Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4153

Pages:91

Published On:December 2025

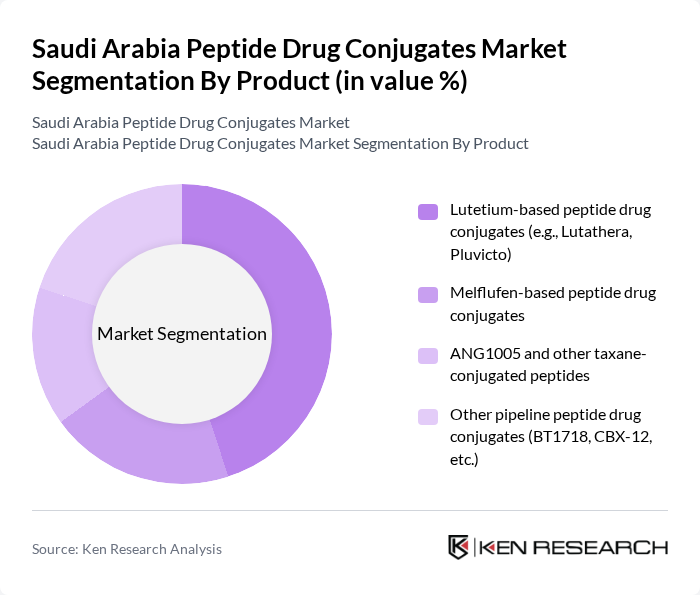

By Product:The product segmentation includes various types of peptide drug conjugates that cater to different therapeutic needs. Radiolabeled, lutetium-177–based peptide drug conjugates constitute the dominant sub-segment in the Saudi context, as agents such as lutetium-177–DOTATATE and related radioligand therapies are widely used in oncology for neuroendocrine tumors and prostate cancer due to their targeted delivery mechanisms and effectiveness in treating specific tumor types. Melflufen-based peptide drug conjugates, exemplified by melphalan flufenamide (Pepaxto/PepaxTO), have shown clinical utility in hematologic malignancies globally, although their availability and use have been more limited and subject to evolving regulatory decisions in major markets. The market is witnessing a growing interest in ANG1005 (paclitaxel trevatide) and other taxane-conjugated peptides in the global pipeline, which are being explored for their potential in treating various solid tumors, including breast and brain cancers. Other pipeline peptide drug conjugates such as BT1718 and CBX?12 are in clinical development internationally, indicating a robust global pipeline that is expected to progressively influence availability and clinical research opportunities in Saudi Arabia as partnerships and technology transfers expand.

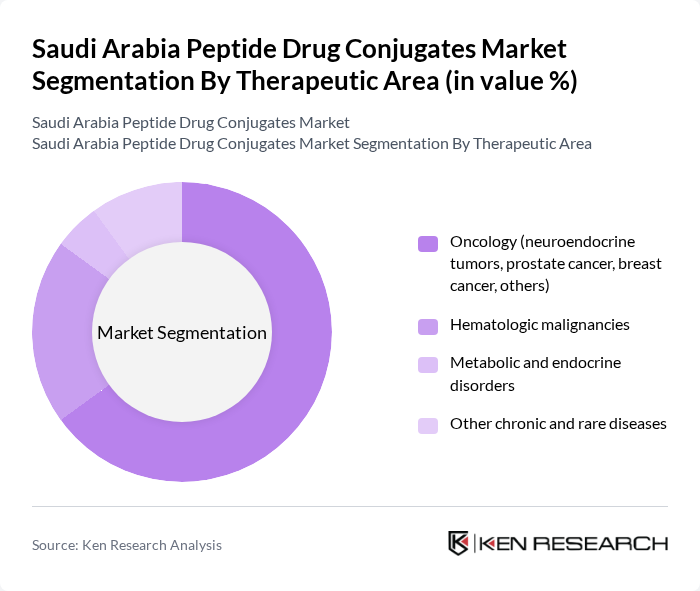

By Therapeutic Area:The therapeutic area segmentation highlights the various medical conditions addressed by peptide drug conjugates. Oncology is the leading therapeutic area, driven by the increasing incidence of cancer in Saudi Arabia and the need for targeted therapies that can deliver cytotoxic or radiolabeled payloads directly to tumor cells. Within oncology, neuroendocrine tumors and metastatic castration?resistant prostate cancer are key focus indications for lutetium-based radioligand PDCs, while breast and other solid tumors remain priority areas for peptide?based conjugate development. Hematologic malignancies are also a crucial segment, with peptide drug conjugates and peptide?linked cytotoxics showing promising results in multiple myeloma and other blood cancers in global clinical studies. Additionally, metabolic and endocrine disorders and other chronic diseases are emerging as important exploratory therapeutic areas for peptide-based conjugates, reflecting the broader recognition of peptide platforms in managing chronic and rare conditions beyond oncology.

The Saudi Arabia Peptide Drug Conjugates Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novartis AG, Advanced Accelerator Applications S.A. (a Novartis company), Amgen Inc., AstraZeneca PLC, Takeda Pharmaceutical Company Limited, Bayer AG, Pfizer Inc., F. Hoffmann-La Roche Ltd, Merck & Co., Inc., Sanofi S.A., Eli Lilly and Company, Gilead Sciences, Inc., Regeneron Pharmaceuticals, Inc., King Faisal Specialist Hospital & Research Centre (KFSH&RC), King Abdulaziz Medical City – Ministry of National Guard Health Affairs contribute to innovation, geographic expansion, and service delivery in this space.

The future of the peptide drug conjugates market in Saudi Arabia appears promising, driven by ongoing advancements in biotechnology and a growing emphasis on personalized medicine. As the healthcare sector continues to evolve, the integration of artificial intelligence in drug development is expected to streamline processes and enhance efficiency. Furthermore, increased collaboration between pharmaceutical companies and academic institutions will likely foster innovation, leading to the development of novel therapies that address unmet medical needs in the region.

| Segment | Sub-Segments |

|---|---|

| By Product | Lutetium-based peptide drug conjugates (e.g., Lutathera, Pluvicto) Melflufen-based peptide drug conjugates ANG1005 and other taxane-conjugated peptides Other pipeline peptide drug conjugates (BT1718, CBX-12, etc.) |

| By Therapeutic Area | Oncology (neuroendocrine tumors, prostate cancer, breast cancer, others) Hematologic malignancies Metabolic and endocrine disorders Other chronic and rare diseases |

| By Type | Therapeutic peptide drug conjugates Diagnostic peptide drug conjugates Combination therapy-based peptide conjugates Others |

| By Technology / Linker Type | Peptide linker-based conjugation Site-specific conjugation technologies Cleavable linker technologies Non-cleavable and other linker technologies |

| By End-User | Tertiary care and specialty hospitals Oncology centers and ambulatory care centers Research and academic institutions Contract research and manufacturing organizations (CROs/CMOs) |

| By Distribution Channel | Hospital and institutional pharmacies Direct tenders and government procurement (NUPCO, MOH) Retail and specialty pharmacies Online and other channels |

| By Region | Central Region (including Riyadh) Western Region (including Jeddah, Makkah, Madinah) Eastern Region (including Dammam, Al Khobar, Dhahran) Southern and Northern Regions |

| By Development Stage | Preclinical candidates Clinical trials (Phase I–III) conducted in/including Saudi Arabia Commercially marketed products Compassionate use and expanded access programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 120 | R&D Directors, Product Managers |

| Healthcare Providers | 90 | Oncologists, Pharmacists |

| Regulatory Bodies | 50 | Regulatory Affairs Specialists, Compliance Officers |

| Academic Institutions | 70 | Research Scientists, Professors |

| Market Analysts | 40 | Market Research Analysts, Industry Consultants |

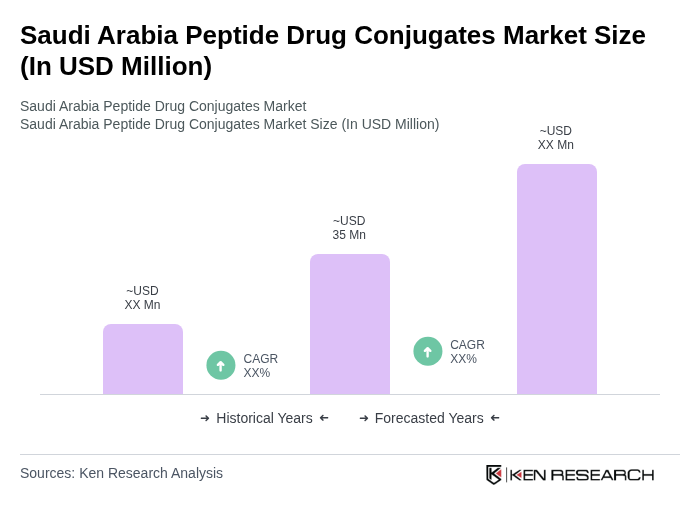

The Saudi Arabia Peptide Drug Conjugates Market is valued at approximately USD 35 million, reflecting a five-year historical analysis that highlights growth driven by advancements in targeted therapies and increasing cancer prevalence in the Kingdom.