Region:Middle East

Author(s):Rebecca

Product Code:KRAB0905

Pages:93

Published On:December 2025

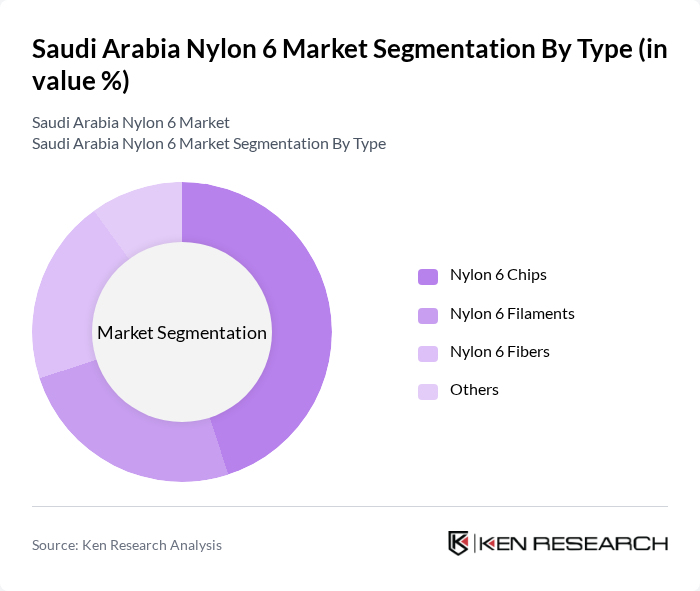

By Type:The market is segmented into various types, including Nylon 6 Chips, Nylon 6 Filaments, Nylon 6 Fibers, and Others. Among these, Nylon 6 Chips dominate the market due to their extensive use in the automotive and electronics industries, where they are favored for their strength and versatility. The demand for Nylon 6 Filaments and Fibers is also significant, particularly in textiles and industrial applications, but they do not match the volume of chips.

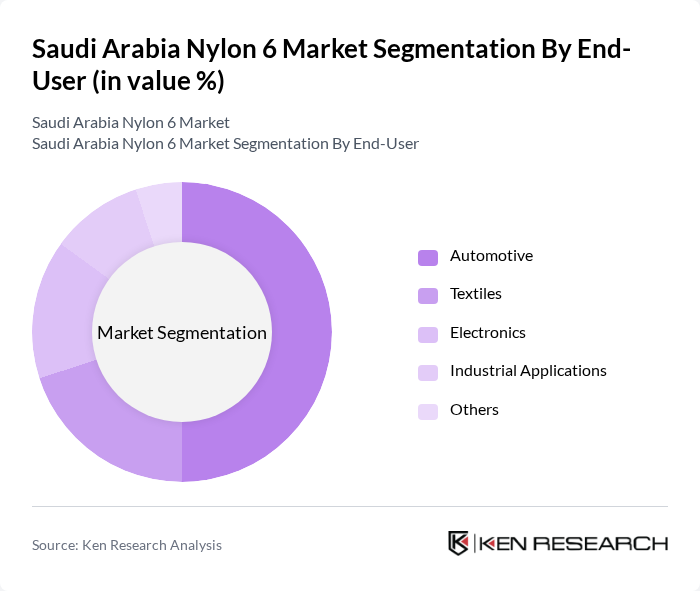

By End-User:The end-user segmentation includes Automotive, Textiles, Electronics, Industrial Applications, and Others. The automotive sector is the leading end-user, driven by the increasing adoption of lightweight materials to enhance fuel efficiency. Textiles and electronics also represent significant segments, but the automotive industry remains the primary driver of growth in the Nylon 6 market.

The Saudi Arabia Nylon 6 Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Alujain Corporation, National Industrialization Company (Tasnee), Advanced Petrochemical Company, Saudi Arabian Oil Company (Saudi Aramco), Petro Rabigh, Saudi Kayan Petrochemical Company, Al-Falak Electronic Equipment & Supplies, Al-Hokair Group, Al-Muhaidib Group, Gulf Plastic Industries, Al-Jomaih Group, Al-Suwaidi Industrial Services, Al-Babtain Group, Al-Mansour Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia Nylon 6 market appears promising, driven by trends in smart manufacturing and sustainability. The ongoing transition to Industry 4.0, with over **4,000 factories** targeted for automation, is expected to enhance production efficiency and material demand. Additionally, the focus on green projects, including the world's largest green hydrogen initiative, will likely create new applications for Nylon 6, particularly in environmentally friendly products and electric vehicle components, fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Nylon 6 Chips Nylon 6 Filaments Nylon 6 Fibers Others |

| By End-User | Automotive Textiles Electronics Industrial Applications Others |

| By Application | Injection Molding Extrusion Blow Molding Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Product Form | Granules Sheets Films Others |

| By End-User Industry | Consumer Goods Healthcare Construction Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nylon 6 Manufacturers | 100 | Production Managers, Operations Directors |

| Textile Industry Users | 80 | Product Development Managers, Procurement Officers |

| Automotive Component Suppliers | 70 | Supply Chain Managers, Quality Assurance Heads |

| Packaging Sector Stakeholders | 60 | Marketing Managers, R&D Specialists |

| Regulatory Bodies and Associations | 50 | Policy Makers, Industry Analysts |

The Saudi Arabia Nylon 6 market is valued at approximately USD 80 million, driven by increasing demand from sectors such as automotive, construction, and electronics, supported by cost-competitive hydrocarbon feedstocks.