Australia Industrial Coatings Market Overview

- The Australia Industrial Coatings Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for protective coatings in various industries, including automotive, construction, and manufacturing. The market is also influenced by the rising awareness of environmental sustainability, leading to a shift towards eco-friendly coating solutions.

- Key players in this market include major cities such as Sydney, Melbourne, and Brisbane, which dominate due to their robust industrial base and significant construction activities. These cities are hubs for manufacturing and infrastructure development, contributing to the high demand for industrial coatings. Additionally, the presence of leading coating manufacturers in these regions further strengthens their market position.

- In 2023, the Australian government implemented regulations aimed at reducing volatile organic compounds (VOCs) in industrial coatings. This regulation mandates that all coatings sold in the market must comply with strict VOC limits, promoting the use of low-emission products and enhancing environmental protection. The initiative is part of a broader strategy to improve air quality and reduce health risks associated with industrial activities.

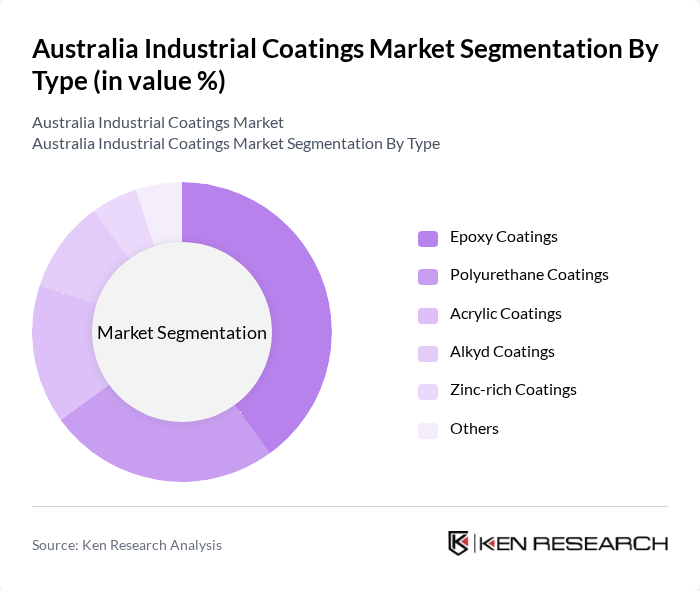

Australia Industrial Coatings Market Segmentation

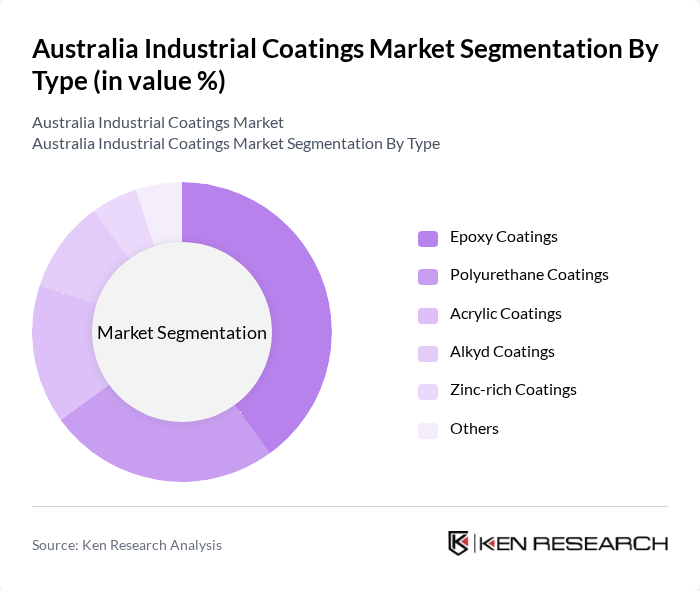

By Type:The market is segmented into various types of coatings, including epoxy, polyurethane, acrylic, alkyd, zinc-rich, and others. Among these, epoxy coatings are the most dominant due to their excellent adhesion, chemical resistance, and durability, making them ideal for industrial applications. Polyurethane coatings are also gaining traction, particularly in automotive and aerospace sectors, due to their superior finish and flexibility. The demand for eco-friendly options is driving growth in the acrylic and alkyd segments as well.

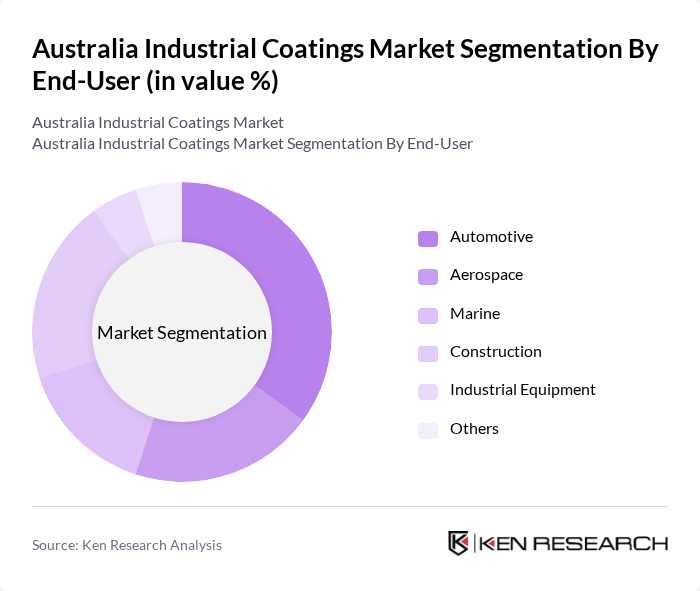

By End-User:The industrial coatings market is segmented by end-user industries, including automotive, aerospace, marine, construction, industrial equipment, and others. The automotive sector is the largest consumer of industrial coatings, driven by the need for protective and aesthetic finishes. The construction industry follows closely, with increasing infrastructure projects boosting demand for durable coatings. The aerospace and marine sectors are also significant, focusing on high-performance coatings that withstand harsh environments.

Australia Industrial Coatings Market Competitive Landscape

The Australia Industrial Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as DuluxGroup, PPG Industries, AkzoNobel, Sherwin-Williams, BASF, Nippon Paint, Jotun, Hempel, Rust-Oleum, Valspar, Sika, Tikkurila, RPM International, Asian Paints, Berger Paints contribute to innovation, geographic expansion, and service delivery in this space.

Australia Industrial Coatings Market Industry Analysis

Growth Drivers

- Increasing Demand for Protective Coatings:The Australian industrial coatings market is experiencing a surge in demand for protective coatings, driven by the need for enhanced durability and corrosion resistance. In future, the protective coatings segment accounted for approximately AUD 1.2 billion, reflecting a growth rate of 5% year-on-year. This demand is primarily fueled by the construction and manufacturing sectors, which are projected to contribute over AUD 300 billion to the national GDP in future, emphasizing the critical role of protective coatings in safeguarding assets.

- Growth in Construction and Infrastructure Projects:The Australian government has allocated AUD 110 billion for infrastructure projects over the next decade, significantly boosting the industrial coatings market. In future, the construction sector is expected to grow by 4.5%, leading to increased demand for coatings that meet stringent performance standards. This growth is particularly evident in urban development initiatives, where protective and decorative coatings are essential for both aesthetic and functional purposes, driving market expansion.

- Technological Advancements in Coating Formulations:Innovations in coating technologies are propelling the Australian industrial coatings market forward. In future, the introduction of advanced formulations, such as high-performance and smart coatings, is expected to enhance product offerings. The market for smart coatings alone is projected to reach AUD 150 million, driven by their ability to provide self-healing and anti-corrosive properties. These advancements are crucial for meeting the evolving demands of various industries, including automotive and aerospace.

Market Challenges

- Fluctuating Raw Material Prices:The industrial coatings market in Australia faces significant challenges due to fluctuating raw material prices. In future, the cost of key raw materials, such as titanium dioxide and epoxy resins, increased by 15%, impacting profit margins for manufacturers. This volatility is largely attributed to global supply chain disruptions and geopolitical tensions, which are expected to persist into future, complicating procurement strategies for coating producers and affecting overall market stability.

- Regulatory Compliance Complexities:Navigating the regulatory landscape poses a challenge for the Australian industrial coatings market. Compliance with stringent VOC emissions regulations, which are set to tighten further in future, requires significant investment in R&D and production processes. Companies must adapt to these evolving standards, which can lead to increased operational costs. The complexity of adhering to both local and international regulations adds another layer of difficulty for manufacturers aiming to maintain market competitiveness.

Australia Industrial Coatings Market Future Outlook

The future of the Australian industrial coatings market appears promising, driven by ongoing technological advancements and a strong focus on sustainability. As industries increasingly adopt eco-friendly practices, the demand for low-VOC and water-based coatings is expected to rise. Additionally, the integration of smart coatings technology will likely enhance product performance, catering to the needs of various sectors. With government support for infrastructure projects, the market is poised for steady growth, fostering innovation and competitiveness among key players.

Market Opportunities

- Expansion in the Automotive Sector:The automotive industry in Australia is projected to grow by 3% annually, creating significant opportunities for industrial coatings. As manufacturers seek advanced coatings for vehicle protection and aesthetics, the demand for high-performance coatings is expected to rise, potentially generating an additional AUD 50 million in revenue by future.

- Focus on Sustainable Coatings:The increasing emphasis on sustainability presents a lucrative opportunity for the industrial coatings market. With the Australian government promoting green initiatives, the market for eco-friendly coatings is anticipated to expand, potentially reaching AUD 200 million by future. This shift towards sustainable products aligns with global trends, positioning Australian manufacturers favorably in the international market.