Region:Middle East

Author(s):Dev

Product Code:KRAB7789

Pages:91

Published On:October 2025

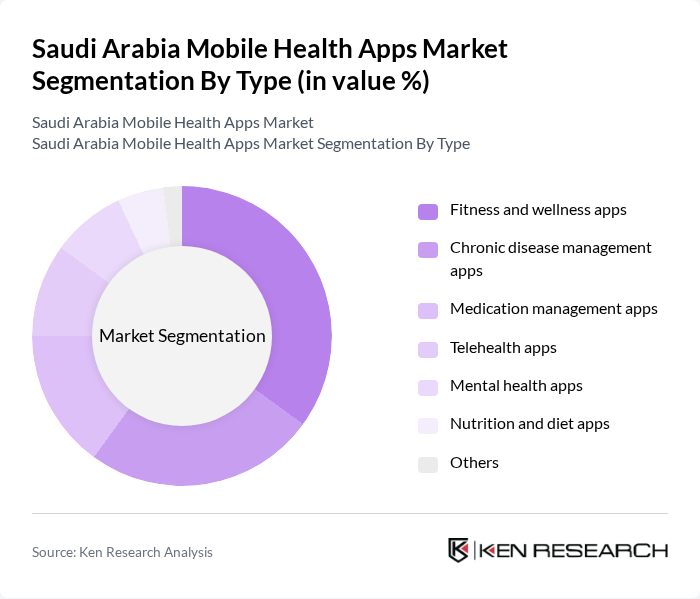

By Type:The mobile health apps market can be segmented into various types, including fitness and wellness apps, chronic disease management apps, medication management apps, telehealth apps, mental health apps, nutrition and diet apps, and others. Among these, fitness and wellness apps are currently leading the market due to the increasing focus on personal health and fitness, driven by a growing awareness of lifestyle diseases and the need for preventive healthcare. Chronic disease management apps are also gaining traction as they provide essential support for patients managing long-term health conditions.

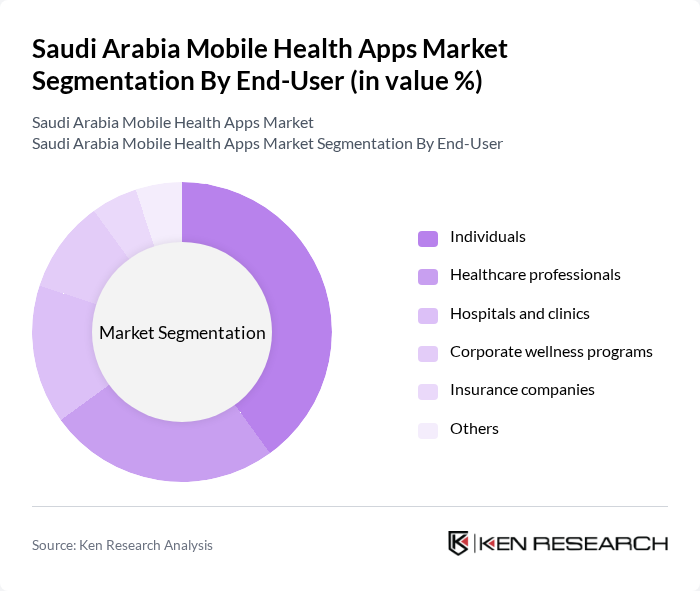

By End-User:The end-user segmentation includes individuals, healthcare professionals, hospitals and clinics, corporate wellness programs, insurance companies, and others. Individuals represent the largest segment, driven by the increasing consumer demand for health management tools and personalized health solutions. Healthcare professionals are also significant users, utilizing mobile health apps to enhance patient care and streamline their workflows. The corporate wellness programs segment is growing as companies recognize the importance of employee health and well-being.

The Saudi Arabia Mobile Health Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as HealthifyMe, MyFitnessPal, Clue, Medisafe, Headspace, Noom, CareClinic, WellDoc, DarioHealth, Omada Health, Talkspace, Zocdoc, Simple Habit, Lifesum, and BetterHelp contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mobile health apps market in Saudi Arabia appears promising, driven by technological advancements and increasing consumer demand for health management solutions. As the government continues to invest in digital health initiatives, the integration of AI and machine learning is expected to enhance app functionalities. Additionally, the growing trend towards preventive healthcare will likely encourage more users to adopt mobile health solutions, creating a vibrant ecosystem for innovation and collaboration among stakeholders in the healthcare sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness and wellness apps Chronic disease management apps Medication management apps Telehealth apps Mental health apps Nutrition and diet apps Others |

| By End-User | Individuals Healthcare professionals Hospitals and clinics Corporate wellness programs Insurance companies Others |

| By Application | Health monitoring Appointment scheduling Health education Remote consultations Others |

| By Distribution Channel | App stores Direct downloads from websites Partnerships with healthcare providers Corporate partnerships Others |

| By Pricing Model | Free apps Freemium apps Subscription-based apps One-time purchase apps Others |

| By User Demographics | Age groups Gender Income levels Geographic location Others |

| By Device Compatibility | iOS Android Web-based Wearable devices Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 100 | Doctors, Nurses, Health Administrators |

| Mobile Health App Users | 150 | Patients, Caregivers, Health Enthusiasts |

| App Developers | 80 | Software Engineers, Product Managers |

| Healthcare Policy Makers | 60 | Government Officials, Health Policy Analysts |

| Insurance Providers | 50 | Insurance Executives, Risk Managers |

The Saudi Arabia Mobile Health Apps Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by smartphone adoption, health awareness, and demand for remote healthcare solutions, particularly accelerated by the COVID-19 pandemic.