Region:Middle East

Author(s):Rebecca

Product Code:KRAA5656

Pages:85

Published On:January 2026

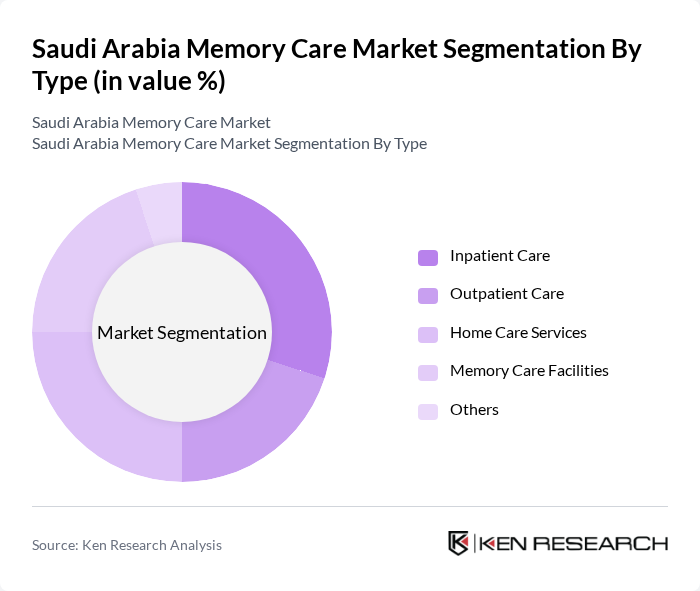

By Type:The memory care market is segmented into various types, including Inpatient Care, Outpatient Care, Home Care Services, Memory Care Facilities, and Others. Inpatient Care is often preferred for patients requiring constant supervision and specialized treatment, while Home Care Services are gaining traction due to the comfort and familiarity they provide. Memory Care Facilities are increasingly being developed to cater to the growing demand for dedicated spaces for individuals with memory impairments.

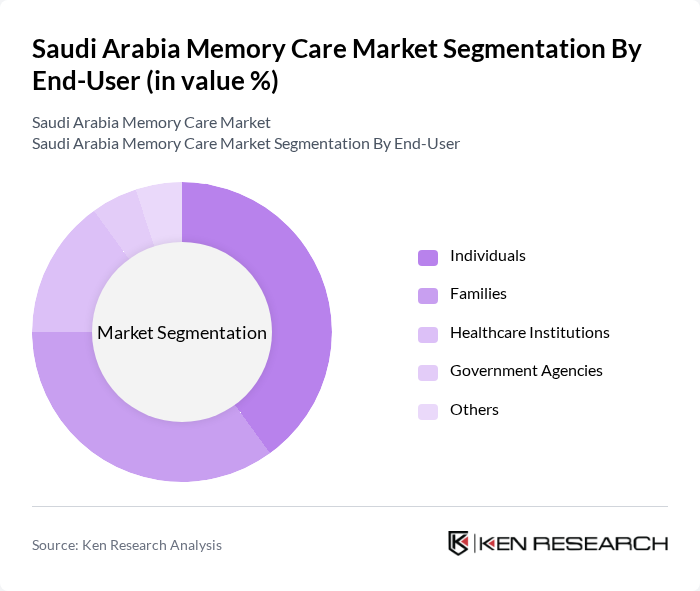

By End-User:The end-user segmentation includes Individuals, Families, Healthcare Institutions, Government Agencies, and Others. Individuals and Families are the primary users of memory care services, as they seek specialized care for their loved ones. Healthcare Institutions play a crucial role in providing professional care, while Government Agencies are involved in policy-making and funding for memory care initiatives.

The Saudi Arabia Memory Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Nahda, Al-Munirah, Al-Mawaddah, Al-Salam, Al-Hekma, Al-Faisal, Al-Jazeera, Al-Maarefa, Al-Mansour, Al-Riyadh, Al-Mahabba, Al-Bir, Al-Mawhiba, Al-Muhtadi, Al-Mu’min contribute to innovation, geographic expansion, and service delivery in this space.

The future of the memory care market in Saudi Arabia appears promising, driven by demographic changes and increased awareness of memory disorders. As the elderly population continues to grow, the demand for specialized care services will likely rise. Additionally, advancements in technology, such as telehealth and AI integration, are expected to enhance care delivery. The government's ongoing support for elderly care initiatives will further facilitate the development of innovative solutions, ensuring that the market adapts to the evolving needs of the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Inpatient Care Outpatient Care Home Care Services Memory Care Facilities Others |

| By End-User | Individuals Families Healthcare Institutions Government Agencies Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Service Model | Residential Care Day Care Services Respite Care Palliative Care Others |

| By Age Group | Young Adults (18-35) Middle-Aged Adults (36-55) Seniors (56 and above) Others |

| By Care Type | Cognitive Behavioral Therapy Medication Management Support Groups Others |

| By Funding Source | Private Funding Government Funding Insurance Coverage Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Memory Care Facilities | 45 | Facility Managers, Care Coordinators |

| Outpatient Memory Care Services | 40 | Healthcare Providers, Psychologists |

| Caregiver Support Programs | 35 | Caregivers, Social Workers |

| Government Health Initiatives | 30 | Policy Makers, Health Administrators |

| Research and Academic Institutions | 25 | Researchers, Academics in Geriatrics |

The Saudi Arabia Memory Care Market is valued at approximately USD 1.15 billion, reflecting a significant growth driven by the increasing prevalence of dementia and Alzheimer's disease, as well as heightened awareness of mental health issues among the population.