Region:Global

Author(s):Dev

Product Code:KRAC3417

Pages:100

Published On:October 2025

By Type:The market is segmented into Innovative Peptides and Generic Peptides. Innovative peptides are gaining traction due to their specificity and efficacy in treating various diseases, while generic peptides are also significant as they provide cost-effective alternatives to branded therapies. The demand for innovative peptides is driven by ongoing research and development efforts, integration of advanced synthesis technologies, and the introduction of novel therapies that address unmet medical needs .

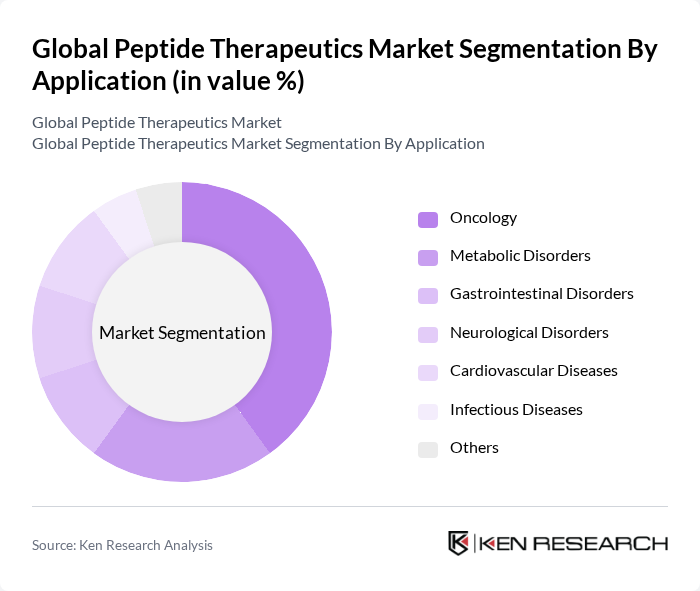

By Application:The applications of peptide therapeutics include Oncology, Metabolic Disorders, Gastrointestinal Disorders, Neurological Disorders, Cardiovascular Diseases, Infectious Diseases, and Others. Oncology is the leading application area, driven by the increasing incidence of cancer and the development of targeted peptide therapies that offer improved efficacy and reduced side effects compared to traditional treatments. Metabolic and infectious diseases are also key segments, supported by expanding clinical trial pipelines and rising prevalence globally .

The Global Peptide Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amgen Inc., Novo Nordisk A/S, Eli Lilly and Company, Pfizer Inc., AstraZeneca PLC, F. Hoffmann-La Roche AG, Sanofi S.A., Takeda Pharmaceutical Company Limited, Ipsen Pharma, Novartis AG, Bristol-Myers Squibb Company, Bachem Holding AG, CordenPharma International, Zealand Pharma A/S, Radius Health, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the peptide therapeutics market appears promising, driven by ongoing advancements in biotechnology and a growing focus on personalized medicine. As the prevalence of chronic diseases continues to rise, the demand for innovative and targeted therapies will likely increase. Furthermore, collaborations between pharmaceutical companies and academic institutions are expected to foster research and development, leading to the introduction of novel peptide-based treatments that address unmet medical needs and enhance patient care.

| Segment | Sub-Segments |

|---|---|

| By Type | Innovative Peptides Generic Peptides |

| By Application | Oncology Metabolic Disorders Gastrointestinal Disorders Neurological Disorders Cardiovascular Diseases Infectious Diseases Others |

| By Route of Administration | Parenteral (Subcutaneous and Intravenous) Oral Intranasal Transdermal Others |

| By Synthesis Technology | Solid-Phase Peptide Synthesis (SPPS) Hybrid Synthesis Methods Recombinant Technology Others |

| By Distribution Channel | Direct Sales Specialized Distributors Online Pharmacies Hospital Pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Peptide Therapeutics | 100 | Oncologists, Clinical Researchers |

| Diabetes Management Peptides | 60 | Endocrinologists, Diabetes Care Specialists |

| Cardiovascular Peptide Applications | 50 | Cardiologists, Pharmacists |

| Neurological Peptide Treatments | 40 | Neurologists, Clinical Trial Coordinators |

| Peptide Drug Development Insights | 80 | Pharmaceutical Executives, R&D Managers |

The Global Peptide Therapeutics Market is valued at approximately USD 46 billion, driven by the rising prevalence of chronic diseases, advancements in peptide synthesis technologies, and increasing demand for targeted therapies.