Region:North America

Author(s):Dev

Product Code:KRAD1778

Pages:98

Published On:November 2025

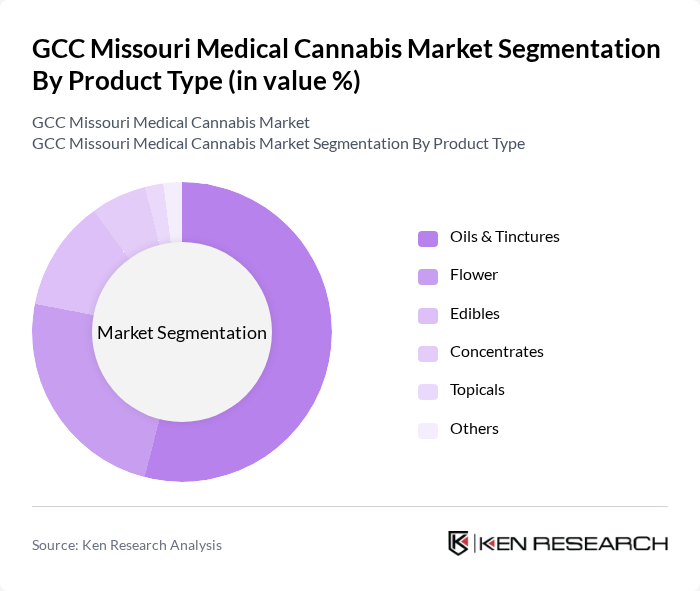

By Product Type:The market is segmented into various product types, including Flower, Edibles, Concentrates, Oils & Tinctures, Topicals, and Others. Oils & Tinctures currently lead the market in revenue share, driven by demand for precise dosing and ease of use among patients with chronic conditions. Flower products remain popular due to traditional use and high consumer preference, while Edibles and Concentrates are gaining traction as consumers seek alternative consumption methods. The trend towards natural and organic products is also influencing the growth of Oils & Tinctures.

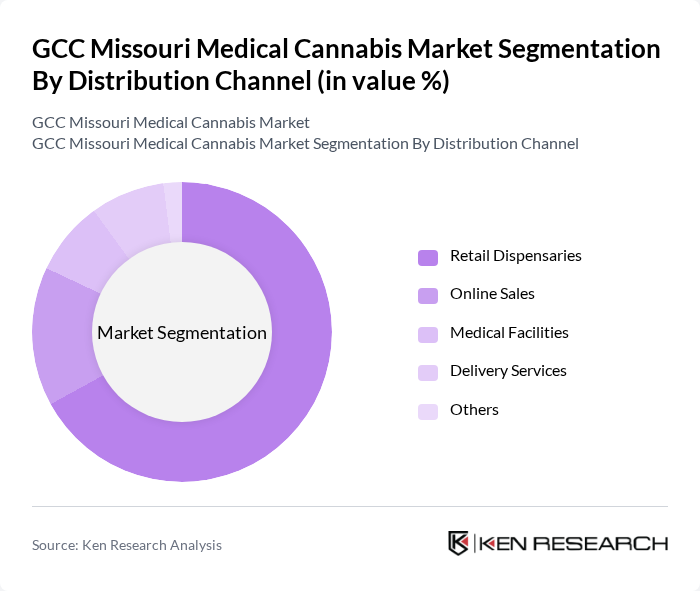

By Distribution Channel:The distribution channels for medical cannabis include Retail Dispensaries, Online Sales, Medical Facilities, Delivery Services, and Others. Retail Dispensaries are the leading channel, providing direct access to consumers and a wide range of products. Online Sales are increasingly popular due to convenience, while Medical Facilities play a crucial role in patient education and product recommendations. Delivery Services are also expanding, reflecting consumer demand for accessibility and privacy.

The GCC Missouri Medical Cannabis Market is characterized by a dynamic mix of regional and international players. Leading participants such as BeLeaf Medical, Blue Sage Cannabis Co., Show Me Alternatives, Heya Wellness, Missouri Wild Alchemy, Organic Remedies, Holistic Industries, Kansas City Cannabis, LOCAL Cannabis Company, MOcann Extracts, Curaleaf Holdings Inc., Green Thumb Industries, Cresco Labs, Trulieve Cannabis Corp., Harvest Health & Recreation Inc., MedMen Enterprises Inc., TerrAscend, Columbia Care Inc., Ayr Wellness, 4Front Ventures, Jushi Holdings, Planet 13 Holdings, The Flowr Corporation, TILT Holdings, Vireo Health International Inc., Liberty Health Sciences, Acreage Holdings contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Missouri medical cannabis market appears promising, driven by ongoing legislative support and increasing patient acceptance. As the market matures, innovations in product development and distribution channels are expected to enhance accessibility. Additionally, the integration of technology in cultivation and sales processes will likely streamline operations and improve product quality. Continued education and awareness campaigns will further reduce stigma, fostering a more inclusive environment for medical cannabis use in the state.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Flower Edibles Concentrates Oils & Tinctures Topicals Others |

| By Distribution Channel | Retail Dispensaries Online Sales Medical Facilities Delivery Services Others |

| By Consumer Demographics | Age Group Gender Income Level Geographic Location Others |

| By Therapeutic Use | Chronic Pain Management Anxiety and Depression Neurological Disorders (Epilepsy, Multiple Sclerosis, Parkinson's, Tourette’s) Cancer PTSD Others |

| By Packaging Type | Bottles Pouches Jars Blister Packs Others |

| By Brand Positioning | Premium Brands Value Brands Local Brands Others |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dispensary Operations | 60 | Dispensary Owners, Store Managers |

| Healthcare Provider Insights | 50 | Physicians, Nurse Practitioners |

| Consumer Attitudes | 120 | Potential Medical Cannabis Patients, Caregivers |

| Regulatory Perspectives | 40 | State Regulators, Compliance Officers |

| Market Trends Analysis | 45 | Market Analysts, Industry Experts |

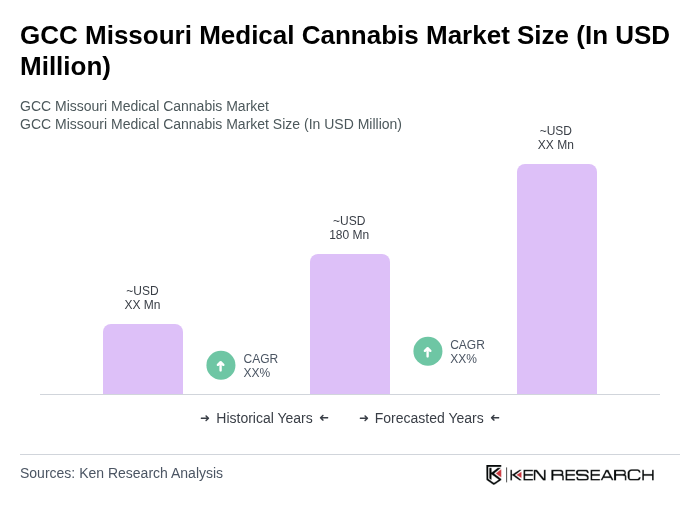

The GCC Missouri Medical Cannabis Market is valued at approximately USD 180 million, reflecting significant growth driven by increased patient acceptance, expanded access, and supportive research on the therapeutic benefits of medical cannabis.