Region:Middle East

Author(s):Rebecca

Product Code:KRAD4373

Pages:91

Published On:December 2025

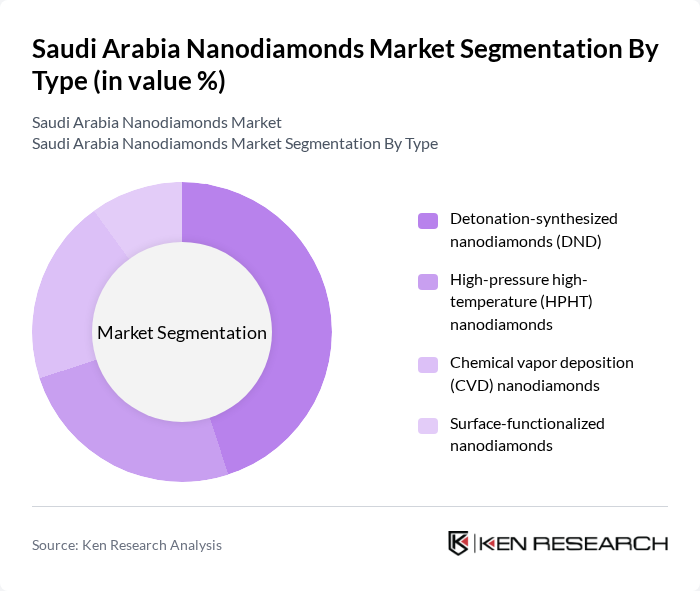

By Type:The nanodiamonds market can be segmented into four main types: Detonation-synthesized nanodiamonds (DND), High-pressure high-temperature (HPHT) nanodiamonds, Chemical vapor deposition (CVD) nanodiamonds, and Surface-functionalized nanodiamonds. Among these, Detonation-synthesized nanodiamonds (DND) are leading the market due to their cost-effectiveness and widespread application in polishing and biomedical fields. The increasing demand for high-quality abrasives and advanced drug delivery systems is driving the growth of this subsegment.

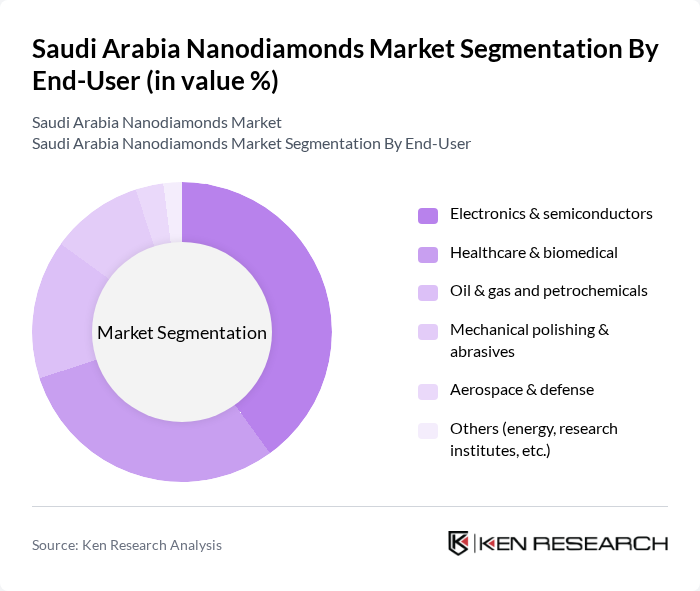

By End-User:The end-user segments for nanodiamonds include Electronics & semiconductors, Healthcare & biomedical, Oil & gas and petrochemicals, Mechanical polishing & abrasives, Aerospace & defense, and Others (energy, research institutes, etc.). The Electronics & semiconductors segment is currently the dominant end-user, driven by the increasing integration of nanodiamonds in electronic components and devices. The demand for high-performance materials in electronics is propelling this segment's growth.

The Saudi Arabia Nanodiamonds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Element Six (De Beers Group), Adámas Nanotechnologies, Microdiamant AG (now part of Pureon), Ray Techniques Ltd., NanoDiamond Products DAC, Henan Yuxing Sino-Crystal Micron Diamond Co., Ltd., Beijing Grish Hitech Co., Ltd., Nanjing Jinhong Chemical Co., Ltd. (nanodiamond dispersions), FND Biotech Inc. (fluorescent nanodiamonds), New Metals and Chemicals Corp. (Japan), Sumitomo Electric Industries, Ltd. (advanced diamond materials), Local Saudi distributors of nanodiamond powders and slurries, Research-focused suppliers to Saudi universities and R&D centers, Regional trading companies serving GCC nanomaterials demand, Emerging Saudi nanomaterials startups active in nanodiamonds contribute to innovation, geographic expansion, and service delivery in this space.

The future of the nanodiamonds market in Saudi Arabia appears promising, driven by increasing investments in research and development, particularly in nanotechnology. As industries recognize the benefits of nanodiamonds, their applications are expected to expand, particularly in electronics and healthcare. Furthermore, collaborations between private companies and academic institutions will likely foster innovation, leading to new product developments and enhanced production techniques, positioning Saudi Arabia as a key player in the global nanodiamonds market.

| Segment | Sub-Segments |

|---|---|

| By Type | Detonation-synthesized nanodiamonds (DND) High-pressure high-temperature (HPHT) nanodiamonds Chemical vapor deposition (CVD) nanodiamonds Surface-functionalized nanodiamonds |

| By End-User | Electronics & semiconductors Healthcare & biomedical Oil & gas and petrochemicals Mechanical polishing & abrasives Aerospace & defense Others (energy, research institutes, etc.) |

| By Application | Polishing and lapping compounds Coatings and surface treatments Drug delivery and bioimaging Lubricant additives Sensors and quantum devices Others |

| By Distribution Channel | Direct sales to industrial end users Local distributors and agents Online specialty chemical platforms International trading houses |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam/Jubail) Western Region (including Jeddah/Makkah/Madina) Southern & Northern Regions |

| By Production Method | Imported finished nanodiamond powders Local detonation synthesis Local HPHT/CVD-based production Toll processing and dispersion services |

| By Pricing Model | Contract-based pricing with volume commitments Spot pricing for small lots Long-term supply agreements indexed to input costs Value-added pricing for functionalized products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electronics Industry Applications | 100 | Product Development Managers, Electronics Engineers |

| Healthcare Sector Utilization | 80 | Biomedical Researchers, Healthcare Product Managers |

| Industrial Applications of Nanodiamonds | 70 | Manufacturing Engineers, Operations Managers |

| Research and Development Insights | 60 | R&D Directors, Innovation Managers |

| Market Trends and Consumer Insights | 90 | Market Analysts, Business Development Executives |

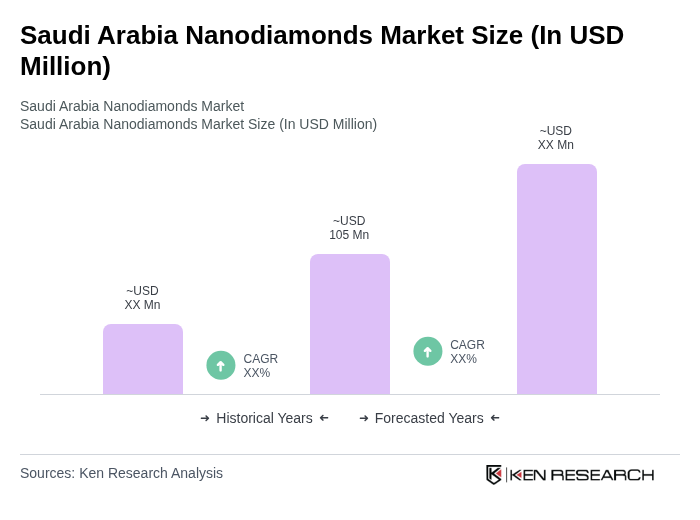

The Saudi Arabia Nanodiamonds Market is valued at approximately USD 105 million, reflecting a five-year historical analysis. This growth is driven by increasing demand across various sectors, including electronics, healthcare, and advanced materials.