Region:Middle East

Author(s):Geetanshi

Product Code:KRAE0003

Pages:103

Published On:December 2025

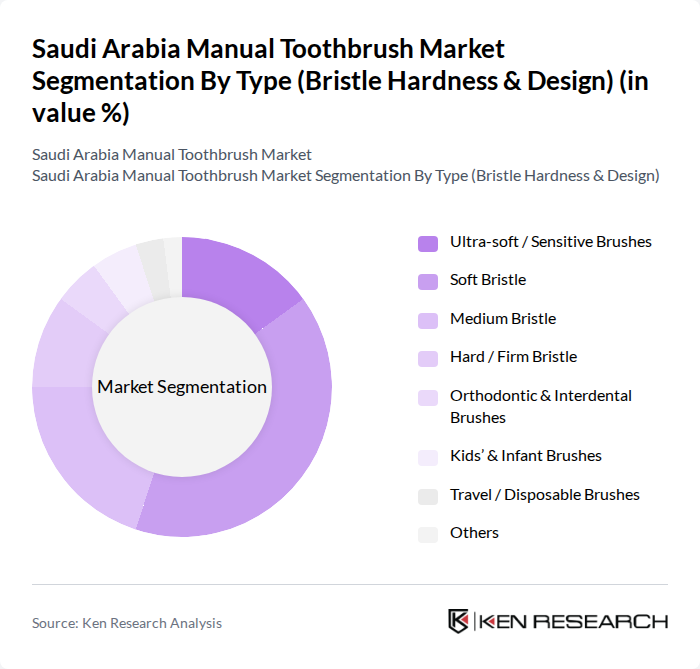

By Type (Bristle Hardness & Design):The market is segmented into various types based on bristle hardness and design, including Ultra-soft / Sensitive Brushes, Soft Bristle, Medium Bristle, Hard / Firm Bristle, Orthodontic & Interdental Brushes, Kids’ & Infant Brushes, Travel / Disposable Brushes, and Others. This structure is consistent with global manual toothbrush product differentiation by bristle type and specialized designs. Among these, soft bristle brushes are the most popular due to their gentle cleaning action, making them suitable for a wide range of consumers, including those with sensitive gums, and aligning with professional recommendations favoring softer bristles. The increasing awareness of dental health, along with the guidance of dental professionals and international dental associations endorsing soft and ultra-soft brushes, further drives the demand for this sub-segment.

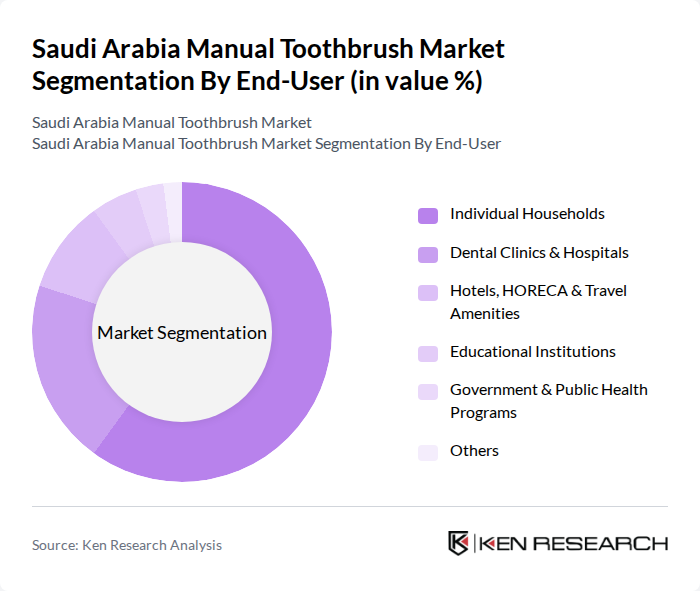

By End-User:The market is segmented by end-user into Individual Households, Dental Clinics & Hospitals, Hotels, HORECA & Travel Amenities, Educational Institutions, Government & Public Health Programs, and Others. This end-user segmentation reflects the principal consumption and distribution channels for manual toothbrushes within the broader Saudi Arabia oral care market. Individual households represent the largest segment, driven by the growing awareness of oral hygiene, regular toothbrushing habits, and the necessity of routine dental care. The increasing population, high urbanization rate, and expansion of organized retail and pharmacy chains in Saudi Arabia contribute to the rising demand for manual toothbrushes in households, as families prioritize daily health and wellness and routinely purchase oral care products as part of fast-moving consumer goods baskets.

The Saudi Arabia Manual Toothbrush Market is characterized by a dynamic mix of regional and international players. Leading participants such as Colgate-Palmolive Company, Procter & Gamble Company (Oral-B brand), Unilever PLC (Signal & Closeup brands), GSK PLC (Sensodyne & Parodontax brands), Johnson & Johnson (Reach brand), Church & Dwight Co., Inc. (Arm & Hammer brand), Henkel AG & Co. KGaA, Sunstar Group (GUM brand), Lion Corporation, GC Corporation, Curaden AG (Curaprox brand), TePe Munhygienprodukter AB, Jordan AS, Trisa AG, Moochie or other leading regional/private label brands in KSA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia manual toothbrush market appears promising, driven by increasing consumer awareness and a shift towards sustainable products. As the population becomes more health-conscious, the demand for eco-friendly toothbrushes is expected to rise. Additionally, the growth of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice. Companies that adapt to these trends and invest in innovative marketing strategies will likely capture a larger market share in the future.

| Segment | Sub-Segments |

|---|---|

| By Type (Bristle Hardness & Design) | Ultra-soft / Sensitive Brushes Soft Bristle Medium Bristle Hard / Firm Bristle Orthodontic & Interdental Brushes Kids’ & Infant Brushes Travel / Disposable Brushes Others |

| By End-User | Individual Households Dental Clinics & Hospitals Hotels, HORECA & Travel Amenities Educational Institutions Government & Public Health Programs Others |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies & Drugstores Online Retail & Marketplaces Convenience & Grocery Stores Wholesale & Institutional / B2B Others |

| By Material | Conventional Plastic Bio-based / Recycled Plastic Bamboo & Wood Other Biodegradable Materials Others |

| By Brand Type | International FMCG Brands Regional GCC Brands Local & Private Label Brands (Modern Trade) Pharmacy & Clinic House Brands Others |

| By Price Range | Value / Economy (Mass) Mid-range (Mainstream) Premium Super-premium / Specialist |

| By Age Group | Infants & Toddlers (0–5 years) Children (6–12 years) Teens & Adults (13–59 years) Seniors (60+ years) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Toothbrush Selection | 120 | General Consumers, Health-Conscious Individuals |

| Retail Insights on Manual Toothbrush Sales | 90 | Store Managers, Retail Buyers |

| Dental Professional Perspectives on Oral Care Products | 60 | Dentists, Dental Hygienists |

| Market Trends in Oral Care Products | 50 | Market Analysts, Industry Experts |

| Distribution Channel Effectiveness | 80 | Distributors, Wholesalers |

The Saudi Arabia Manual Toothbrush Market is valued at approximately USD 100 million, reflecting its significant share within the national oral care sector and the global manual toothbrush market.