Region:Middle East

Author(s):Shubham

Product Code:KRAB8266

Pages:86

Published On:October 2025

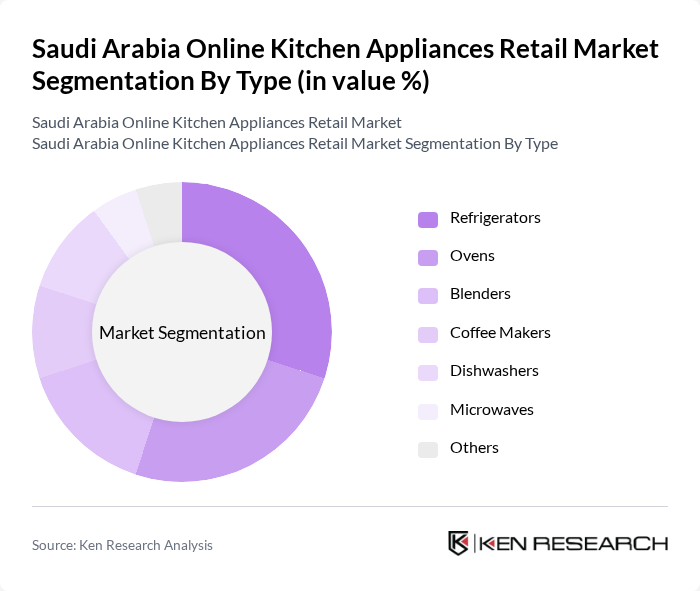

By Type:The market is segmented into various types of kitchen appliances, including refrigerators, ovens, blenders, coffee makers, dishwashers, microwaves, and others. Among these, refrigerators and ovens are the most popular due to their essential roles in food preservation and cooking. The demand for smart appliances is also on the rise, reflecting changing consumer preferences towards technology integration in kitchen solutions.

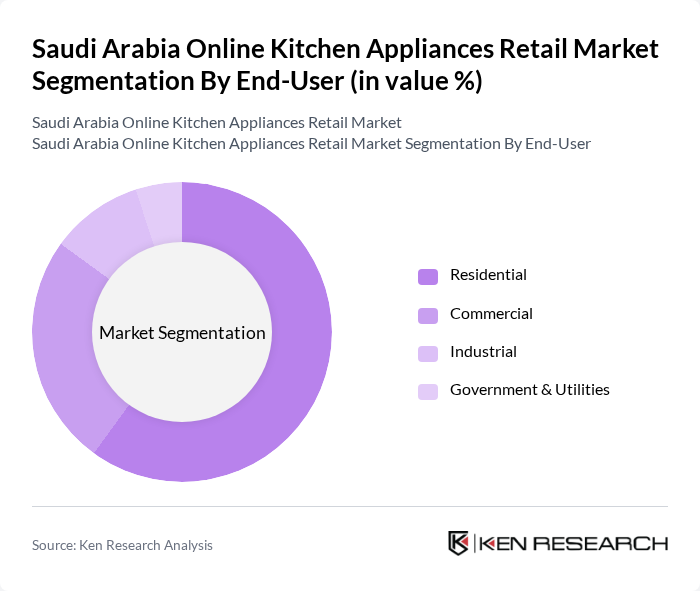

By End-User:The end-user segmentation includes residential, commercial, industrial, and government & utilities. The residential segment dominates the market, driven by the increasing number of households and the growing trend of home cooking. Commercial establishments, such as restaurants and cafes, also contribute significantly to the demand for kitchen appliances, particularly for high-capacity and durable products.

The Saudi Arabia Online Kitchen Appliances Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Group, Carrefour, LuLu Hypermarket, Jarir Bookstore, Extra Stores, Home Centre, IKEA, Sharaf DG, Souq.com, Amazon.sa, Al-Muhaidib Group, Al-Jazira Equipment Co., Al-Hokair Group, Al-Mansour Group, Al-Babtain Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online kitchen appliances market in Saudi Arabia appears promising, driven by technological advancements and changing consumer preferences. The integration of smart technology in appliances is expected to enhance user experience, while the growing trend of home cooking will further boost demand. Retailers are likely to focus on enhancing their online platforms and customer engagement strategies to capture the evolving market. Sustainability will also play a crucial role, as consumers increasingly seek eco-friendly options in their kitchen appliances.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators Ovens Blenders Coffee Makers Dishwashers Microwaves Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Sales Channel | Online Retail Direct Sales Third-party Marketplaces Others |

| By Price Range | Budget Mid-range Premium |

| By Brand | Local Brands International Brands Private Labels |

| By Distribution Mode | Home Delivery In-store Pickup Same-day Delivery |

| By Product Features | Smart Features Energy Efficiency Design Aesthetics Warranty and Service |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Kitchen Appliance Retailers | 100 | Retail Managers, E-commerce Directors |

| Consumer Purchase Behavior | 150 | Online Shoppers, Household Decision Makers |

| Market Trends and Insights | 80 | Industry Analysts, Market Researchers |

| Logistics and Supply Chain | 70 | Supply Chain Managers, Distribution Coordinators |

| Product Development and Innovation | 60 | Product Managers, R&D Specialists |

The Saudi Arabia Online Kitchen Appliances Retail Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased e-commerce adoption, rising disposable incomes, and a preference for smart kitchen appliances among consumers.