Region:Middle East

Author(s):Dev

Product Code:KRAD1674

Pages:100

Published On:November 2025

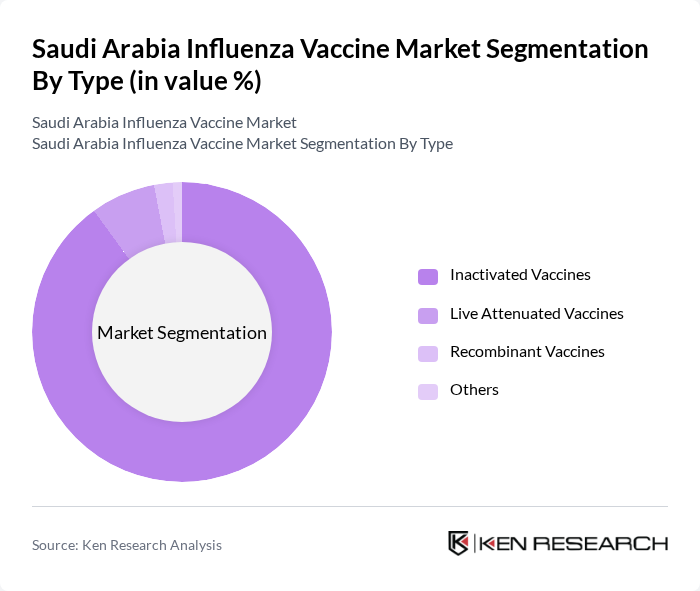

By Type:The market is segmented into various types of vaccines, including Inactivated Vaccines, Live Attenuated Vaccines, Recombinant Vaccines, and Others. Inactivated Vaccines are the most widely used due to their established safety profile and effectiveness in preventing influenza, accounting for the vast majority of administered doses. Live Attenuated Vaccines are also gaining traction, particularly among pediatric populations, while Recombinant Vaccines are emerging as a newer option that offers rapid production capabilities. The Others category includes various formulations and combinations that cater to specific patient needs .

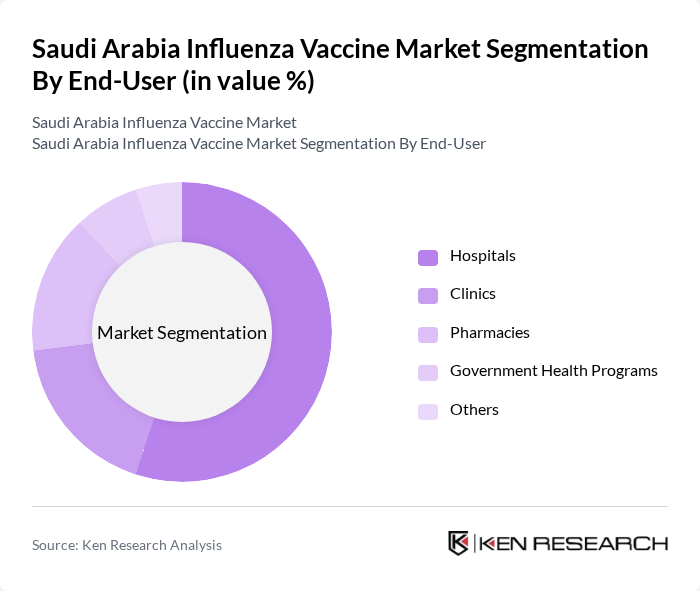

By End-User:The end-user segmentation includes Hospitals, Clinics, Pharmacies, Government Health Programs, and Others. Hospitals are the leading end-users due to their capacity to administer vaccines on a large scale and their role in managing influenza outbreaks. Clinics and pharmacies also play significant roles, particularly in urban areas where access to healthcare is more convenient. Government health programs are crucial for public health initiatives, ensuring that vulnerable populations receive vaccinations. Hospitals remain the fastest-growing segment due to centralized vaccination campaigns and high patient throughput .

The Saudi Arabia Influenza Vaccine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Pharmaceutical Industries and Medical Appliances Corporation (SPIMACO), GlaxoSmithKline (GSK), Sanofi Pasteur, Pfizer Inc., AstraZeneca, Merck & Co., Inc., Seqirus, Sinovac Biotech Ltd., Viatris Inc., CSL Ltd., Emergent BioSolutions Inc., Vaxess Technologies, Osivax, Emergex Vaccines contribute to innovation, geographic expansion, and service delivery in this space.

The future of the influenza vaccine market in Saudi Arabia appears promising, driven by ongoing government initiatives and increasing public health awareness. As healthcare infrastructure expands, more facilities will be equipped to administer vaccines, enhancing accessibility. Additionally, collaborations with international manufacturers are likely to introduce innovative vaccine formulations, further improving efficacy. The focus on preventive healthcare will continue to shape public attitudes, fostering a culture of vaccination that is crucial for managing seasonal influenza outbreaks effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Inactivated Vaccines Live Attenuated Vaccines Recombinant Vaccines Others |

| By End-User | Hospitals Clinics Pharmacies Government Health Programs Others |

| By Distribution Channel | Direct Sales Wholesalers Retail Pharmacies Online Sales Others |

| By Age Group | Pediatric Adult Elderly Others |

| By Geography | Central Region Eastern Region Western Region Southern Region |

| By Vaccine Formulation | Single-Dose Multi-Dose Others |

| By Policy Support | Government Subsidies Tax Incentives Public Awareness Campaigns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 120 | Doctors, Nurses, Public Health Officials |

| Pharmacy Sector | 100 | Pharmacists, Pharmacy Managers |

| Patient Perspectives | 80 | Patients, Caregivers, Community Health Workers |

| Government Health Officials | 50 | Policy Makers, Health Program Directors |

| Vaccine Manufacturers | 70 | Sales Managers, Product Development Teams |

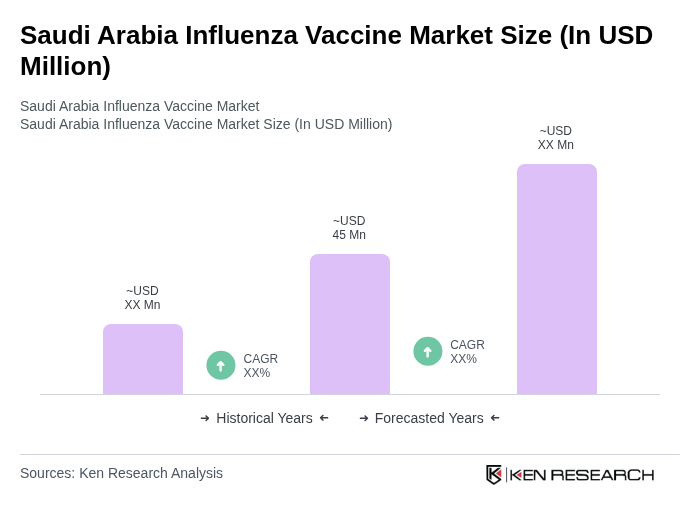

The Saudi Arabia Influenza Vaccine Market is valued at approximately USD 45 million, reflecting a steady demand for vaccines driven by public health awareness, government initiatives, and the rising incidence of influenza outbreaks.