Region:Middle East

Author(s):Shubham

Product Code:KRAD5495

Pages:99

Published On:December 2025

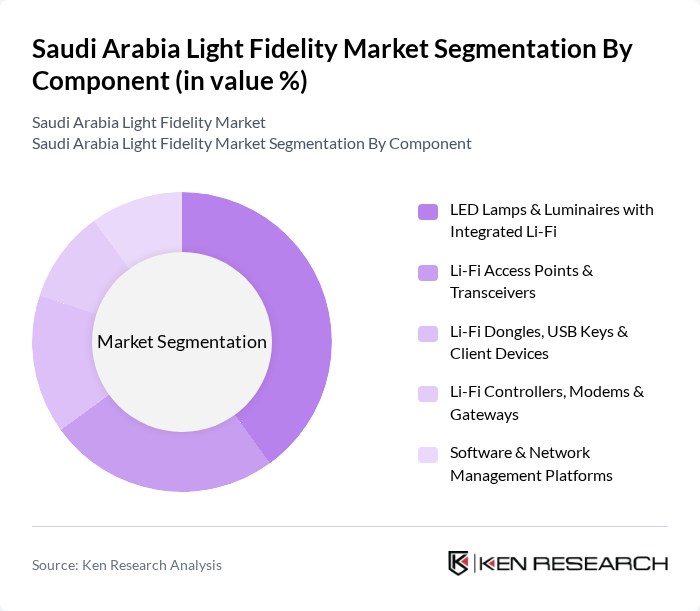

By Component:The components of the Saudi Arabia Light Fidelity market include various technologies and devices that facilitate Li-Fi communication. The leading sub-segment is LED Lamps & Luminaires with Integrated Li-Fi, which is gaining traction due to its dual functionality of providing illumination and data transmission. Other components such as Li-Fi Access Points & Transceivers and Software & Network Management Platforms are also essential for establishing a robust Li-Fi infrastructure.

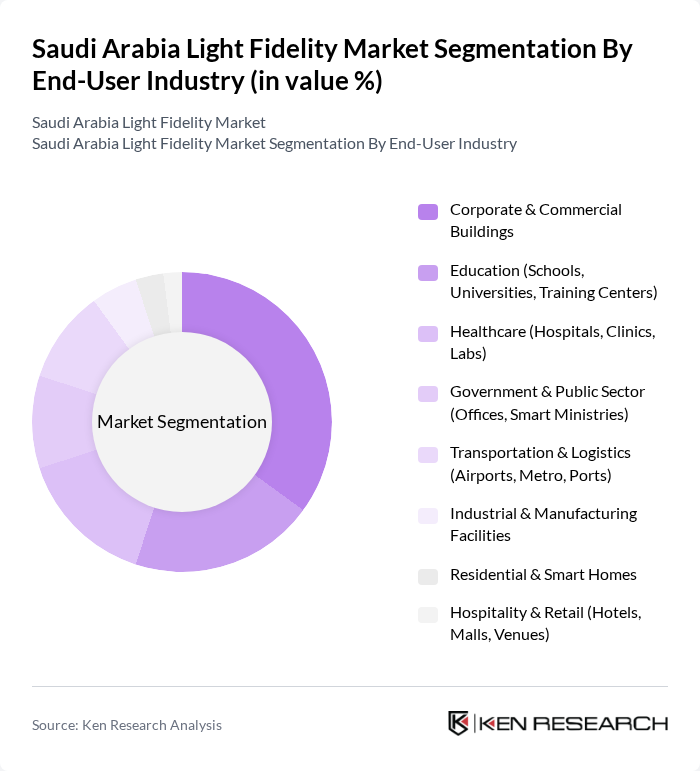

By End-User Industry:The end-user industries for the Saudi Arabia Light Fidelity market encompass a wide range of sectors, including corporate buildings, education, healthcare, and transportation. The corporate and commercial buildings segment is the largest, driven by the need for high-speed internet and secure communication in business environments. The education sector is also rapidly adopting Li-Fi technology to enhance learning experiences and connectivity in schools and universities.

The Saudi Arabia Light Fidelity market is characterized by a dynamic mix of regional and international players. Leading participants such as pureLiFi Ltd., Signify N.V. (Trulifi), Oledcomm SAS, Fraunhofer HHI (Fraunhofer Heinrich Hertz Institute), Lucibel SA, Velmenni OÜ, VLNComm Inc., Phillips Lighting Saudi Arabia Ltd. (Signify Saudi Arabia), Zain KSA (Zain Saudi Arabia), STC (Saudi Telecom Company), NEOM Tech & Digital Company, Huawei Tech Investment Saudi Arabia Co. Ltd., Cisco Systems Saudi Arabia Ltd., Al-Falak Electronic Equipment & Supplies Co., Advanced Electronics Company (AEC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Light Fidelity market in Saudi Arabia appears promising, driven by ongoing government support and technological advancements. As urbanization accelerates, the demand for high-speed internet and smart city solutions will likely increase. Furthermore, the integration of Light Fidelity with emerging technologies, such as 5G and IoT, will enhance its appeal. Continued investment in research and development will also foster innovation, paving the way for new applications and broader market acceptance in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Component | LED Lamps & Luminaires with Integrated Li?Fi Li?Fi Access Points & Transceivers Li?Fi Dongles, USB Keys & Client Devices Li?Fi Controllers, Modems & Gateways Software & Network Management Platforms |

| By End-User Industry | Corporate & Commercial Buildings Education (Schools, Universities, Training Centers) Healthcare (Hospitals, Clinics, Labs) Government & Public Sector (Offices, Smart Ministries) Transportation & Logistics (Airports, Metro, Ports) Industrial & Manufacturing Facilities Residential & Smart Homes Hospitality & Retail (Hotels, Malls, Venues) |

| By Application | Indoor High?Speed Data Communication Secure & RF?Restricted Communications (Defense, Healthcare) Location?Based Services & Indoor Positioning Vehicle?to?Infrastructure (V2I) & Automotive Connectivity Industrial Automation & Smart Factory Connectivity Backhaul & Network Offloading |

| By Technology | Visible Light Communication (VLC) Infrared-Based Li?Fi Hybrid Li?Fi/Wi?Fi Systems Integrated Li?Fi in Smart Lighting Systems |

| By Deployment Environment | New-Build Smart City Projects (e.g., NEOM, Qiddiya) Retrofit of Existing Buildings Pilot & Trial Deployments Large-Scale Commercial Rollouts |

| By Investment Source | Domestic Private Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government and Sovereign Fund Programs |

| By Market Maturity Cluster (Within Saudi Arabia) | Tier-1 Cities (Riyadh, Jeddah, Dammam Metropolitan Area) Emerging Smart City Zones (NEOM, The Line, Qiddiya) Secondary Cities & Industrial Hubs Pilot Corridors & Testbeds (Universities, Tech Parks) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Sector Adoption | 100 | IT Managers, Facility Managers |

| Residential User Experience | 80 | Homeowners, Tenants |

| Healthcare Applications | 70 | Healthcare Administrators, IT Directors |

| Educational Institutions | 60 | School Administrators, IT Coordinators |

| Retail Sector Implementation | 90 | Store Managers, Technology Officers |

The Saudi Arabia Light Fidelity market is valued at approximately USD 120 million, driven by the increasing demand for high-speed wireless communication and the expansion of smart city initiatives across the region.