Region:Middle East

Author(s):Rebecca

Product Code:KRAC4030

Pages:100

Published On:October 2025

By Type:The market is segmented into various types of interior building materials, including flooring materials, wall finishes, ceiling systems, decorative elements, insulation materials, paints and coatings, and others. Each sub-segment caters to specific consumer needs and preferences, with flooring materials and wall finishes being particularly popular due to their essential roles in interior aesthetics and functionality. The market has also seen increased demand for advanced acoustic and thermal insulation, as well as innovative decorative elements that align with modern design trends .

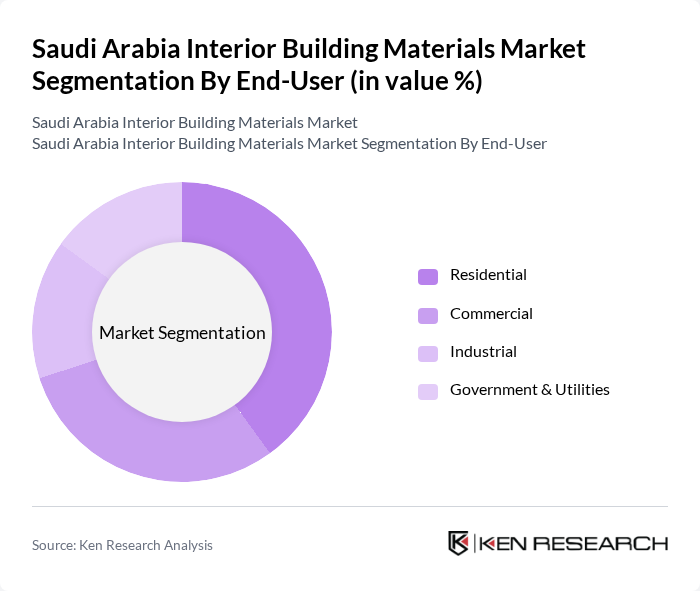

By End-User:The end-user segmentation includes residential, commercial, industrial, and government & utilities sectors. The residential segment is the largest, driven by increasing housing demands and urban development. Commercial spaces also contribute significantly, as businesses invest in quality interiors to enhance their environments. The industrial and government segments are also expanding, supported by infrastructure upgrades and public sector modernization initiatives .

The Saudi Arabia Interior Building Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Ceramics Company, Al-Fozan Group, Saudi Building Materials Company, Al-Jazira Factory for Steel Products, Al-Muhaidib Group, Al-Rajhi Construction, Saudi Readymix Concrete Company, Al-Khodari & Sons, Al-Babtain Group, Al-Hokair Group, Al-Mansour Group, Al-Suwaidi Industrial Services, Al-Omran Group, Al-Faisal Holding, and Al-Saad Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia interior building materials market is poised for significant growth driven by urbanization, government investments, and rising disposable incomes. As the demand for sustainable and innovative materials increases, manufacturers are likely to adopt advanced technologies to enhance production efficiency. Additionally, the integration of smart technologies in building design will further shape market dynamics, creating a landscape where quality and sustainability are paramount in meeting consumer expectations and regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Flooring Materials (e.g., Ceramic, Marble, Wood) Wall Finishes (e.g., Paints, Coatings, Wallpapers) Ceiling Systems (e.g., Suspended Ceilings, Acoustic Panels) Decorative Elements (e.g., Lighting Fixtures, Furniture) Insulation Materials (e.g., Thermal, Acoustic) Paints and Coatings (e.g., Interior, Exterior) Others (e.g., Adhesives, Sealants) |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | New Construction Renovation Interior Design Projects |

| By Distribution Channel | Direct Sales Retail Outlets Online Platforms |

| By Price Range | Budget Mid-Range Premium |

| By Material Source | Locally Sourced Imported |

| By Brand Preference | Established Brands Emerging Brands Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Interior Design | 100 | Interior Designers, Homeowners |

| Commercial Building Projects | 90 | Project Managers, Facility Managers |

| Retail Space Renovations | 70 | Store Owners, Retail Managers |

| Hospitality Sector Developments | 60 | Hotel Managers, Architects |

| Government Infrastructure Projects | 80 | Public Works Officials, Contractors |

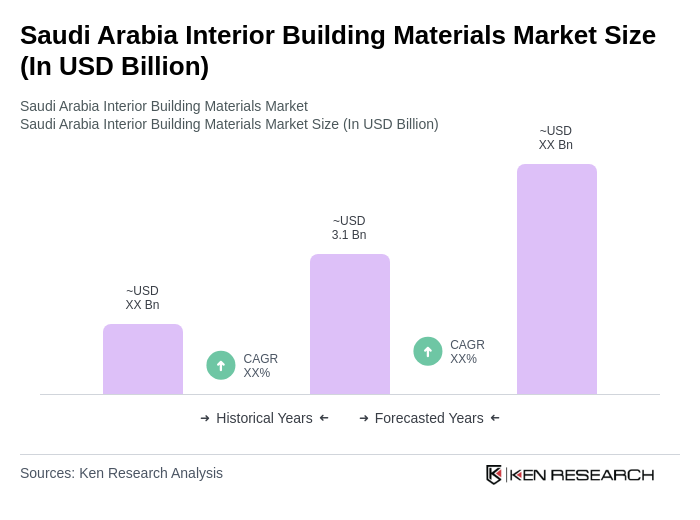

The Saudi Arabia Interior Building Materials Market is valued at approximately USD 3.1 billion, driven by rapid urbanization, government infrastructure investments, and a growing demand for residential and commercial spaces.