Region:Middle East

Author(s):Shubham

Product Code:KRAE0427

Pages:85

Published On:December 2025

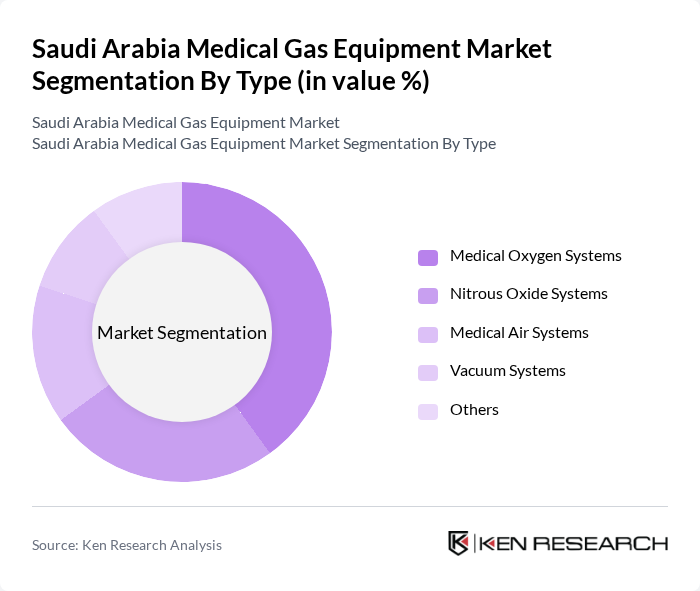

By Type:The market is segmented into various types of medical gas equipment, including Medical Oxygen Systems, Nitrous Oxide Systems, Medical Air Systems, Vacuum Systems, and Others. Among these, Medical Oxygen Systems dominate the market due to the increasing demand for oxygen therapy, particularly among the aging population and patients with chronic respiratory conditions. The growing number of surgical procedures also contributes to the rising need for these systems.

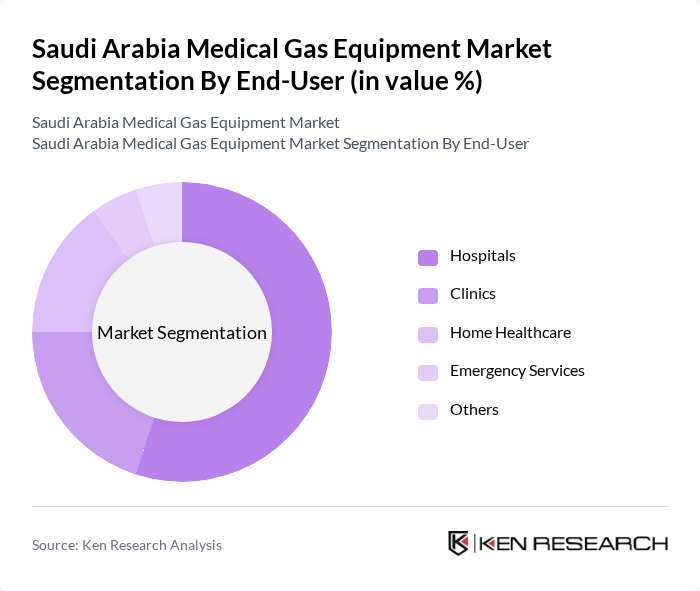

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare, Emergency Services, and Others. Hospitals are the leading end-users of medical gas equipment, driven by the increasing number of patients requiring surgical interventions and critical care. The expansion of healthcare facilities and the rising prevalence of chronic diseases further enhance the demand for medical gases in hospitals.

The Saudi Arabia Medical Gas Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Products and Chemicals, Inc., Linde Healthcare, Praxair, Inc., Messer Group, Air Liquide, BeaconMedaes, Matheson Tri-Gas, Inc., GCE Group, BOC Healthcare, AGA Medical Corporation, DME Medical, SMC Medical, Harsco Corporation, Caire Inc., Inogen, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia medical gas equipment market is poised for significant growth, driven by increasing healthcare investments and the rising prevalence of chronic diseases. As the government continues to enhance healthcare infrastructure, the demand for advanced medical gas solutions will likely escalate. Additionally, the integration of IoT technologies and a focus on patient safety will shape future developments, ensuring that healthcare providers can deliver high-quality care while adhering to stringent regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Medical Oxygen Systems Nitrous Oxide Systems Medical Air Systems Vacuum Systems Others |

| By End-User | Hospitals Clinics Home Healthcare Emergency Services Others |

| By Application | Anesthesia Respiratory Therapy Surgical Procedures Critical Care Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Traditional Systems Advanced Automated Systems Hybrid Systems Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Coordinators |

| Medical Gas Equipment Suppliers | 80 | Sales Directors, Product Managers |

| Healthcare Facilities (Clinics & Home Care) | 70 | Facility Managers, Healthcare Administrators |

| Regulatory Bodies and Associations | 50 | Policy Makers, Compliance Officers |

| Medical Professionals (Doctors & Nurses) | 90 | Doctors, Nursing Supervisors |

The Saudi Arabia Medical Gas Equipment Market is valued at approximately USD 155 million. This valuation reflects the growing demand for medical gases driven by an increase in chronic respiratory diseases and the expansion of healthcare infrastructure in the country.