Region:Middle East

Author(s):Rebecca

Product Code:KRAD4990

Pages:87

Published On:December 2025

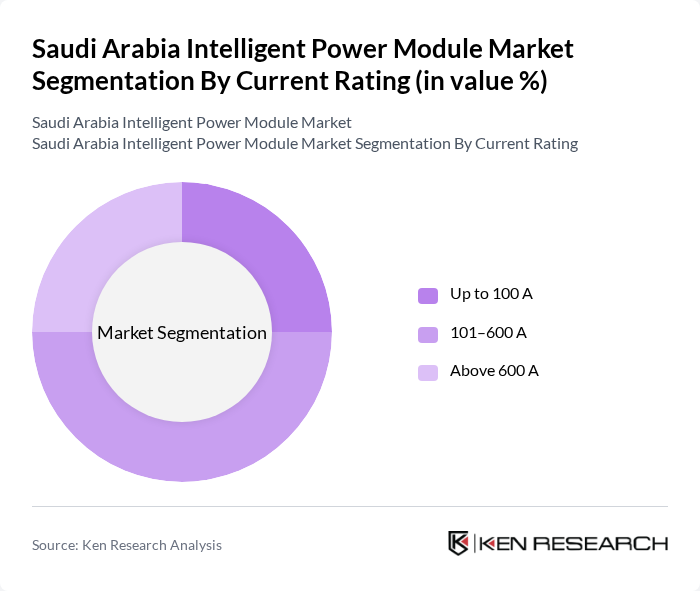

By Current Rating:

The current rating segmentation includes three subsegments: Up to 100 A, 101–600 A, and Above 600 A. The 101–600 A subsegment is currently dominating the market due to its versatility and application in various industrial and automotive sectors, in line with global IPM usage where mid?current modules are preferred for motor drives, inverters, and industrial automation. This range is particularly favored for its balance between performance and efficiency, making it suitable for a wide array of applications, including electric vehicles, industrial motor drives, and renewable energy systems such as photovoltaic inverters. The increasing adoption of variable-speed drives in industrial facilities, the growth of HVAC and pump systems in commercial buildings, and the need for efficient power management in EV powertrains and charging infrastructure are driving the demand for this subsegment in Saudi Arabia.

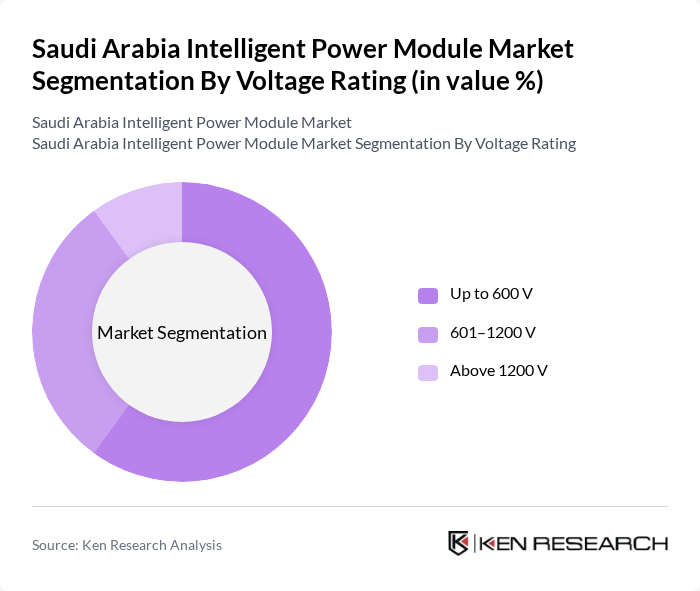

By Voltage Rating:

The voltage rating segmentation consists of three subsegments: Up to 600 V, 601–1200 V, and Above 1200 V. The Up to 600 V subsegment is leading the market, primarily due to its widespread use in consumer electronics, low?voltage motor drives, and many industrial control applications, consistent with global demand patterns where sub?600 V IPMs hold the largest share. This voltage range is ideal for many applications, including HVAC systems, pumps, fans, elevators, and industrial drives, which require reliable and efficient power management and are being increasingly deployed in Saudi Arabia’s commercial and industrial buildings. The growing trend towards automation, smart buildings, and digitally monitored industrial systems under Vision 2030, as well as the use of intelligent power modules in appliances and data?center cooling infrastructure, is further propelling the demand for this subsegment.

The Saudi Arabia Intelligent Power Module Market is characterized by a dynamic mix of regional and international players. Leading participants such as Infineon Technologies AG, Mitsubishi Electric Corporation, Fuji Electric Co., Ltd., ON Semiconductor Corporation (onsemi), STMicroelectronics N.V., Texas Instruments Incorporated, Renesas Electronics Corporation, Semikron Danfoss A/S, Rohm Co., Ltd., Vishay Intertechnology, Inc., Power Integrations, Inc., NXP Semiconductors N.V., Toshiba Electronic Devices & Storage Corporation, Siemens AG, ABB Ltd. contribute to innovation, geographic expansion, and service delivery in this space, providing IPMs across current and voltage classes for applications ranging from consumer appliances and industrial drives to renewable energy inverters and EV systems.

The future of the Saudi Arabia intelligent power module market appears promising, driven by ongoing government initiatives and technological advancements. As the nation progresses towards its renewable energy goals, the integration of intelligent power modules will become increasingly vital. The anticipated growth in electric vehicle infrastructure and the rise of smart grid technologies will further enhance the demand for these solutions. Additionally, the collaboration between local firms and international technology providers is expected to accelerate innovation and market penetration, fostering a more sustainable energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Current Rating (Up to 100 A, 101–600 A, Above 600 A) | Up to 100 A –600 A Above 600 A |

| By Voltage Rating (Up to 600 V, 601–1200 V, Above 1200 V) | Up to 600 V –1200 V Above 1200 V |

| By Circuit Configuration (6-Pack, 7-Pack, Others) | Pack (Three-Phase Inverter) Pack (Three-Phase Inverter with Brake) Others (Dual, Single-Phase, Custom) |

| By Power Device Type (IGBT?Based, MOSFET?Based, Hybrid) | IGBT?Based Intelligent Power Modules MOSFET?Based Intelligent Power Modules (Silicon, SiC, GaN) Hybrid Intelligent Power Modules |

| By Application (Industrial Drives, Renewable Energy, EV & Charging, Consumer & HVAC, Others) | Industrial Motor Drives, Robotics & Automation Renewable Energy Inverters (Solar, Wind) Electric Vehicles, HEVs & Charging Infrastructure Consumer Appliances & HVAC (ACs, Pumps, Compressors) Others (Rail, Medical, UPS & Data Centers) |

| By End User (Industrial, Automotive, Energy & Utilities, Consumer Electronics, Others) | Industrial Equipment Manufacturers Automotive OEMs and Tier?1 Suppliers Energy & Utilities (Smart Grid, IPP, T&D) Consumer Electronics & Appliance OEMs Others (Oil & Gas, Rail, Healthcare) |

| By Region (Central, Eastern, Western, Southern) | Central Eastern Western Southern |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Renewable Energy Projects | 100 | Project Managers, Energy Analysts |

| Automotive Power Electronics | 80 | Product Engineers, R&D Managers |

| Industrial Automation Solutions | 70 | Operations Managers, Technical Directors |

| Smart Grid Technologies | 90 | Utility Executives, System Integrators |

| Consumer Electronics Applications | 75 | Marketing Managers, Product Development Leads |

The Saudi Arabia Intelligent Power Module Market is valued at approximately USD 0.2 billion, driven by the increasing demand for energy-efficient solutions across various sectors, including automotive, industrial, and renewable energy.