Region:Middle East

Author(s):Rebecca

Product Code:KRAC3309

Pages:88

Published On:October 2025

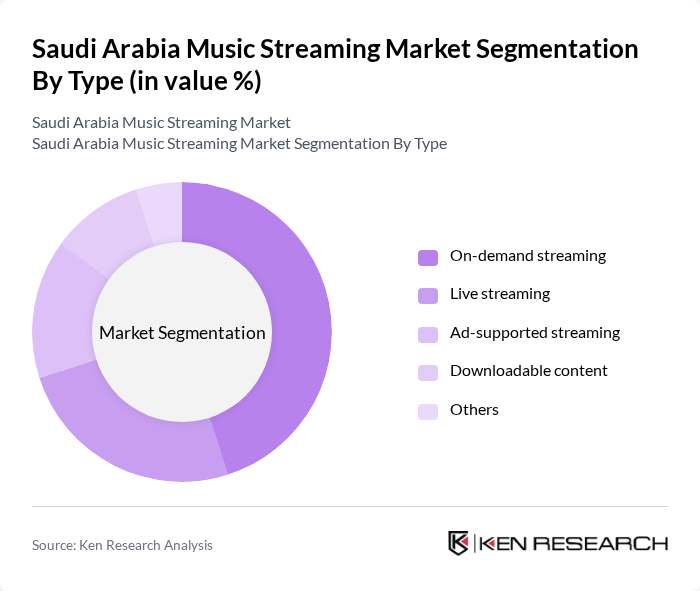

By Type:The market is segmented into on-demand streaming, live streaming, ad-supported streaming, downloadable content, and others. On-demand streaming is the most popular segment, driven by consumer preferences for personalized music experiences and instant access to large music libraries. Live streaming has gained traction, especially during concerts and virtual events, while ad-supported streaming appeals to users seeking free access to music. Downloadable content remains relevant for offline listening, particularly in regions with intermittent internet connectivity .

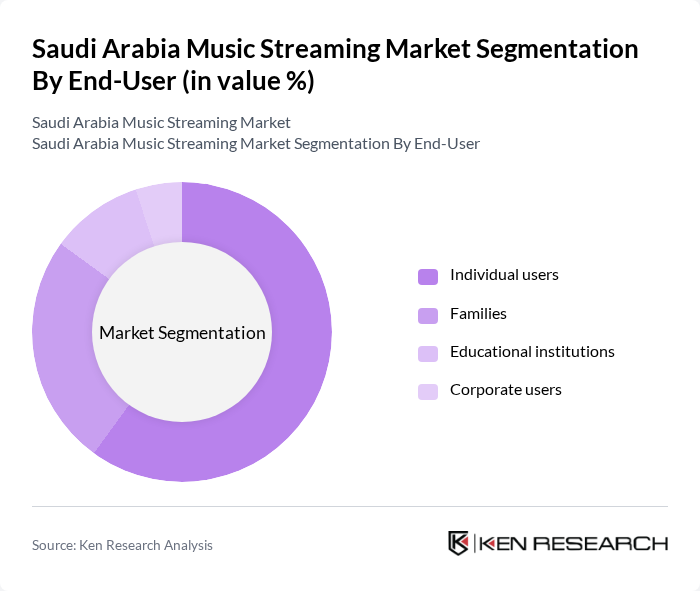

By End-User:The end-user segmentation includes individual users, families, educational institutions, and corporate users. Individual users dominate the market, driven by the widespread adoption of smartphones and the growing trend of personal music consumption. Families are increasingly subscribing to bundled family plans, while educational institutions utilize music streaming for educational and extracurricular activities. Corporate users leverage music streaming for employee engagement and event management .

The Saudi Arabia Music Streaming Market is characterized by a dynamic mix of regional and international players. Leading participants such as Anghami, Spotify, Apple Music, Deezer, YouTube Music, SoundCloud, Tidal, Mawal, Qobuz, Rotana Music, Shahid, MBC Group, STC (Saudi Telecom Company), Zain KSA, and Mobily contribute to innovation, geographic expansion, and service delivery in this space. These platforms compete by offering extensive content libraries, localized playlists, exclusive releases, and advanced personalization features .

The Saudi Arabia music streaming market is poised for significant growth, driven by technological advancements and changing consumer preferences. As the youth population continues to expand, the demand for personalized music experiences will increase. Additionally, the integration of artificial intelligence in music recommendations is expected to enhance user engagement. Streaming services that focus on exclusive content and collaborations with local artists will likely capture a larger market share, positioning themselves favorably in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | On-demand streaming Live streaming Ad-supported streaming Downloadable content Others |

| By End-User | Individual users Families Educational institutions Corporate users |

| By Genre | Pop Hip-hop Traditional Arabic music Rock Others |

| By Subscription Model | Monthly subscriptions Annual subscriptions Pay-per-use |

| By Device Type | Mobile devices Desktop computers Smart speakers Smart TVs |

| By Payment Method | Credit/debit cards Mobile wallets Bank transfers |

| By Region | Central Region Western Region Eastern Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Music Streaming Users | 120 | Music Consumers aged 18-35 |

| Industry Professionals | 60 | Music Producers, Artists, and Managers |

| Telecom Partnerships | 40 | Telecom Executives and Marketing Managers |

| Content Creators | 50 | Independent Musicians and Podcasters |

| Advertising Stakeholders | 40 | Marketing Directors and Brand Managers |

The Saudi Arabia Music Streaming Market is valued at approximately USD 700 million, reflecting significant growth driven by smartphone penetration, internet connectivity, and a shift towards subscription-based models among consumers.