Region:Middle East

Author(s):Rebecca

Product Code:KRAD5054

Pages:84

Published On:December 2025

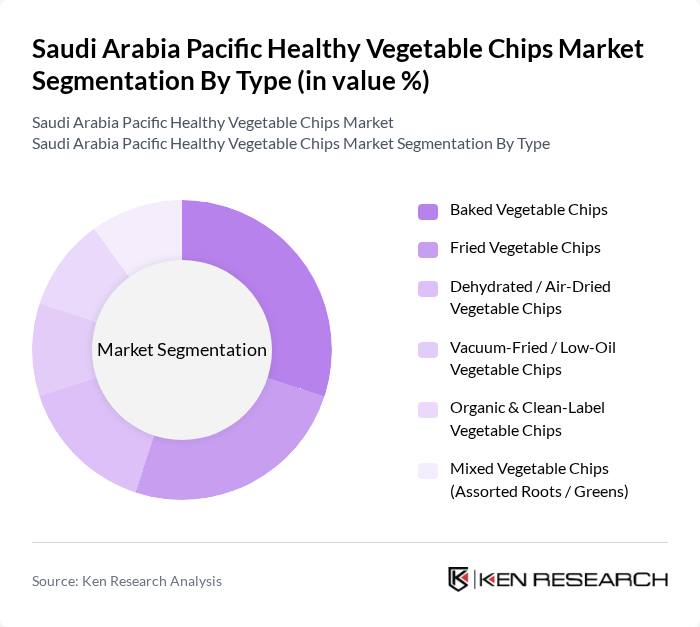

By Type:The market is segmented into various types of vegetable chips, including Baked Vegetable Chips, Fried Vegetable Chips, Dehydrated / Air-Dried Vegetable Chips, Vacuum-Fried / Low-Oil Vegetable Chips, Organic & Clean-Label Vegetable Chips, and Mixed Vegetable Chips (Assorted Roots / Greens). This structure is consistent with global vegetable chips and non?potato veggie chips categorization, where products are differentiated by processing method and positioning (baked, vacuum-fried, organic, clean label). Among these, Baked Vegetable Chips are gaining popularity due to their perceived health benefits and lower fat content, appealing to health-conscious consumers, reflecting the broader global preference for lower-fat, baked, and better-for-you snacks.

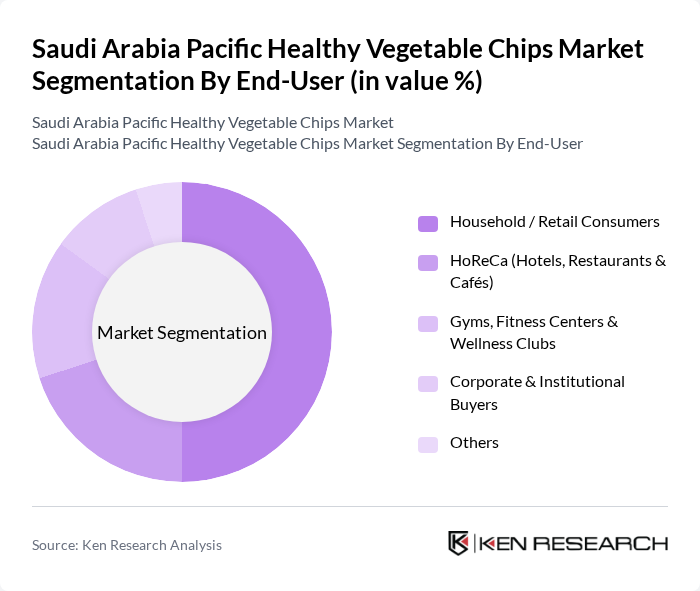

By End-User:The end-user segmentation includes Household / Retail Consumers, HoReCa (Hotels, Restaurants & Cafés), Gyms, Fitness Centers & Wellness Clubs, Corporate & Institutional Buyers, and Others. This breakdown aligns with typical demand-side structures observed in snacks and fruits & vegetable chips markets, where retail consumers account for the majority of sales and foodservice and institutional channels form secondary demand pools. The Household / Retail Consumers segment is the largest, driven by the increasing trend of healthy snacking at home, the penetration of better-for-you snack brands into supermarkets, hypermarkets, convenience stores, and online grocery platforms, and growing awareness of clean-label and plant-based snack options.

The Saudi Arabia Pacific Healthy Vegetable Chips Market is characterized by a dynamic mix of regional and international players. Leading participants such as PepsiCo, Inc. (Lay’s, Sunbites), The Kellogg Company (Pringles, wholesome snacks portfolio), Calbee, Inc., Bare Snacks (A PepsiCo Brand), Terra Chips (The Hain Celestial Group, Inc.), Rhythm Superfoods, LLC, Eat Real (Vegan & Gluten-Free Snacks), Simply 7 Snacks, Local Private Label Brands (e.g., Tamimi Markets, Carrefour Saudi, Lulu Hypermarket), Al Rifai International Holding Ltd., Hunter Foods LLC, Indofood / Chitato & Regional Asian Veggie Snack Exporters, Local Saudi Healthy Snack Start-Ups (e.g., Bold, Najla’s, Nabati), Import & Distribution Companies (e.g., Arabian Trading Supplies, Abu Dawood Trading), Online-First Healthy Snack Retailers & Marketplaces (e.g., Nana, HungerStation, Jahez – health snack assortments) contribute to innovation, geographic expansion, and service delivery in this space. Many of these brands are active across the broader fruits and vegetable chips and better-for-you snacks categories in the Middle East, focusing on baked, vacuum-fried, organic, and clean-label product lines tailored to regional tastes.

The future of the Saudi Arabia Pacific Healthy Vegetable Chips market appears promising, driven by a sustained focus on health and wellness among consumers. As the market adapts to evolving consumer preferences, innovations in product offerings and marketing strategies will play a crucial role. The anticipated growth in e-commerce and the introduction of organic variants are expected to further enhance market dynamics, providing brands with opportunities to engage new demographics and expand their reach effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Baked Vegetable Chips Fried Vegetable Chips Dehydrated / Air-Dried Vegetable Chips Vacuum-Fried / Low-Oil Vegetable Chips Organic & Clean-Label Vegetable Chips Mixed Vegetable Chips (Assorted Roots / Greens) |

| By End-User | Household / Retail Consumers HoReCa (Hotels, Restaurants & Cafés) Gyms, Fitness Centers & Wellness Clubs Corporate & Institutional Buyers Others |

| By Packaging Type | Stand-Up Pouches Resealable Bags Bulk / Foodservice Packs Single-Serve / On-the-Go Packs Premium / Gift & Multipacks |

| By Distribution Channel | Supermarkets / Hypermarkets Convenience Stores & Baqalas Specialty Health & Organic Stores Online Grocery & E-commerce Platforms Pharmacies & Nutrition Stores |

| By Flavor Profile | Spicy (e.g., Chili, Paprika) Savory (e.g., Salted, Herb, Cheese) Sweet (e.g., Honey, Date, Cinnamon) Middle Eastern & Local Flavors (e.g., Za’atar, Sumac, Kabsa-Inspired) Mixed & Exotic Flavors |

| By Region | Central Region (incl. Riyadh) Eastern Region (incl. Dammam, Al Khobar) Western Region (incl. Jeddah, Makkah, Madinah) Southern Region |

| By Consumer Demographics | Age Group (Children, Youth, Adults, Seniors) Income Level (Low, Middle, High) Lifestyle (Health-Conscious, Weight-Management, Sports & Fitness, Casual Snackers) Nationality (Saudi Nationals, Expatriates) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 120 | Store Managers, Category Buyers |

| Consumer Preferences Survey | 150 | Health-conscious Consumers, Snack Enthusiasts |

| Distribution Channel Analysis | 100 | Distributors, Wholesalers |

| Health and Nutrition Expert Opinions | 60 | Dietitians, Nutritionists |

| Market Trend Analysis | 80 | Market Analysts, Industry Experts |

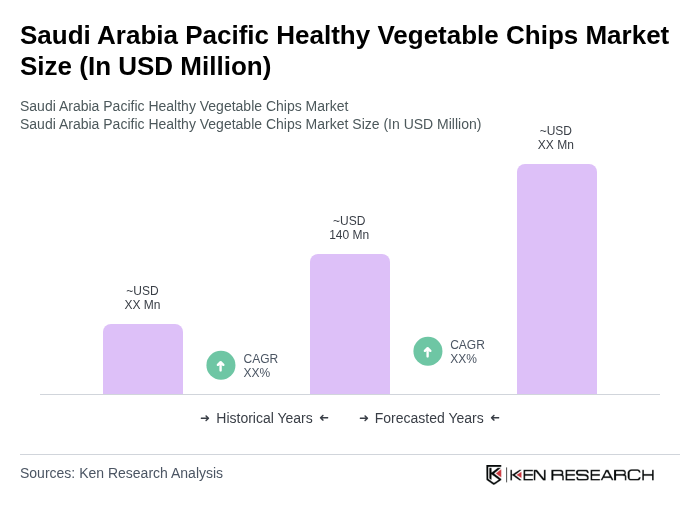

The Saudi Arabia Pacific Healthy Vegetable Chips Market is valued at approximately USD 140 million, reflecting a growing trend towards healthier snacking options among consumers in the region.