Region:Middle East

Author(s):Geetanshi

Product Code:KRAE0636

Pages:88

Published On:December 2025

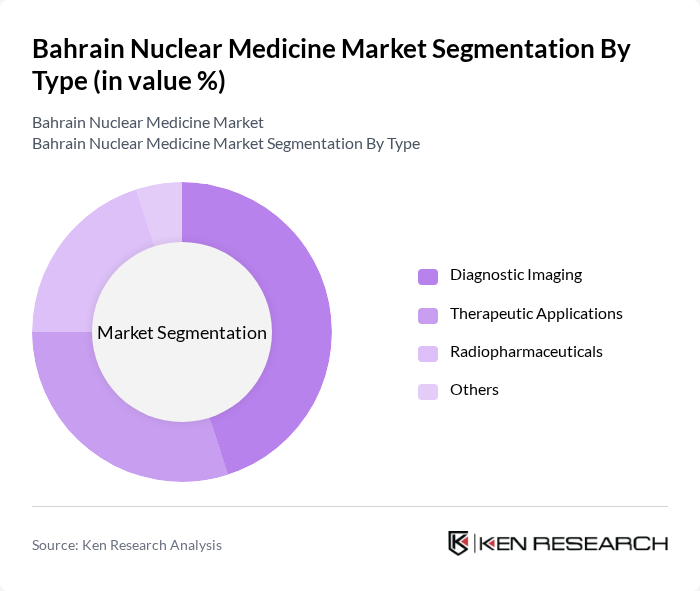

By Type:The nuclear medicine market in Bahrain is segmented into various types, including diagnostic imaging, therapeutic applications, radiopharmaceuticals, and others. Among these, diagnostic imaging is the leading sub-segment, driven by the rising demand for early disease detection and the growing adoption of advanced imaging technologies. The increasing prevalence of chronic diseases necessitates accurate diagnostic tools, making this segment crucial for healthcare providers.

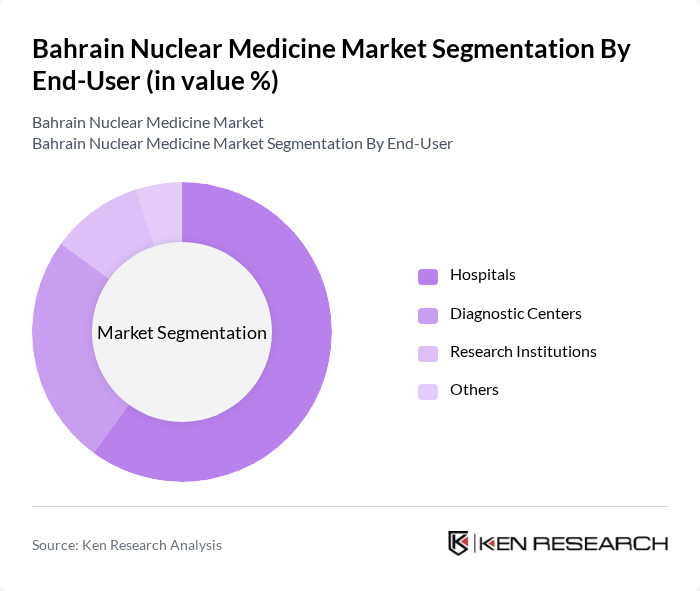

By End-User:The end-user segmentation of the nuclear medicine market includes hospitals, diagnostic centers, research institutions, and others. Hospitals dominate this segment due to their comprehensive healthcare services and the increasing number of patients requiring nuclear medicine procedures. The integration of nuclear medicine into hospital settings enhances patient care and facilitates advanced treatment options.

The Bahrain Nuclear Medicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Radiopharmaceuticals, Gulf Nuclear Medicine, Bahrain Medical Imaging, Almoayed Technologies, Bahrain Oncology Center, Gulf Health Council, Bahrain National Health Authority, Bahrain Institute of Radiology, Bahrain Medical Services, Bahrain Health Ministry, Bahrain Nuclear Research Center, Bahrain University Medical Center, Bahrain Specialized Hospital, Bahrain Health Network, Bahrain Radiology Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the nuclear medicine market in Bahrain appears promising, driven by ongoing advancements in technology and increasing healthcare investments. As the government continues to enhance healthcare infrastructure, the integration of innovative imaging techniques and therapies will likely improve patient outcomes. Furthermore, the growing emphasis on personalized medicine and targeted therapies will create new avenues for development, ensuring that nuclear medicine remains a vital component of Bahrain's healthcare landscape in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Imaging Therapeutic Applications Radiopharmaceuticals Others |

| By End-User | Hospitals Diagnostic Centers Research Institutions Others |

| By Application | Oncology Cardiology Neurology Others |

| By Technology | PET Imaging SPECT Imaging Hybrid Imaging Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Northern Governorate Southern Governorate Capital Governorate Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nuclear Medicine Procedures | 100 | Nuclear Medicine Physicians, Radiologists |

| Healthcare Facility Administrators | 80 | Hospital Administrators, Health Services Managers |

| Medical Equipment Suppliers | 60 | Sales Managers, Product Specialists |

| Patient Experience in Nuclear Medicine | 75 | Patients, Caregivers |

| Regulatory Compliance in Nuclear Medicine | 50 | Regulatory Affairs Specialists, Compliance Officers |

The Bahrain Nuclear Medicine Market is valued at approximately USD 320 million, reflecting a significant growth trend driven by the rising prevalence of chronic diseases and government investments in advanced diagnostic technologies.