product Code:KRAE2874

Pages:93

Published On:February 2026

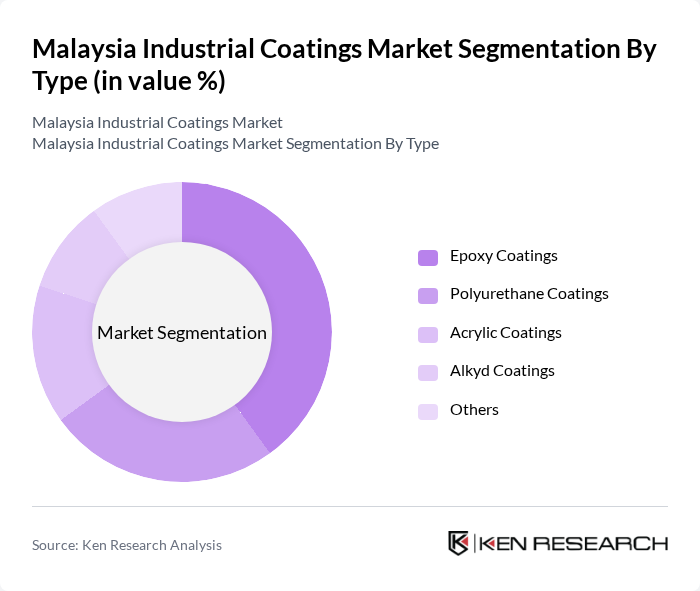

By Type:The market is segmented into various types of coatings, including epoxy, polyurethane, acrylic, alkyd, and others. Among these, epoxy coatings are particularly dominant due to their excellent adhesion, chemical resistance, and durability, making them suitable for a wide range of applications in industrial settings. Polyurethane coatings are also gaining traction, especially in automotive and decorative applications, due to their aesthetic appeal and protective qualities.

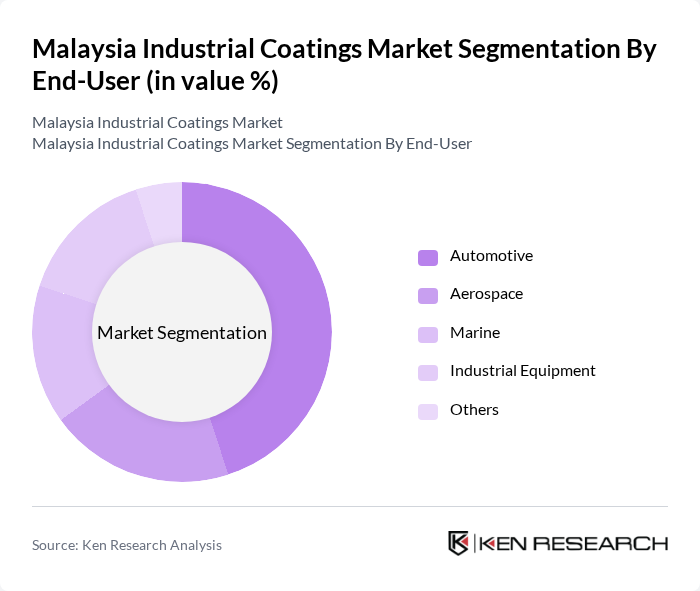

By End-User:The industrial coatings market is segmented by end-user industries, including automotive, aerospace, marine, industrial equipment, and others. The automotive sector is the largest consumer of industrial coatings, driven by the increasing production of vehicles and the need for protective and aesthetic finishes. The aerospace and marine industries also contribute significantly, as they require specialized coatings that can withstand harsh environmental conditions.

The Malaysia Industrial Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as AkzoNobel, PPG Industries, Sherwin-Williams, BASF, Nippon Paint, Jotun, Asian Paints, RPM International, Hempel, Tikkurila, Berger Paints, Kansai Paint, Valspar, DuPont, and 3M contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysia industrial coatings market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt eco-friendly coatings, the market is expected to witness a shift towards innovative solutions that meet regulatory standards. Additionally, the expansion of the automotive and aerospace sectors will further fuel demand for high-performance coatings. Companies that invest in R&D and sustainable practices are likely to gain a competitive edge in this evolving landscape, positioning themselves for long-term growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Epoxy Coatings Polyurethane Coatings Acrylic Coatings Alkyd Coatings Others |

| By End-User | Automotive Aerospace Marine Industrial Equipment Others |

| By Application | Protective Coatings Decorative Coatings Industrial Coatings Specialty Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Region | Central Region Northern Region Southern Region Eastern Region |

| By Product Formulation | Solvent-Based Coatings Water-Based Coatings Powder Coatings Others |

| By Performance Characteristics | High Durability Chemical Resistance Temperature Resistance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Coatings | 100 | Production Managers, Quality Control Supervisors |

| Construction Coatings | 80 | Project Managers, Procurement Officers |

| Industrial Equipment Coatings | 70 | Maintenance Managers, Operations Directors |

| Protective Coatings for Infrastructure | 60 | Site Engineers, Safety Officers |

| Marine Coatings | 50 | Fleet Managers, Coating Application Specialists |

The Malaysia Industrial Coatings Market is valued at approximately USD 1.2 billion, reflecting a robust growth trajectory driven by demand from sectors such as automotive, construction, and manufacturing, alongside a focus on sustainability and advanced coating technologies.