Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7508

Pages:87

Published On:October 2025

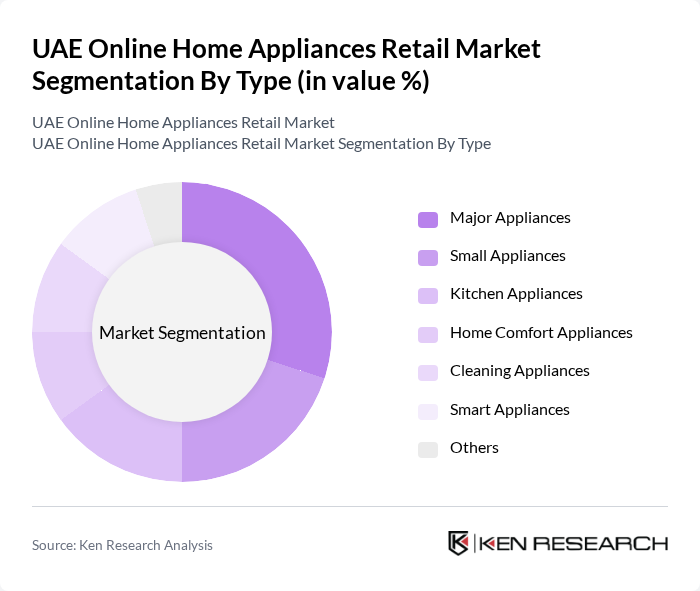

By Type:The market is segmented into various types of appliances, including Major Appliances, Small Appliances, Kitchen Appliances, Home Comfort Appliances, Cleaning Appliances, Smart Appliances, and Others. Each of these segments caters to different consumer needs and preferences, with smart appliances gaining significant traction due to technological advancements and consumer interest in automation.

The Major Appliances segment is currently dominating the market, driven by the increasing demand for refrigerators, washing machines, and air conditioners. Consumers are investing in high-quality, durable products that offer energy efficiency and advanced features. The trend towards home improvement and renovation has also contributed to the growth of this segment, as consumers seek to upgrade their existing appliances.

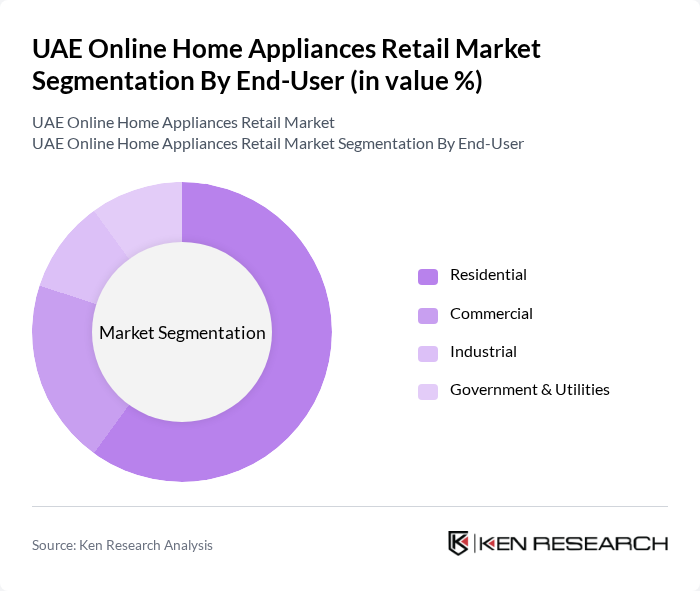

By End-User:The market is segmented into Residential, Commercial, Industrial, and Government & Utilities. Each segment has distinct requirements and purchasing behaviors, with the residential segment being the largest due to the growing trend of home automation and the increasing number of households in the UAE.

The Residential segment is leading the market, fueled by the increasing number of households and the rising disposable income of consumers. Homeowners are increasingly investing in modern appliances that enhance convenience and energy efficiency, driving the demand for various home appliances.

The UAE Online Home Appliances Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carrefour, Sharaf DG, LuLu Hypermarket, Emax Electronics, Jumbo Electronics, Home Centre, Al-Futtaim Electronics, Amazon.ae, Noon.com, Carrefour UAE, Sharaf DG Online, Emax Online, LuLu Online, Home Appliances Online, Al-Futtaim Online contribute to innovation, geographic expansion, and service delivery in this space.

The UAE online home appliances market is poised for significant transformation in the coming years, driven by technological advancements and evolving consumer preferences. As smart home technology gains traction, retailers will increasingly offer connected appliances that enhance convenience and energy efficiency. Additionally, the focus on sustainability will shape product offerings, with consumers seeking eco-friendly options. These trends will likely redefine the competitive landscape, compelling retailers to innovate and adapt to meet the changing demands of the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Major Appliances Small Appliances Kitchen Appliances Home Comfort Appliances Cleaning Appliances Smart Appliances Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Sales Channel | E-commerce Platforms Brand Websites Third-party Retailers Social Media Marketplaces |

| By Price Range | Budget Mid-range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers First-time Buyers |

| By Product Features | Energy-efficient Appliances Smart Technology Integration Design and Aesthetics |

| By Customer Demographics | Age Group Income Level Family Size |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Retailers of Home Appliances | 150 | eCommerce Managers, Marketing Directors |

| Consumer Insights on Appliance Purchases | 200 | Homeowners, Renters, First-time Buyers |

| Distribution Channels for Home Appliances | 100 | Supply Chain Managers, Logistics Coordinators |

| Market Trends in Smart Appliances | 80 | Product Development Managers, Technology Analysts |

| Customer Service and Support in Retail | 120 | Customer Service Representatives, Operations Managers |

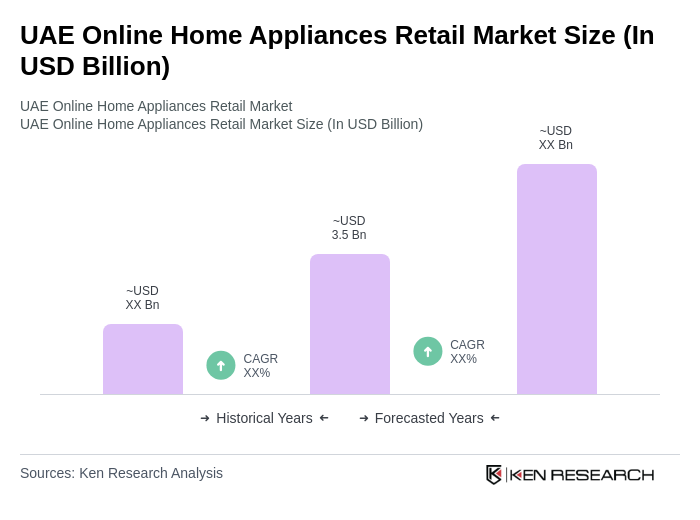

The UAE Online Home Appliances Retail Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by increased e-commerce adoption, rising disposable incomes, and a preference for smart home technologies among consumers.