Region:Middle East

Author(s):Shubham

Product Code:KRAD6741

Pages:94

Published On:December 2025

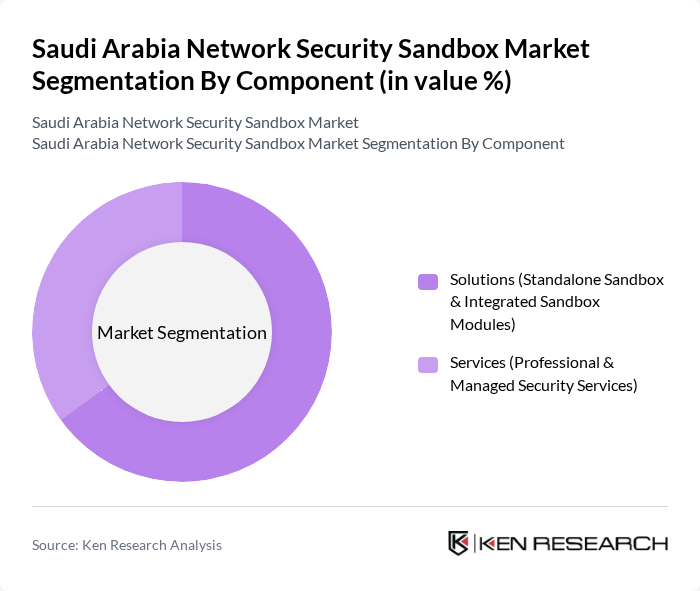

By Component:The components of the Saudi Arabia Network Security Sandbox Market include solutions and services. The solutions segment is further divided into standalone sandboxes and integrated sandbox modules, while the services segment encompasses professional and managed security services. The solutions segment is currently leading the market due to the increasing demand for advanced threat detection and response capabilities. Organizations are increasingly adopting integrated sandbox modules that provide comprehensive security solutions, enabling them to effectively combat sophisticated cyber threats.

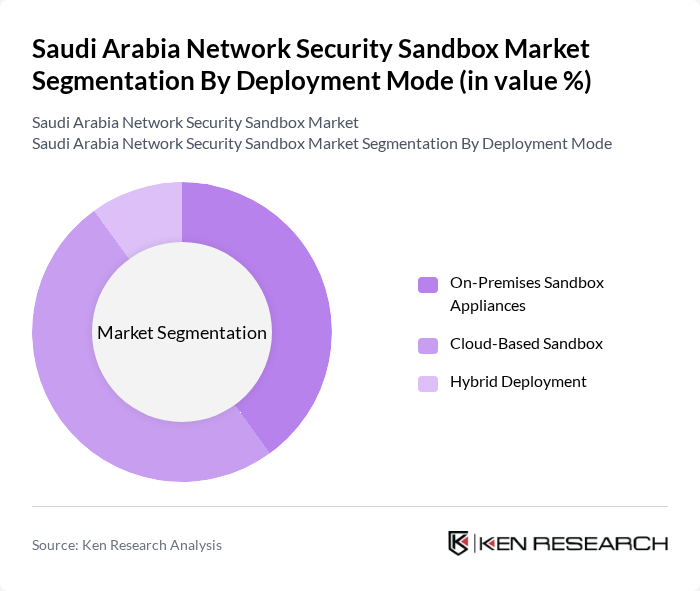

By Deployment Mode:The deployment modes in the Saudi Arabia Network Security Sandbox Market include on-premises sandbox appliances, cloud-based sandboxes, and hybrid deployment. The cloud-based sandbox segment is gaining traction due to its scalability and cost-effectiveness, allowing organizations to quickly adapt to changing security needs. On-premises solutions remain popular among large enterprises that prioritize data control and compliance, while hybrid deployments are increasingly favored for their flexibility in managing security across various environments.

The Saudi Arabia Network Security Sandbox Market is characterized by a dynamic mix of regional and international players. Leading participants such as Palo Alto Networks, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., Cisco Systems, Inc., Trend Micro Incorporated, Trellix (formerly McAfee Enterprise & FireEye), CrowdStrike Holdings, Inc., Darktrace plc, Kaspersky Lab, Broadcom Inc. (Symantec Enterprise Security), Juniper Networks, Inc., Huawei Technologies Co., Ltd., STC Solutions (Saudi Telecom Company), Cyberani (Saudi Information Technology Company), Sirar by stc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia network security sandbox market appears promising, driven by ongoing digital transformation and increasing cybersecurity threats. As organizations prioritize security, the integration of advanced technologies such as artificial intelligence and machine learning will enhance threat detection capabilities. Furthermore, collaboration with international cybersecurity firms is expected to bolster local expertise and innovation, fostering a more resilient cybersecurity landscape. This evolving environment will likely create new avenues for growth and investment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Component | Solutions (Standalone Sandbox & Integrated Sandbox Modules) Services (Professional & Managed Security Services) |

| By Deployment Mode | On-Premises Sandbox Appliances Cloud-Based Sandbox Hybrid Deployment |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Application / Use Case | Advanced Threat Protection for Email & Web Gateways Zero-Day Malware & Ransomware Detection Network Traffic Analysis & Intrusion Detection Cloud & SaaS Security |

| By Industry Vertical | Banking, Financial Services & Insurance (BFSI) Government & Public Sector Energy & Utilities (including Oil & Gas) IT & Telecom Healthcare Retail & E?Commerce Manufacturing & Industrial |

| By Channel / Procurement Model | Direct Enterprise Sales Through Local System Integrators & MSPs Through Telecom Operators & Cloud Service Providers |

| By Region (Within Saudi Arabia) | Central Region (Riyadh) Western Region (Jeddah, Makkah, Madinah) Eastern Province (Dammam, Dhahran, Al Khobar) Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Network Security | 120 | IT Security Managers, Compliance Officers |

| Healthcare Cybersecurity Solutions | 90 | Chief Information Officers, IT Directors |

| Telecommunications Security Measures | 80 | Network Security Engineers, Operations Managers |

| Government Cybersecurity Initiatives | 60 | Policy Makers, Cybersecurity Analysts |

| SME Network Security Practices | 70 | Business Owners, IT Consultants |

The Saudi Arabia Network Security Sandbox Market is valued at approximately USD 110 million, reflecting a significant investment in cybersecurity solutions driven by increasing cyber threats and the need for advanced security measures across various sectors.