Region:Middle East

Author(s):Geetanshi

Product Code:KRAD8165

Pages:80

Published On:December 2025

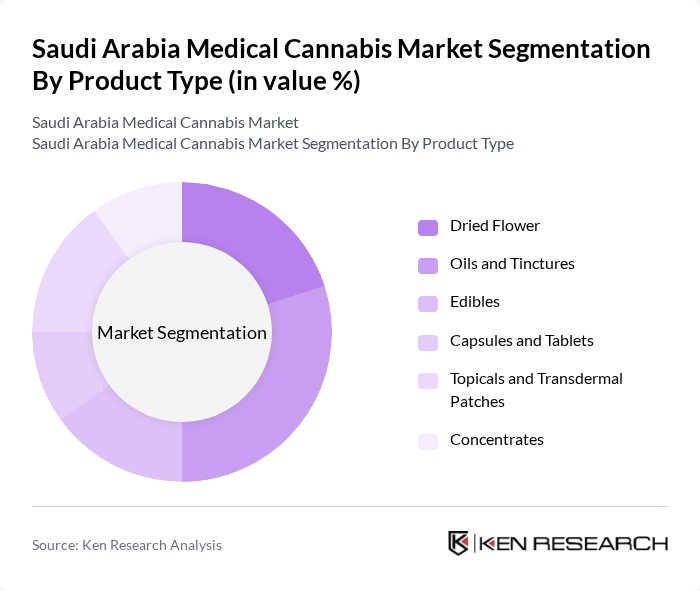

By Product Type:The product type segmentation includes various forms of medical cannabis products that cater to different consumer preferences and therapeutic needs. The subsegments are Dried Flower, Oils and Tinctures, Edibles, Capsules and Tablets, Topicals and Transdermal Patches, and Concentrates. Among these, Oils and Tinctures are gaining significant traction due to their ease of use and effectiveness in delivering precise dosages. The growing trend towards natural and organic products is also boosting the demand for these forms.

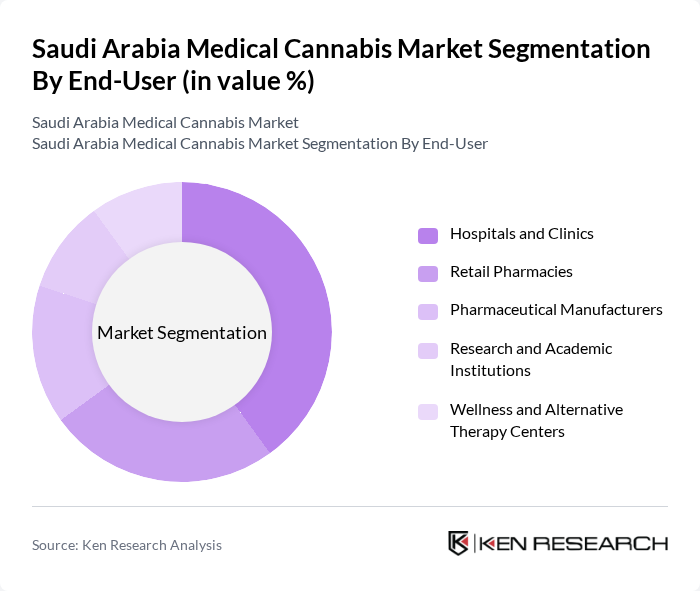

By End-User:The end-user segmentation encompasses various entities that utilize medical cannabis products, including Hospitals and Clinics, Retail Pharmacies, Pharmaceutical Manufacturers, Research and Academic Institutions, and Wellness and Alternative Therapy Centers. Hospitals and Clinics are the leading end-users, as they are increasingly incorporating medical cannabis into treatment plans for patients with chronic conditions. This trend is driven by the growing body of research supporting the therapeutic benefits of cannabis.

The Saudi Arabia Medical Cannabis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Pharmaceutical Industries and Medical Appliances Corporation (SPIMACO), Al Rajhi Pharma, Dammam Pharmaceutical Company, Jazeera Pharmaceutical Company, Saudi German Hospital Group, King Faisal Specialist Hospital and Research Centre, Ministry of Health Research Centers, Tilray Brands Inc., Canopy Growth Corporation, Aurora Cannabis Inc., Curaleaf Holdings Inc., Trulieve Cannabis Corp., Cresco Labs Inc., Acreage Holdings Inc., GreenTherapeutics (Regional Partner) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the medical cannabis market in Saudi Arabia appears promising, driven by increasing acceptance and government support for research. As healthcare professionals become more educated about cannabis benefits, patient access is likely to improve. Additionally, the anticipated regulatory framework will facilitate market entry for new players. The integration of technology in cultivation and distribution will further enhance efficiency, positioning the market for significant growth in the coming years as demand for alternative therapies rises.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Dried Flower Oils and Tinctures Edibles Capsules and Tablets Topicals and Transdermal Patches Concentrates |

| By End-User | Hospitals and Clinics Retail Pharmacies Pharmaceutical Manufacturers Research and Academic Institutions Wellness and Alternative Therapy Centers |

| By Application | Chronic Pain Management Epilepsy Neurological Disorders Cancer Arthritis Migraine Mental Health Disorders Others |

| By Distribution Channel | Online Pharmacies Hospital Pharmacies Retail Pharmacies Specialty Dispensaries Direct-to-Patient (DTP) |

| By Route of Administration | Oral Solutions and Capsules Vaporizers Topicals Others |

| By Geographic Region | Northern and Central Region Eastern Region Western Region Southern Region |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Chronic Illness Prevalence |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 120 | Doctors, Pharmacists, Medical Researchers |

| Patient Demographics | 100 | Patients with chronic conditions, Caregivers |

| Industry Stakeholders | 80 | Distributors, Retailers, Industry Analysts |

| Regulatory Bodies | 50 | Government Officials, Policy Makers |

| Public Perception Surveys | 120 | General Public, Advocacy Groups |

The Saudi Arabia Medical Cannabis Market is valued at approximately USD 300 million, reflecting a significant growth trend driven by increasing acceptance of medical cannabis for therapeutic purposes and a rise in chronic diseases and mental health disorders.